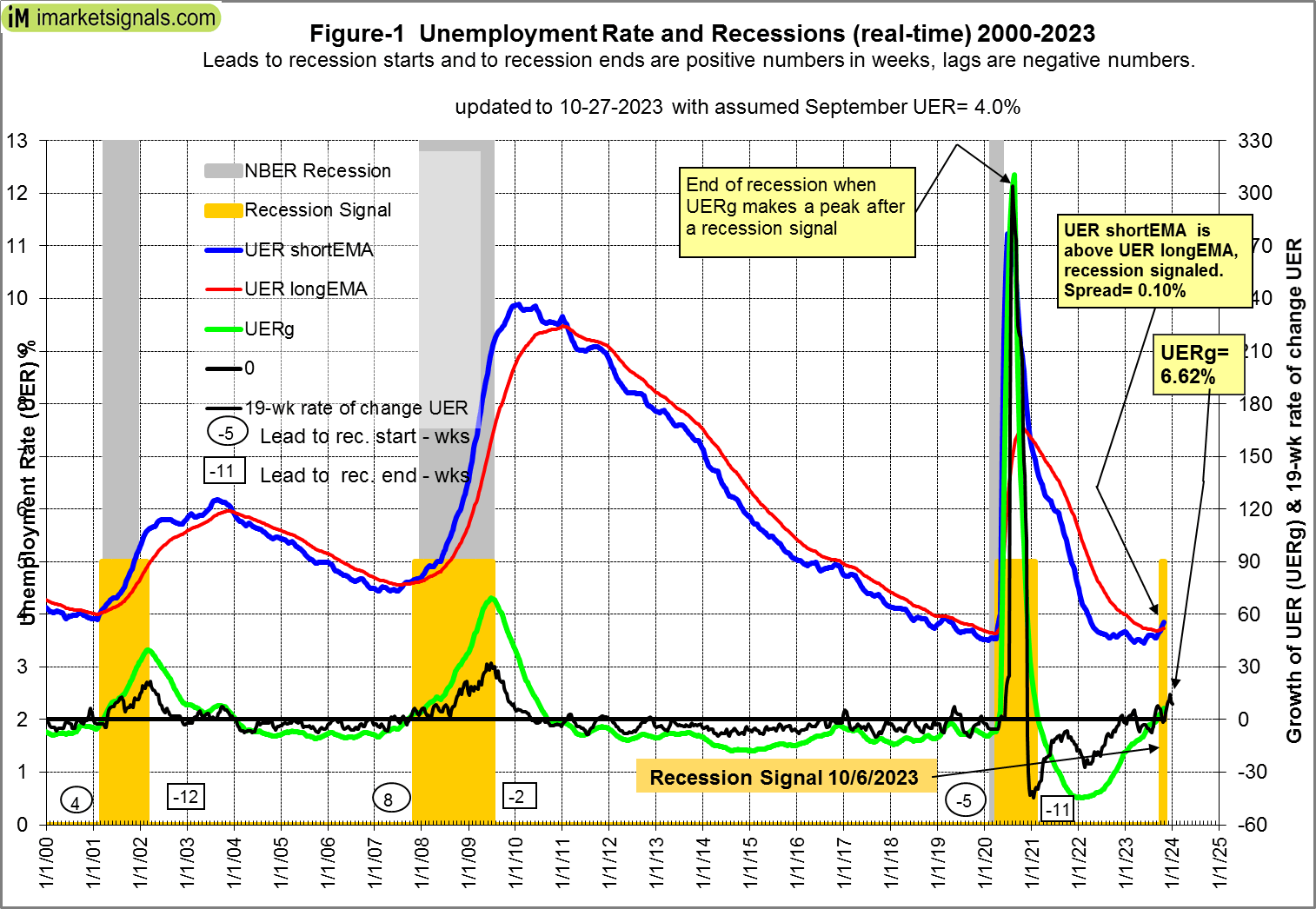

- A reliable source for recession forecasting is the unemployment rate (UER), which can provide signals for the beginnings and ends of recessions.

- The model was published in 2012 and has correctly signaled the 2020 recession.

- The latest UER (August 2023) is 3.8%, signifying no recession. However, if the September UER is 4% or higher a recession will be signaled according to the model.