- This strategy exploits the anomaly that Cyclical Sectors and Small Caps perform best from November to April, and Defensive Sectors do better from May to October during most years.

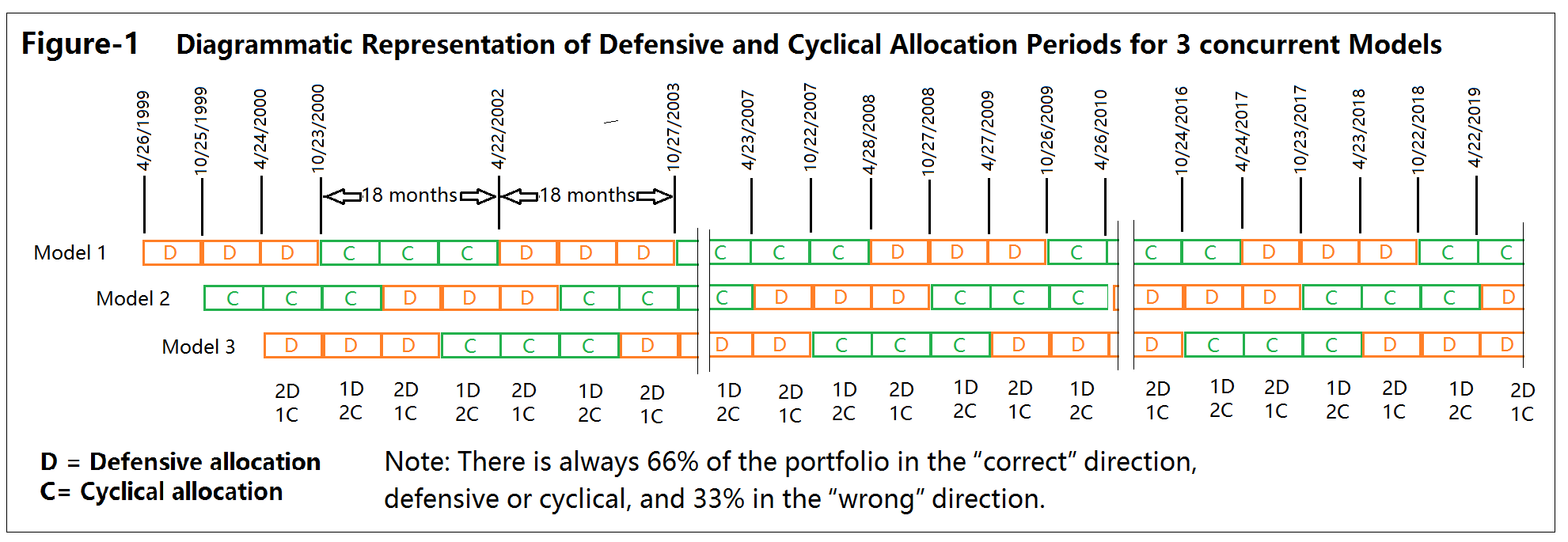

- Three identical models starting 6 months apart are used. Each model holds only one ETF for 18 months selected by a simple ranking system from the cyclical and defensive groups.

- The effect of this is that the combination model always has 66% of the portfolio in the “correct” direction, defensive or cyclical, and 33% in the “wrong” direction.

- The combination model trades only twice a year, switching only one position at the end of April and end of October.

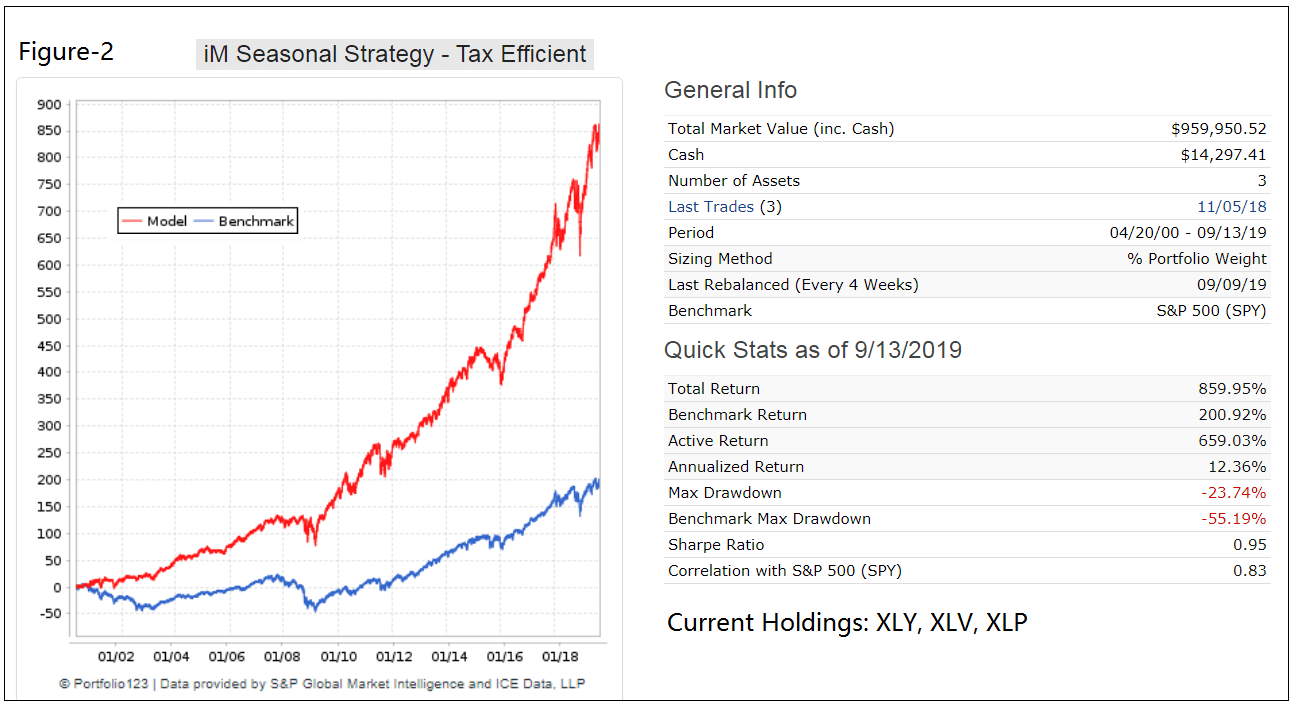

- For the approximately 18.5 year period from end of Apr-2000 to Sep-2019 the backtest showed an annualized return of 12.3% with a maximum drawdown of -24%.

The Case for Seasonal Switching

In this May-2013 article, What To Sell, If Selling In May, it was shown that since 1926 most of the excess return of Small Caps was earned during the seasonally strong months of November through April, and that one could have sat in cash each May through October and beaten “Small Cap Buy and Hold” on a total return basis.

The article also demonstrates that since the inception of the S&P 500 sector data in late 1989 it would have been beneficial to own cyclicals (Discretionary, Industrials and Materials) during the seasonally strong market months of November through April, and then swap into defensives (Staples, Health Care and Utilities) for the May to October period. This anomaly is exploited in the iM Seasonal Switching Strategy which holds a position for 6 months, which is not tax efficient as this would require a holding period longer than one year.

The Cyclical and Defensive ETFs

For the tax efficient model the cyclical ETF group used is:

- Consumer Discretionary SPDR ETF (XLY)

- Industrials SPDR ETF (XLI)

- Materials SPDR ETF (XLB)

- Vanguard Small-Cap Value ETF (VBR)

The defensive ETF group used is:

- Consumer Staples SPDR ETF (XLP)

- Health Care SPDR ETF (XLV) rev.11/22/20: XLK replaces XLV

- Utilities SPDR ETF (XLU)

- iShares 7-10 Year Treasury Bond ETF (IEF)

Constructing a tax-efficient seasonal switching strategy model

In order to provide tax efficiency an investment position has to be held for over one year. Here, a combination of three identical models is used with starting dates 6 months apart and fixed 18 months position holding periods. This results in a combination model which always has two thirds of the portfolio allocation in the “correct” direction, defensive or cyclical, and one third in the “wrong” direction, as shown in Figure-1.

The model was back-tested on the on-line simulation platform Portfolio123, which provides historical economic and financial data as well as extended price data for ETFs before their start dates. Only one ETF is periodically selected for each component model from the ETF groups by a simple ranking system and held for 18 months. There are no market timing- or stop-loss rules in the models.

The ranking system is based on the price changes over a short period. The notion is that ETFs which have experienced a decline over a short period will bounce back, reverting and doing better than ETFs which have not declined in this way.

The combination model only trades at the end of April and end of October each year. In the Appendix is a listing of all the 38 completed transactions since 1999. There were 5 losers, of which the highest was -43% for Model-3 over the 18-month investment period 10/22/2007 to 4/27/2009 which included the Great Recession, officially lasting from December 2007 to June 2009.

Performance of the tax-efficient seasonal switching strategy

The red graph in Figure-2 shows the performance of the model including dividends and with trading costs and slippage accounted for. The blue graph represents the buy&hold performance of SPY (the ETF tracking the S&P 500 index). The model shows an annualized return of 12.4% with a maximum Drawdown of -24%, greatly out-performing with less risk the benchmark SPY which only produced an annualized return of 5.8% with a maximum drawdown of -55%.

Performance Statistics and Risk Measurements

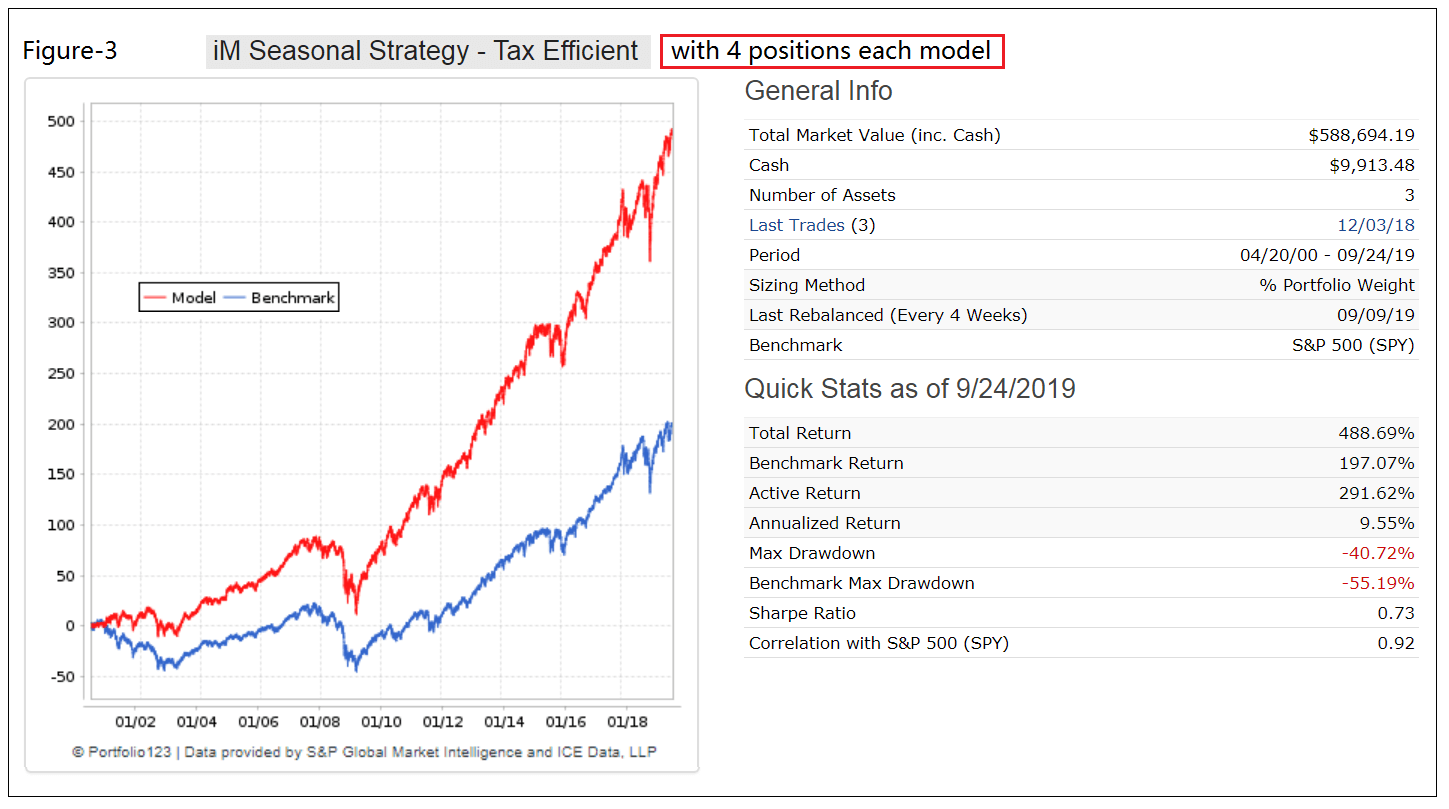

Performance of the tax-efficient seasonal switching strategy with 4 positions

This strategy combines three models each holding 4 positions for 18 month. Since all the ETFs of each group are used the effect of the ranking system is eliminated. The model shows an annualized return of 9.5% with a maximum Drawdown of -41%, still out-performing with less risk the benchmark SPY and confirming the seasonality of the stock market.

Conclusion

Backtesting with historic data shows that investment returns can be greatly improved over buy-and-hold by employing a seasonal tax efficient ETF switching strategy. Minimum trading effort is required as one would only switch between ETFs every six months after holding a position for 18 months, trading on the first trading day of the last week in April and October of each year.

The performance of this model and ETF selection is reported at iMarketSignals.

Acknowledgement

We thank our reader Ian Fellows for providing the idea of using 3 models in parallel.

Appendix

Realized Transactions (Return is without dividends) |

||||||

| Trade No. | Model No. | Symbol | Open | Close | Days held | Pct Return |

| 1 | 1 | IEF | 4/26/1999 | 10/23/2000 | 546 | 6.00% |

| 2 | 2 | XLI | 10/25/1999 | 4/23/2001 | 546 | 5.20% |

| 3 | 3 | XLV | 4/24/2000 | 10/22/2001 | 546 | -17.40% |

| 4 | 1 | XLB | 10/23/2000 | 4/22/2002 | 546 | 32.30% |

| 5 | 2 | IEF | 4/23/2001 | 10/28/2002 | 553 | 16.00% |

| 6 | 3 | XLY | 10/22/2001 | 4/28/2003 | 553 | 2.60% |

| 7 | 1 | IEF | 4/22/2002 | 10/27/2003 | 553 | 9.50% |

| 8 | 2 | XLB | 10/28/2002 | 4/26/2004 | 546 | 39.80% |

| 9 | 3 | XLP | 4/28/2003 | 10/25/2004 | 546 | 11.10% |

| 10 | 1 | VBR | 10/27/2003 | 4/25/2005 | 546 | 26.20% |

| 11 | 2 | IEF | 4/26/2004 | 10/24/2005 | 546 | -0.10% |

| 12 | 3 | XLB | 10/25/2004 | 4/24/2006 | 546 | 28.40% |

| 13 | 1 | XLP | 4/25/2005 | 10/23/2006 | 546 | 12.70% |

| 14 | 2 | XLI | 10/24/2005 | 4/23/2007 | 546 | 24.20% |

| 15 | 3 | XLV | 4/24/2006 | 10/22/2007 | 546 | 13.30% |

| 16 | 1 | XLI | 10/23/2006 | 4/28/2008 | 553 | 11.90% |

| 17 | 2 | IEF | 4/23/2007 | 10/27/2008 | 553 | 7.50% |

| 18 | 3 | VBR | 10/22/2007 | 4/27/2009 | 553 | -43.00% |

| 19 | 1 | IEF | 4/28/2008 | 10/26/2009 | 546 | 2.20% |

| 20 | 2 | XLY | 10/27/2008 | 4/26/2010 | 546 | 87.70% |

| 21 | 3 | XLV | 4/27/2009 | 10/25/2010 | 546 | 30.60% |

| 22 | 1 | VBR | 10/26/2009 | 4/25/2011 | 546 | 35.30% |

| 23 | 2 | XLV | 4/26/2010 | 10/24/2011 | 546 | 8.30% |

| 24 | 3 | XLB | 10/25/2010 | 4/23/2012 | 546 | 2.80% |

| 25 | 1 | XLP | 4/25/2011 | 10/22/2012 | 546 | 15.80% |

| 26 | 2 | XLB | 10/24/2011 | 4/22/2013 | 546 | 11.50% |

| 27 | 3 | IEF | 4/23/2012 | 10/28/2013 | 553 | -2.40% |

| 28 | 1 | VBR | 10/22/2012 | 4/28/2014 | 553 | 37.60% |

| 29 | 2 | XLV | 4/22/2013 | 10/27/2014 | 553 | 36.20% |

| 30 | 3 | VBR | 10/28/2013 | 4/27/2015 | 546 | 15.90% |

| 31 | 1 | IEF | 4/28/2014 | 10/26/2015 | 546 | 5.70% |

| 32 | 2 | XLB | 10/27/2014 | 4/25/2016 | 546 | -0.50% |

| 33 | 3 | IEF | 4/27/2015 | 10/24/2016 | 546 | 1.90% |

| 34 | 1 | VBR | 10/26/2015 | 4/24/2017 | 546 | 20.30% |

| 35 | 2 | XLU | 4/25/2016 | 10/23/2017 | 546 | 15.60% |

| 36 | 3 | XLI | 10/24/2016 | 4/23/2018 | 546 | 32.20% |

| 37 | 1 | XLV | 4/24/2017 | 10/22/2018 | 546 | 21.90% |

| 38 | 2 | XLY | 10/23/2017 | 4/22/2019 | 546 | 30.90% |

| 39 | 3 | XLP | 4/23/18 | holding | — | — |

| 40 | 1 | XLY | 10/22/18 | holding | — | — |

| 41 | 2 | XLV | 4/22/19 | holding | — | — |

Nice work Georg. Do you know what the returns & drawdowns would be if the entry/exit dates were changed to the seasonal entry/exit dates determined by using MACD developed by Gerald Appel? Ex: Buy cyclical on or after Oct 1 when MACD is is buy mode and hold till MACD triggers a sell on or after April 1, at which time you would go defensive. Holding period for any position would be 18 months once entered same as you have done.

This model has no market timing and fixed buy and sell dates. It should be useful for 529 plans which only allow 2 switch trades per year.

Introducing an MACD timer would require investors to monitor this model more often than intended.

where and how do i follow this system thanx