- This is a copycat trading strategy based on the quarterly 13F filings of five hedge funds.

- The model holds the top 20 consensus picks from a group of five hedge funds.

- Changes in the holdings occur only every three months when the end-of-the-month 13F filings becomes public information.

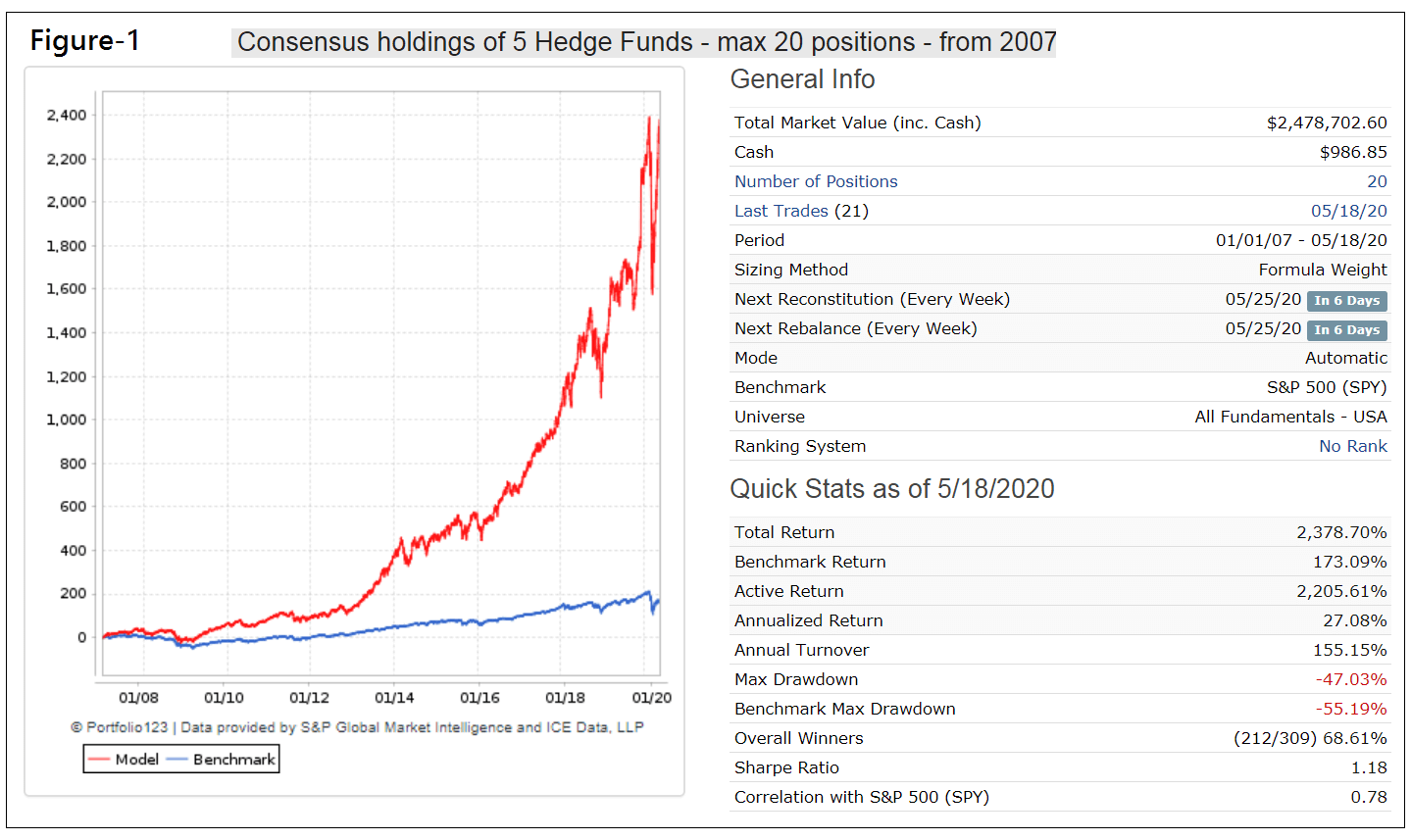

- From Jan-2007 to May-2020 this strategy would have produced an annualized return (CAGR) of 27.1%, much more than the 7.8% CAGR of the S&P 500 ETF (SPY).

Rational for a Copycat Strategy

Research from Barclay and Novus published in October 2019 found that a stock selection copycat strategy that combines conviction and consensus of fund managers that have longer-term views outperformed the S&P 500 by 3.80% on average annually from Q1 2004 to Q2 2019.

Similarly, our weekly published Best10(VDIGX) trading model which selects the 10 highest ranked stocks from the holdings of the of the Vanguard Dividend Growth Fund (VDIGX) outperformed the fund and SPY since July 2014 on average by about 5.4% annually.

Therefore, relying on the stock picking expertise of professional fund managers should provide better returns than a “do-it-yourself” strategy for an average investor.

Stock Selection from the Fund Manager Group

Stocks come from the quarterly 13F filings, point in time, approximately 45 days after the end of month filing date of each quarter, typically by the middle of February, May, August and November. Thus, the model is reconstituted with an approximate 45-day lag after the quarter-end, with positions occasionally rebalanced to equally weight.

Hedge Fund Filers:

- BRANDYWINE MANAGERS, LLC

- RA CAPITAL MANAGEMENT, L.P.

- SHANNON RIVER FUND MANAGEMENT LLC

- TCI FUND MANAGEMENT LTD

- WHALE ROCK CAPITAL MANAGEMENT LLC

The top 20 consensus picks from the group are selected by looking at each fund’s top 10 holdings and counting the number of times a stock is found in all of the funds. Stocks with the highest count are picked first.

Historic Performance

Figure-1 shows the performance of this strategy since Jan-2007 done on the on-line portfolio simulation platform Portfolio 123. It would have produced an annualized return of 27.1% with low 1.5-times annual turnover. The total return is almost 14-times that of SPY and the average holding period for a position would have been 250 days.

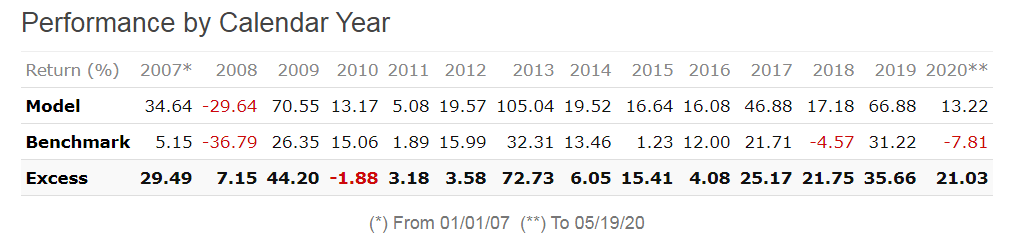

The model outperformed the benchmark SPY every year, except for a small underperformance over 2010, as can be seen from the table below.

Conclusion:

The analysis shows that a hedge fund copycat strategy would have produced excellent returns and is preferable to a buy-and-hold investment strategy of index funds. Minimum trading is required, only four times per year. The current holdings are listed in the appendix.

At iMarketSignals one can follow this strategy where the performance is updated weekly. The next holdings update will be middle of August 2020, but the holdings’ weights should be periodically rebalanced to approximately 5%.

Appendix

Current Holdings (as of 5/18/2020)

Ticker |

Buy Date |

Stock |

| CPB | 2014-11-17 | Campbell Soup Co. |

| AMZN | 2015-08-17 | Amazon.com Inc. |

| CHTR | 2016-08-15 | Charter Communications Inc |

| MSFT | 2018-02-15 | Microsoft Corp. |

| GOOG | 2018-02-15 | Alphabet Inc. Class C |

| NYT | 2018-08-15 | New York Times Co. Class A |

| CP | 2018-11-15 | Canadian Pacific Railway Ltd. (2001) |

| SHOP | 2019-05-16 | Shopify Inc |

| CNI | 2019-05-16 | Canadian National Railway Co. |

| MCO | 2019-05-16 | Moodys Corp |

| IDCC | 2019-08-15 | InterDigital, Inc. |

| FLEX | 2019-11-15 | Flextronics International Inc. |

| DT | 2020-02-18 | Dynatrace Inc |

| OKTA | 2020-05-18 | Okta Inc |

| V | 2020-05-18 | VISA Inc |

| CCXI | 2020-05-18 | ChemoCentryx, Inc. |

| ADSK | 2020-05-18 | Autodesk, Inc. |

| ARVN | 2020-05-18 | Arvinas Holding Company LLC |

| TSLA | 2020-05-18 | Tesla Inc |

| ZGNX | 2020-05-18 | Zogenix Inc |

What subscription level is required to follow this model?

Gold subscription will be required to follow this model. However, the current consensus holdings listed in the article which will not change until about Aug-15-2020 when the hedge funds’ Q2 13F filings become public.

Georg,

excellent idea, to say the least!

How did you pick the selected Hedge Funds?

What makes them “better” than others?

Thanks.

There are hundreds of hedge funds. We selected five from those who have had a good track record for about 20 years.

We have more copycat models in the pipeline with fewer stocks.

Holy survivorship bias. How is this any different than saying buying amazon will outperform the S&P because amazon has had a “good track record?” You are selecting funds based on the outcome of interest which is a recipe for overstated expected future returns.

This is not the same as selecting stocks that have done well in the past.

We selected the fund managers which performed well over longer periods of time assuming that they know what they are doing, and therefore are likely to perform well going forward.

Unless you invest in index funds you have to rely on fund managers or select the stocks yourself.

The issue is if you have 100 funds picking stocks in different ways, but each with expected returns equal to the S&P, the top 5 will have historical returns way above the S&P just by chance. If you then look at the intersection of the stocks picked by those firms, you’d not be surprised to find that they beat the S&P.

This is all to say that your selection of hedge funds in your backtesting is based on information not available at the time of investment.

I’d be much more convinced if you (on a rolling basis) selected from among hedge funds in existence based on information available at the time such as AUM, age or historical performance up to that date. Then if you take the consensus and it turns out to have good returns, I’d call that intriguing.

Will these new copycat models with fewer stocks be available in the mid August timeframe?

We have a 12-stock model which tracks 10 funds with AUM>3.5 Billion which we will release soon.

There is proposal from the SEC to dramatically raise the required reporting threshold for 13F filings, which would exempt funds with AUM<3.5 Billion from disclosing their holdings.

In all likelihood it will come into effect despite the numerous objections the SEC is receiving. This will make the 5HedgeFundSelect obsolete, since 3 of the the 5 funds will not report their holdings.

Is the ideal balance equal dollar weight per stock with a deviation of +/- 5% per any holding value before any mid-quarter rebalance?

That would be a satisfactory rebalancing strategy.

@afinn: “This is all to say that your selection of hedge funds in your backtesting is based on information not available at the time of investment.”

That is a true statement because we were not invested in these funds since 2007. However, the backtest uses point in time data, namely when the 13F filings of the holdings become public information.

The actual selection was made in February 2020, which would be the beginning of our live investment period. It is similar to a new investor placing money into a particular hedge fund. That investor’s decision is also based on the past performance of the manager.

The typical minimum hedge fund investment is between $500,000 and $1 million. Typical hedge fund fees include a 2 percent management fee and a performance fee of about 20 percent for investment gains. Nobody will entrust so much money and pay such high fees unless the historic fund performance over many years was good. That is also what we have been looking at in our evaluation.

But the proof of the pudding is in the eating. We will report performance of this strategy weekly. So far, from Feb-21 to May-22, the live portfolio gained 1.74% while the benchmark’s (SPY) return was -10.89% (a loss). Trading costs and slippage of about 0.15% of the trade amount was taken into account.

If you selected the funds from among funds active in 2007 and based on historical performance up to 2007, then the back test is valid. If you base the selection from among hedge funds in existence in 2020 based on performance up to 2020, then your backtest is contaminated by future information.

Regarding hedge fund performance… maybe, but https://www.investopedia.com/articles/investing/030916/buffetts-bet-hedge-funds-year-eight-brka-brkb.asp

This model is live from Feb-2020. Let’s see how it performs out of sample. We do not suggest that the backtest performance will necessarily be repeated in the future.

However, it would be rational to follow successful managers’ stock selections in preference to picking your own portfolio.

For a live example of a similar strategy please refer to our VDIGX and USMV models who have outperformed SPY and their parent funds for about 6 years now.

Hey guys,

Great stuff as always.

Curious. What would happen if you invested in the sector leader at each change point?

Tom C

sector leader, that is measured by the % of stocks (right now that would be tech)

The backtest shows highest returns with 20 positions.

For a 2 position model CAGR= 25.7% from 1/1/2007 to 5/22/2020, but risk is much higher, Sharpe= 0.76, and max D/D= -53%.

5 position and 3 position models show lower returns than the 2 position alternative.

I’m confused… I see Tesla in the portfolio, but I don’t see it any of the holdings of any of the 5 funds for the latest 13F filings

As per filings reported on 2020-05-18.

Tesla Inc TSLA New Purchase Bought 164.720440 sh @ $813.63/sh

my mistake, there’s also a “Whalerock POINT” fund which i was looking at by accident

What are the selling rules?

There are no sell rules. The model just uses the 20 positions from the 5 funds after each quarterly rebalancing. That is why stocks are held for a minimum period of 3 months.

Brandywine had >90% in CPB. RA is all about health care. Whooooeeeee.

That is why we use 5 funds. In the model CPB has a nominal weight of 5%.

Whats the selection criteria for stocks only occurring once in the 50 stock list?

The selection process looks at the top 10 largest holdings from each selected filer and then picks the most frequently held stocks among all of the selected filers.

If there are not enough consensus picks, then stocks are selected based on the highest % ownership for each filer.

Investing every 6 months seem to iimprove CAGR, can you also test it and post whole history for the original 3 month model?

Rebalancing every other quarter reduces CAGR by about 10% for this strategy according to our backtest.