- A reliable source for recession forecasting is the unemployment rate (UER), which can provide signals for the beginnings and ends of recessions.

- The February 2020 UER is 3.5%, signifying that no recession was imminent. However, if the March 2020 UER is 3.9% then a recession will be signaled, according to the model.

- According to the Washington Post more than a million workers are expected to lose their jobs by the end of March, a dramatic turnaround from February.

- Goldman Sachs estimates that 2.25 million Americans filed for their first week of unemployment benefits in the week ending March 20.

- If the number of unemployed rises only by one million than the March UER will be 4.1%, if it rises by 2.25 million it will be 4.9%.

According to the Bureau of Labor Statistics ( BLS ), for February 2020 the number of people in the civilian labor force was 164.5 million of which 5.8 million were unemployed, resulting in an UER of 3.5%. If 2.25 million workers are added to the unemployed there will be about 8.0 million people without jobs, and the UER will increase to 4.9%. If one million workers are added to the unemployed there will be about 6.8 million unemployed, and the UER will increase to 4.1%. (Note, we do not know what the BLS will report for the March UER on Apr-3-2020, and it may significantly differ from our expected number.)

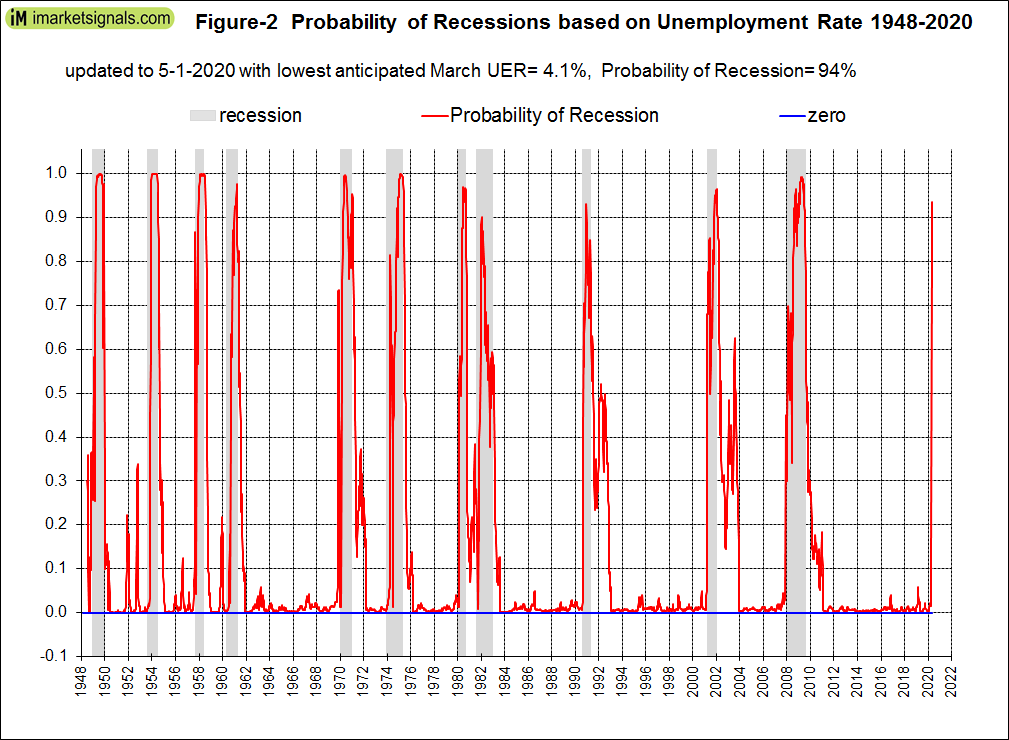

Let us assume the best case scenario that the March UER will only be 4.1%. The model will then signal a recession with a probability of 94%, as shown in Figures-1 and -2.

The following indicators are used to signal recession starts:

- A short 12-period and a long 60-period exponential moving average (EMA) of the unemployment rate (UER).

- The 8-month smoothed annualized growth rate of the UER (UERg).

- The 19-week rate of change of the UER.

The criteria for the model to signal the start of recessions are given in the original 2012 article and repeated in the Appendix.

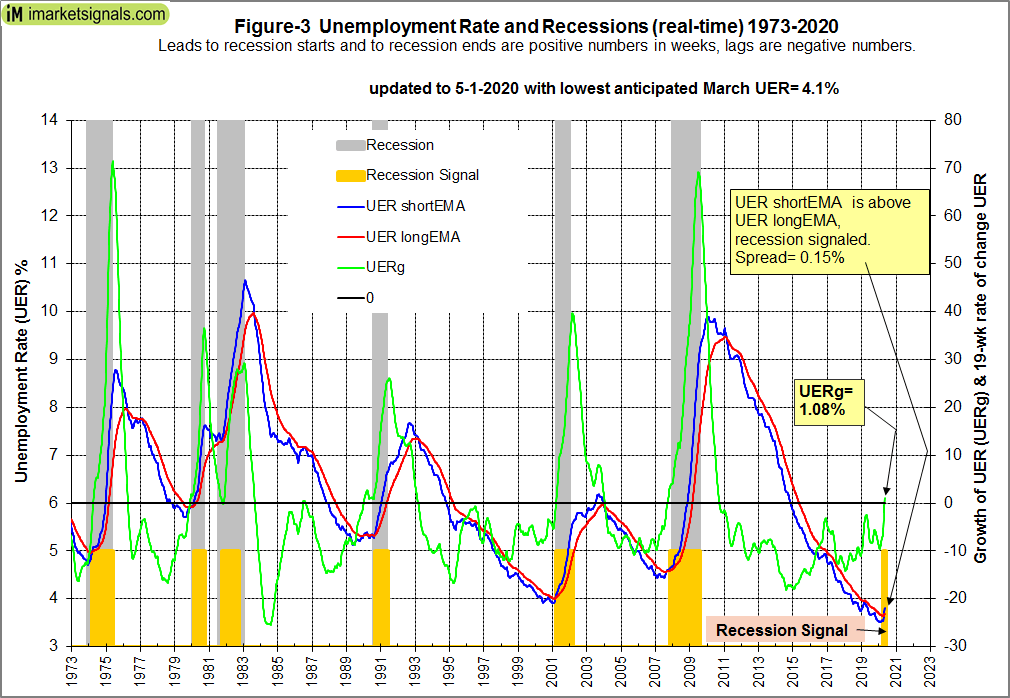

Anecdotal news reports support our forecast for the UER to increase to at least 4.1% by the end of March 2020, and we updated the model accordingly. For a recession signal, the short EMA of the UER would have to form a trough and then cross its long EMA to the upside. Alternatively, the UERg graph would have to turn upwards and rise above zero, or the 19-week rate of change of the UER would have to be above 8%.

Referring to Figure-1 (with minimum expected UER of 4.1% for March 2020), and looking at the end portion of it, one can see that all three conditions for a recession signal will have been met.

- The UER formed a trough and its short EMA is above its long EMA – the blue and red graphs, respectively, the spread being = 0.15%.

- UERg is above zero, +1.08%, the green graph.

- The 19-week rate of change of the UER is 16.6%.

Recession Probability

Based on the anticipated March 2020 unemployment rate of 4.1%, the probability of an imminent recession is 94%, as shown in Figure-2. The probability plot spans the period 1948 to 2020, encompassing eleven recessions.

Historic patterns of the unemployment rate indicators prior to recessions

Monthly unemployment data is listed at FRED from 1948 onwards, a dataset that spans eleven recessions and covers a much longer period than the historical data for most other indicators. Figure-3 shows the period 1973 to 2020, with anticipated UER data for March 2020. One can see that the patterns of the indicators are always similar before and after recessions.

Others have also observed this. For example, Gundlach in a 2016 webcasts has been following a “new metric” – the U.S. unemployment rate versus its 12-month moving average; when the former moves above the latter it is indicative of an oncoming recession. For March 2020, the minimum anticipated UER is 4.1%, and the 12-month moving average is 3.6%, supporting a recession call according to this metric.

Leads to recession starts

Leads to recession start from the UER model for the last eleven recessions:

Maximum lead time = 21 weeks (out of seven early signals)

Minimum lead time = -14 weeks (out of four late signals)

Average lead time = 2 weeks

Conclusion

On the strength of the historic performance of this model, and the current news reports of the size of initial unemployment insurance claims, we can now with high confidence state that the US economy is on the cusp of a recession.

Appendix

The model signals the start of a recession when any one of the following three conditions occurs:

- The short exponential moving average (EMA) of the unemployment rate (UER) rises and crosses the long EMA to the upside, and the difference between the two EMAs is at least 0.07.

- The unemployment rate growth rate (UERg) rises above zero, while the long EMA of the unemployment rate has a positive slope, and the difference between the long EMA at that time and the long EMA 10 weeks before is greater than 0.025.

- The 19-week rate of change of the UER is greater than 8.0%, while simultaneously the long EMA of the UER has a positive slope and the difference between the long EMA at the time and the long EMA 10 weeks earlier is greater than 0.015.

Georg,

thank you for another fine piece.

The problem with these numbers is the time lag. For the current crash in the stock market, practically all warning signs came too late. Once we have them, portfolios are already deep in the red.

The only timely warning signs I have been aware were sentiment readings and a cluster of Hindenburgs.

I agree with you but the question is if the market will recover fast or if it will go much lower again, -70 or -80%.

True enough. Data driven Technical Analysis tends to be backward looking; the impact of COVID-19 is forward looking & is destructive (a very black swan). That said, Fundamental Analysis (interpreted by thoughtful economists) plus the iM 3-mo Hi-Lo Index and iM Google Timer helped provide the confidence I needed to make timely portfolio adjustments.

I am cautiously optimistic Technical Analysis will prove helpful as the market wends its way into the future… but Fundamentals are important, too.

An economist once said, “It is Technicals ON TOP of Fundamentals. But economists say a great many things * sigh *

At the moment it looks like the “recession indicator” has signaled the perfect time for going LONG and ENTER the markets, not vice versa.

There are probably so many distortions in the markets (massive government programs, Zero interest rates) so that “normal” indicators do not work anymore. At least not for timing the stock market.