- In February 2018 Vanguard released a set of five actively managed sector ETF’s and one multi-factor ETF. Here we report on the performance of the Momentum Factor ETF (VFMO).

- Shortly after the inception of VFMO we published “Why Not To Invest In Vanguard’s New U.S. Momentum Factor ETF” which demonstrated that Vanguard’s selection criteria for this fund was flawed.

- In the referenced article we stated that it was unlikely that VFMO would show a higher return than the SPDR S&P 500 ETF (SPY) over the year following inception.

- In April 2019 in a follow up article we showed that the actual performance of VFMO since inception was 6.8% lower than that of SPY, confirming the conclusion in the bullet-point above.

- Again, VFMO has underperformed SPY, and we come to the same conclusion for the following year, namely that the one-year return to Feb-2021 will be less than that of SPY.

Vanguard’s selection strategy

The investment strategy described in VFMO’s prospectus is to target primarily U.S. common stocks (from the Russell 3000 Index) with strong recent performance, which have tended to earn a higher return than those with weak recent performance.

There was no evidence given why stocks with strong recent performance will earn a higher return going forward than those with a weaker recent performance.

The opposite applies: Bob Farrell’s rule-1 states: “Markets tend to return to the mean over time. When stocks go too far in one direction, they come back.”

Testing Vanguard’s selection strategy

In our February 28, 2018 article we showed why Vanguard’s rule based strategy would not work by testing the historic performance of hypothetical models whose holdings were selected according to rules similar to that of Vanguard. Our conclusion then did not support Vanguard’s unsubstantiated claim that stocks with strong recent performance have tended to earn a higher return than those with weak recent performance.

About a year later we reported the actual under-performance since inception of VFMO in this April-2019 article, and again concluded that VFMO will underperform going forward.

Now we are in the position to check on the 1-year performance of this ETF from Feb-2019 to Feb-2020.

Vanguards stock selection for VFMO is based on the theory that stocks which have performed well will continue to do so going forward.

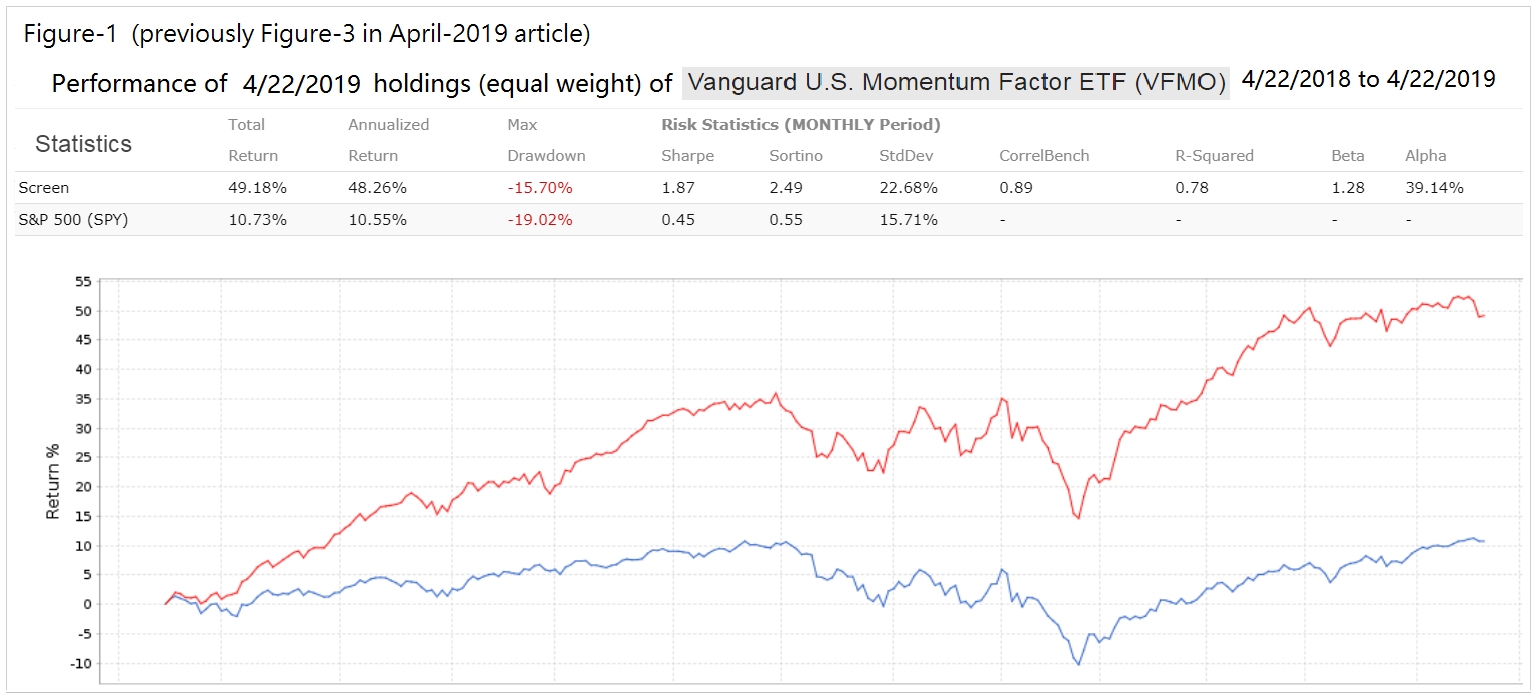

One can see in Figure-1 the performance of the holdings as of as of 4/22/2019 over the preceding period, from 2/22/2018 to 2/22/2019. (This was Figure-3 in our April-2019 article.) The historic data came from Portfolio 123 and is for an equal weighted portfolio which the fund then held. The 1-year return of this was a high 49.2% (confirming Vanguards selection criteria to target stocks with historic high returns), versus 10.7%% for the benchmark SPY.

Actual 1-year performance of VFMO, from Feb-2019 to Feb-2020

The performance of VFMO from Feb-15-2019 to Feb-15-2020 is shown in Figure-2 below and compared to the performance of SPY. As expected VFMO under-performed SPY. The total return for VFMO was 18.2% versus 24.0% for SPY. The Russell 3000 ETF (IWV), from which VFMO’s holdings come from, returned 22.5%.

The lower performance of VFMO relative to the Russell 3000 ETF and the S&P 500 ETF confirms our 2019 forecast, namely that VFMO would again under-perform the broader market going forward. This is clearly visible from the performance plots in Figure-2.

And it is not as if momentum did not work over the last year. The comparable performance of iShares Edge MSCI USA Momentum Factor ETF (MTUM) was 26.9%, 8.7% higher than what VFMO produced.

VFMO current holdings

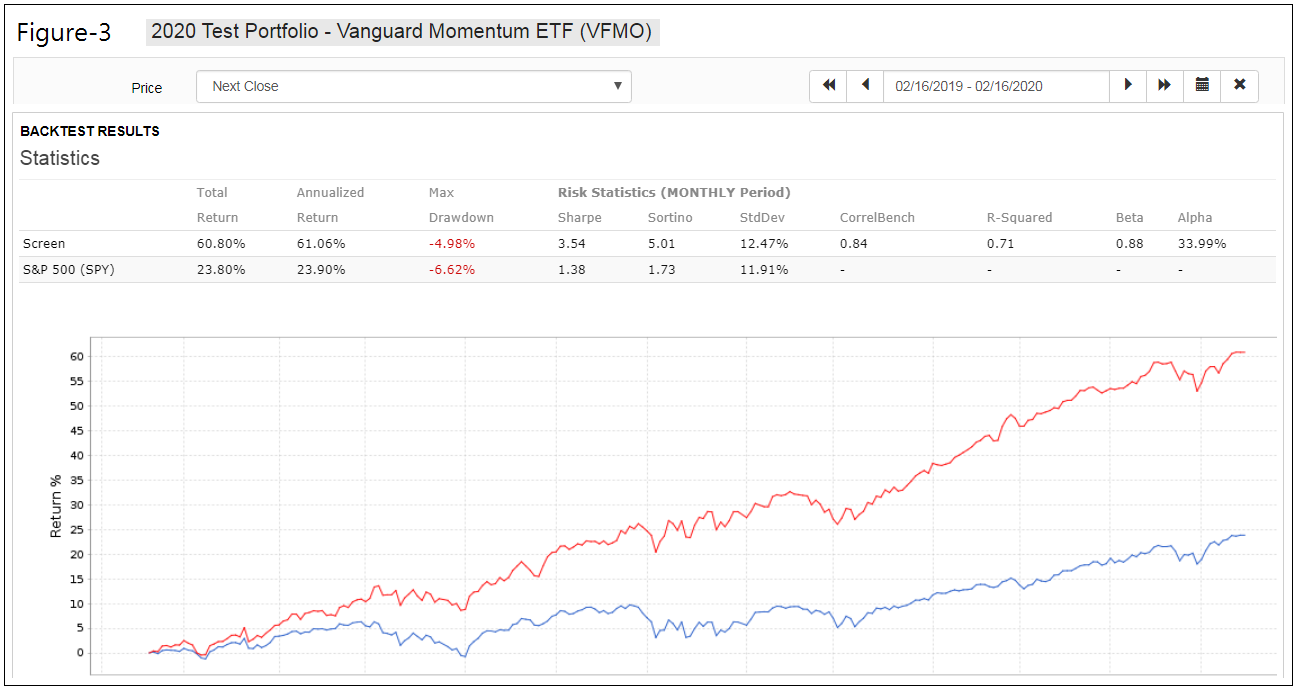

Figure-3 shows the performance of VFMO’s current holdings as of 2/16/2020 over the preceding year, from 2/16/2019 to 2/16/2020. The historic data comes from Portfolio 123 and is for an equal weighted portfolio which the fund now holds. The 1-year return of this was a high 60.8%, versus 23.8% for the benchmark SPY.

Conclusion

Vanguards rule-based selection criteria to target stocks with strong recent performance in the hope that they will continue to perform better is flawed. It just does not work.

The actual performance of this fund so far, and the previous analyses presented in the referenced articles clearly show that the most recent winners may be the ones most vulnerable to under-performance in the future. As per Bob Farrell rule-1: “When stocks go too far in one direction, they come back.”

It is time for Vanguard to retire this fund or change the selection criteria of its holdings.

Leave a Reply

You must be logged in to post a comment.