Profiting From Trading Stocks Of The S&P 500 Materials Sector (iM-Top5(XLB)Select)

- This 5-stock trading strategy with the Materials Sector stocks of the S&P 500 produces much higher returns than the Materials Select Sector SPDR Fund (XLB).

- The universe from which stocks are selected holds point-in-time, the S&P 500 non-energy materials stocks of FactSet’s Reverse Business Industry Classification System.

- The model ranks the stocks of this custom universe and selects periodically the highest ranked stocks which also satisfy stipulated yield requirements.

- From 1/2/2009 to 10/21/2020 this strategy would have produced an annualized return (CAGR) of 19.2%, significantly more than the 11.5% CAGR of XLB over this period.

Profiting From Trading Stocks Of The S&P 500 Utility Sector (iM-Top5(XLU)Select)

- This 5-stock trading strategy with the Utility Sector stocks of the S&P 500 produces much higher returns than the Utility Select Sector SPDR Fund (XLU).

- The universe from which stocks are selected holds point-in-time, the S&P 500 utility stocks of FactSet’s Reverse Business Industry Classification System.

- The model ranks the stocks of this custom universe and selects periodically the highest ranked stocks which also satisfy stipulated yield requirements.

- From 1/2/2009 to 10/1/2020 this strategy would have produced an annualized return (CAGR) of 12.7%, versus the 10.2% CAGR of XLU over this period.

Profiting From Trading Stocks Of The S&P 500 Industrial Sector (iM-Top5(XLI)Select)

- This 5-stock trading strategy with the Industrial Sector stocks of the S&P 500 produces much higher returns than the Industrial Select Sector SPDR Fund (XLI).

- The universe from which stocks are selected holds point-in-time the S&P 500 industrial stocks of FactSet’s Reverse Business Industry Classification System.

- The model ranks the stocks of this custom universe with the Portfolio123 “Greenblatt” ranking system and selects periodically the highest ranked stocks which also satisfy stipulated yield requirements.

- From 1/2/2009 to 10/2/2020 this strategy would have produced an annualized return (CAGR) of 20.6%, significantly more than the 12.7% CAGR of XLI over this period.

Profiting From Trading Stocks Of The S&P 500 Healthcare Sector (iM-Top5(XLV)Select)

- This 5-stock trading strategy with the Healthcare Sector stocks of the S&P 500 produces much higher returns than the Healthcare Select Sector SPDR Fund (XLV).

- The universe from which stocks are selected holds point-in-time, the S&P 500 healthcare stocks of FactSet’s Reverse Business Industry Classification System.

- The model ranks the stocks of this custom universe with the Portfolio123 “Greenblatt” ranking system and selects periodically the highest ranked stocks which also satisfy stipulated industry and yield requirements.

- From 1/2/2009 to 9/28/2020 this strategy would have produced an annualized return (CAGR) of 23.6%, significantly more than the 13.8% CAGR of XLV over this period.

Profiting From Trading Stocks Of The S&P 500 Consumer Staples Sector (iM-Top5(XLP)Select)

- This 5-stock trading strategy with the Consumer Staples Sector stocks of the S&P 500 produces much higher returns than Consumer Staples Select Sector SPDR Fund (XLP).

- The universe from which stocks are selected holds point-in-time, the S&P 500 consumer non-cyclical stocks of FactSet’s Reverse Business Industry Classification System.

- The model ranks the stocks of this custom universe with a modified “Greenblatt” ranking system and selects periodically the highest ranked stocks which also satisfy stipulated yield requirements.

- From 1/2/2009 to 9/23/2020 this strategy would have produced an annualized return (CAGR) of 25.3%, significantly more than the 11.4% CAGR of XLP over this period.

Profiting from Trading Stocks of the Technology Select Sector SPDR Fund (XLK) — iM-Top5(XLK)Select

- This trading strategy with five stocks from those of ETF (XLK), mainly with a dividend yield greater than that of the S&P 500 index, produces much higher returns than XLK.

- The universe from which stocks are selected holds point-in-time, the S&P 500 technology stocks of FactSet’s Reverse Business Industry Classification System and some electronic payments industry stocks, similar to XLK.

- The model ranks the stocks of this custom universe with the Portfolio 123 “Greenblatt” ranking system and selects periodically the highest ranked stocks which also satisfy the stipulated yield requirement.

- From 1/2/2009 to 9/8/2020 this strategy would have produced an annualized return (CAGR) of 31.8%, significantly more than the 20.1% CAGR of XLK over this period.

The analysis was performed on the on-line portfolio simulation platform Portfolio 123.

Read more >

Profiting from the Consensus Stock Holdings of Ten Large Hedge Funds (iM-10LargeHedgeFundSelect)

- This is a copycat trading strategy based on the quarterly 13F filings of 10 large hedge funds with assets under management (AUM) greater than $3.5-Billion.

- The algorithm looks at the top 20 largest holdings from each of the 10 filers and then picks the 15 most frequently held stocks among all of the filers.

- The model selects 12 of the 15 consensus picks from this hedge fund group with a ranking system based on quality.

- Changes in the holdings occur only every three months, about 45 days after the end of a quarter when 13F filings become public information, February, May, August, and November.

- From Feb-2008 to Aug-2020 this strategy would have produced an annualized return (CAGR) of 27.6%, significantly more than the 10.1% CAGR of the S&P 500 ETF (SPY) over this period.

A Dividend Growth Strategy for Perennial Income

- A simulation of this strategy with annual withdrawal rates of up to 10% still showed long-term growth which exceeded that of buy-and-hold the S&P 500 ETF (SPY).

- The backtests use the FactSet stock database and FactSet’s Revere Business Industry Classifications System (RBICS).

- The model holds equal-weight 10 stocks of the Russell 1000 index which are ranked with a simple ranking system to identify shares of the highest “quality” companies.

- The strategy provides a high dividend yield because a minimum yield excess (depending on RBICS sector type) over the yield of SPY is a critirium for stock selection.

- From Jan-2000 to Jun-2020 this strategy without withdrawals would have produced an annualized return (CAGR) of 21.5%, much more than the 5.6% CAGR obtained from SPY over the same period.

Covid-19 Recession — No Sign of a Recovery: The iM-Weekly Unemployment Monitor

- A truer picture of the employment situation is extracted from the Unemployment Insurance Weekly Claims (UIWC) report.

- Persons receiving some form of unemployment benefit account for 18.6% of the labor force and not 13.3% – the official unemployment rate.

- Monitoring of the weekly insured unemployed can provide early indication of recovery from the Covid-19 crisis.

- No meaningful economic recovery is identified from the current UIWC report.

Profiting from the Consensus Stock Holdings of Five Hedge Funds (iM-5HedgeFundSelect)

- This is a copycat trading strategy based on the quarterly 13F filings of five hedge funds.

- The model holds the top 20 consensus picks from a group of five hedge funds.

- Changes in the holdings occur only every three months when the end-of-the-month 13F filings becomes public information.

- From Jan-2007 to May-2020 this strategy would have produced an annualized return (CAGR) of 27.1%, much more than the 7.8% CAGR of the S&P 500 ETF (SPY).

Rational for a Copycat Strategy

Research from Barclay and Novus published in October 2019 found that a stock selection copycat strategy that combines conviction and consensus of fund managers that have longer-term views outperformed the S&P 500 by 3.80% on average annually from Q1 2004 to Q2 2019.

Profiting from the Expected Uptrend of Gold with a Momentum Trading Strategy of Gold Mining Stocks

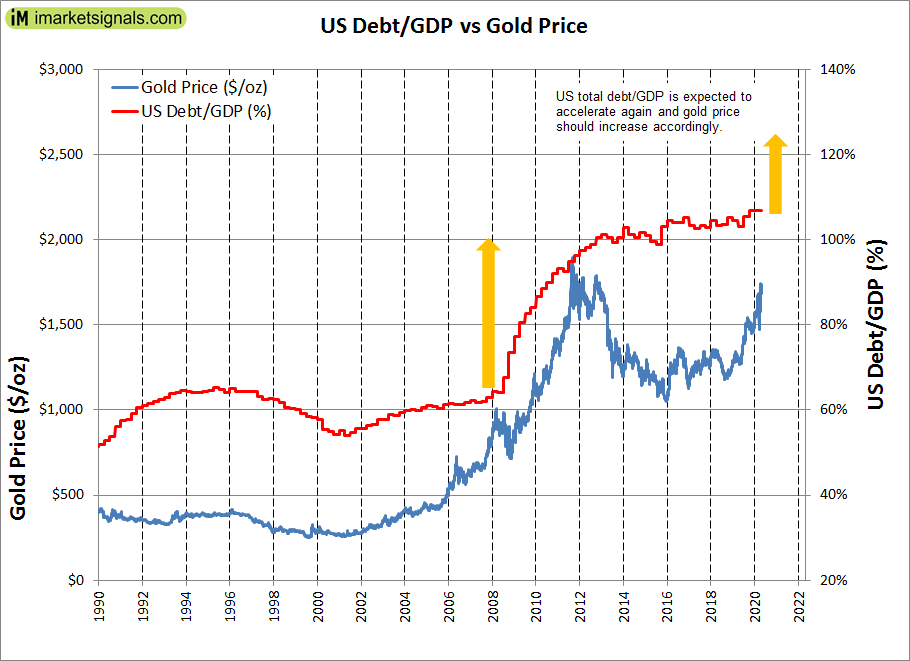

- The ratio of federal debt to the GDP is expected to rise dramatically due to the covid-19 pandemic fiscal stimulus. This should result in a significant gold price rally.

- The analysis shows that a trading strategy for gold miners is preferable to a buy-and-hold investment strategy of individual mining stocks.

- This momentum strategy selects periodically one gold mining stock from a set of three: AngloGold Ashanti Ltd (AU), Newmont Corp. (NEM) and Sibanye-Stillwater Ltd. (SBSW).

- The selection is based on the momentum of the percentage price change and the up/down volume ratio of the stocks.

- From Jan-2016 to Apr-2019 this strategy would have produced an annualized return (CAGR) of 80.6%, much more than that of the best performing single stock of the three considered.

The ratio of federal debt to the economic output of the U.S. is expected to rise dramatically by the end of 2020 as a result of the covid-19 pandemic fiscal stimulus. This, and low interest rates should result in a significant rally in gold, similar to the post 2008 gold price increase, as shown in the figure below.

Short-Term Losses for Stocks Could Exceed 30%, But 10-Year Forward Returns Look Good

- The average of S&P500 for March-2020 was 2652. A 12% decline, or 325 point drop, would bring it to 2327, the end of March level of the long-term trend line.

- A recession appears to be imminent. Stocks could lose up to 50% if the S&P reaches the lower prediction band line of the long-term trend.

- If the percentage decline matches the loss during 2009-09 recession then the S&P500 could reach a low of 1560, a decline of about 35% from the current value.

- The Shiller Cyclically Adjusted Price to Earnings Ratio (CAPE) is at a level of 24.5, almost identical to the 35-year moving average (MA35) of the CAPE of 24.3.

- The CAPE-MA35 ratio is 1.01, forecasting a 10-year annualized real return of 7.9%. Should the CAPE-MA35 ratio decline further then 10-year forward returns will be higher.

The Anticipated March 2020 Unemployment Rate Will Signal A Recession

- A reliable source for recession forecasting is the unemployment rate (UER), which can provide signals for the beginnings and ends of recessions.

- The February 2020 UER is 3.5%, signifying that no recession was imminent. However, if the March 2020 UER is 3.9% then a recession will be signaled, according to the model.

- According to the Washington Post more than a million workers are expected to lose their jobs by the end of March, a dramatic turnaround from February.

- Goldman Sachs estimates that 2.25 million Americans filed for their first week of unemployment benefits in the week ending March 20.

- If the number of unemployed rises only by one million than the March UER will be 4.1%, if it rises by 2.25 million it will be 4.9%.

Why Vanguard Should Retire The U.S. Momentum Factor ETF (VFMO)

- In February 2018 Vanguard released a set of five actively managed sector ETF’s and one multi-factor ETF. Here we report on the performance of the Momentum Factor ETF (VFMO).

- Shortly after the inception of VFMO we published “Why Not To Invest In Vanguard’s New U.S. Momentum Factor ETF” which demonstrated that Vanguard’s selection criteria for this fund was flawed.

- In the referenced article we stated that it was unlikely that VFMO would show a higher return than the SPDR S&P 500 ETF (SPY) over the year following inception.

- In April 2019 in a follow up article we showed that the actual performance of VFMO since inception was 6.8% lower than that of SPY, confirming the conclusion in the bullet-point above.

- Again, VFMO has underperformed SPY, and we come to the same conclusion for the following year, namely that the one-year return to Feb-2021 will be less than that of SPY.

The iM-SuperTimer – Update No.2a:Timing the Market with the iM-Stock Market Confidence Level

- For a detailed model description of the system please read the original description and previous update.

- To make this model more user-friendly we will be providing signals for three different version of this model, all updated weekly.

- The models’ holdings alternate between ETF (SPY) and ETF (IEF), being proxies for investments during up- and down stock market periods, repectively.

- The iM-1wk-SuperTimer (SPY-IEF) would have produced an annualized return of 19.9% with a max drawdown of about -10%.

- Appendix 2 shows that a (50%SPY+50%VCIT)-(IEF) strategy reduces drawdowns to -6.2% but would still have achieved an annualized return of 14%.

Robust Recession Forecasting With The FED’s Brave-Butters-Kelley Indexes ─ Update February 4, 2020

- The new Federal Reserve Bank of Chicago Brave-Butters-Kelley Indexes ( BBK ) provide useful input for recession forecasting.

- In the past, low estimates of BBK GDP growth related to the respective recessions, this allow the extraction of a recession warning signal from this growth series.

- We combine two BBK indexes with the Conference Board LEI and iMarketSignals’ Business Cycle Index BCIg to derive our Long Leading Index (iM-LLI) for the US economy.

- Currently neither index signals a recession warning.

Robust Recession Forecasting With Our New Long Leading Index For The US Economy

- The new Federal Reserve Bank of Chicago Brave-Butters-Kelley Indexes (BBK) provide useful input for recession forecasting.

- We combine two BBK indexes with the Conference Board LEI and our Business Cycle Index BCIg to derive iMarketSignals’ new Long Leading Index (iM-LLI) for the US economy.

- Our analysis shows that the iM-LLI would have provided an average warning signal about eight months before the start of recessions, as observed for the last seven recessions since 1967.

- We are replacing the iM-Composite Index (COMP) with the new iM-LLI.

- Currently this Leading Index is not yet warning of an oncoming recession.

Recession Forecasting With the Federal Reserve Bank of Chicago’s Newly Released Brave-Butters-Kelley Indexes

- From November 2019 onward, the Federal Reserve Bank of Chicago is releasing new measures of monthly real GDP growth and its components, the Brave-Butters-Kelley Indexes.

- The data release is for four indicators constructed from a panel of 500 monthly macroeconomic time series and quarterly real gross domestic product growth.

- Our analysis shows that apart from the Leading Index, the other three indicators would have been extremely accurate identifying recessions were it not for the publication time-lag.

- This time-lag makes, on average, these indicators about two month late to signal the start and end of recessions in real-time, as observed for the last seven recessions since 1967.

- Currently none of the Brave-Butters-Kelley Index models are warning of a recession.

Estimating 10-Year Forward Returns For Stocks With The Shiller CAPE Ratio And The Long-Term Trend – Update January 2020

- The average of S&P 500 for Dec-2019 was 3166; that is 852 (i.e. 27% of 3166) above the Jan-2020 level of the long-term trend line.

- The Shiller Cyclically Adjusted Price to Earnings Ratio (CAPE) is at a relatively high level of 30.1, and the 35-year moving average (MA35) of the CAPE is at 24.2.

- The CAPE-MA35 ratio is 1.25, forecasting a 10-year annualized real return of 5.9%.

- Investing in equities for the long-haul when the CAPE-MA35 ratio is below 1.30 should produce reasonable returns, as this level of the ratio does not indicate an abnormally overvalued market.

The iM Tax-Efficient Seasonal ETF Switching Strategy

- This strategy exploits the anomaly that Cyclical Sectors and Small Caps perform best from November to April, and Defensive Sectors do better from May to October during most years.

- Three identical models starting 6 months apart are used. Each model holds only one ETF for 18 months selected by a simple ranking system from the cyclical and defensive groups.

- The effect of this is that the combination model always has 66% of the portfolio in the “correct” direction, defensive or cyclical, and 33% in the “wrong” direction.

- The combination model trades only twice a year, switching only one position at the end of April and end of October.

- For the approximately 18.5 year period from end of Apr-2000 to Sep-2019 the backtest showed an annualized return of 12.3% with a maximum drawdown of -24%.