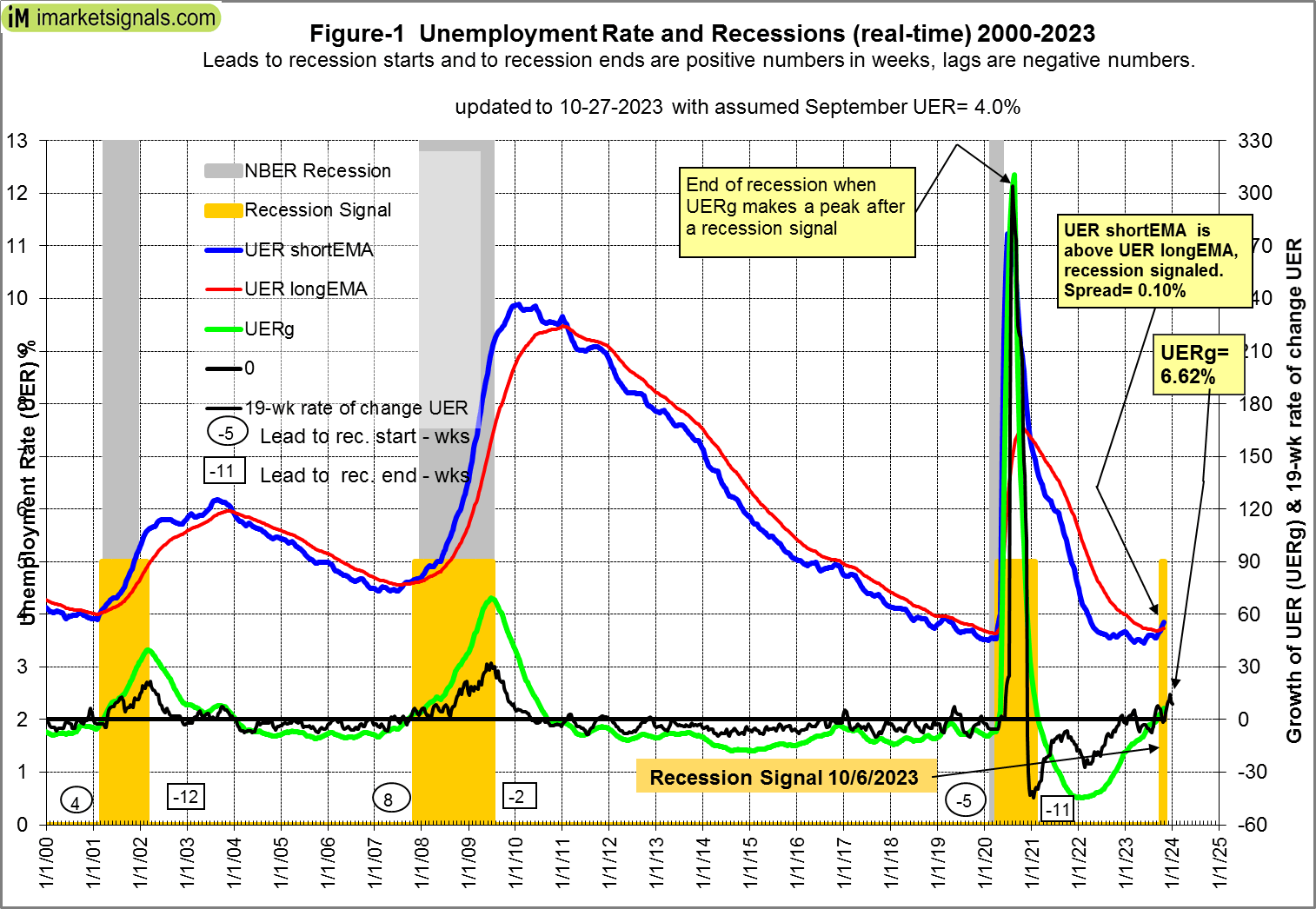

A September Unemployment Rate of 4.0% Will Signal a Recession

- A reliable source for recession forecasting is the unemployment rate (UER), which can provide signals for the beginnings and ends of recessions.

- The model was published in 2012 and has correctly signaled the 2020 recession.

- The latest UER (August 2023) is 3.8%, signifying no recession. However, if the September UER is 4% or higher a recession will be signaled according to the model.

Stocks Are Moderately Overvalued And 10-Year Forward Returns Look Reasonably Good: Update July 2023

- The average of S&P 500 for July-2023 was 4,497 (4% down from Dec-2021 high average of 4,675) and is 859 points higher than the corresponding long-term trend value of 3,638.

- For the S&P 500 to reach the corresponding long-trend value would entail a 20% decline from the July average value, indicating that the S&P 500 is moderately overvalued.

- The Shiller CAPE-ratio is at 30.9, 19% higher than its 35-year moving average (MA35), currently at 26.1, forecasting a 10-year annualized real return of about 6.5%.

- The long-term trend indicates a forward 10-year annualized real return of 4.4%

Posted in 2020, blogs, featured

Leave a comment

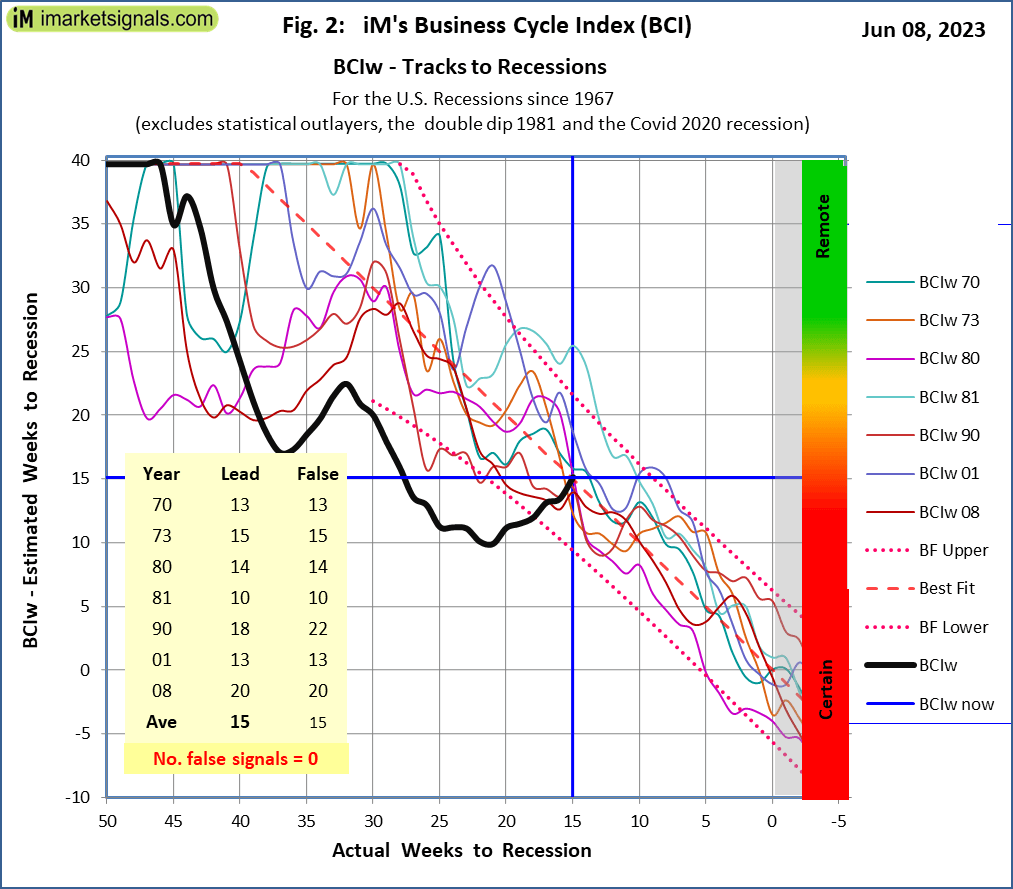

iM’s Business Cycle Index Recovers but still Signals a Recession – Update 6/9/2023

- Knowing when the U.S. economy is heading for recession is paramount to successful investment decisions.

- Our weekly Business Cycle Index would have provided early reliable warnings for the past seven recessions and signaled the Covid 2020 recession one week late.

- The BCIg has signaled a recession warning mid March 2023, but BCIg recovered and is no longer signalling a recession.

- However the BCIw, also on recovery path, continues to signal a recession which now is estimated to begin in 9 to 22 weeks.

- It is too early to say if a recession has been averted, more likely is it is delayed towards the end the end of 2023 or begin 2024.

Timing The Stock Market With The Conference Board Leading Economic Index

- This ETF trading model uses the Conference Board Leading Economic Index to determine “Risk-On” periods for equities.

- A universe is defined from the SPDR, Vanguard, and PowerShares ETF providers for the sectors healthcare, energy, communication, technology, and general multi-sector funds, holding large-mega cap stocks from the United States.

- The model selects 3 ETFs from the previously defined universe at the beginning of a “Risk-On” period and holds these ETFs continuously until the end of the “Risk-On” period.

- During “Risk-Off” periods for equities it goes to the gold ETF (GLD) to maximize returns. ETF (BND) is also a suitable alternative to GLD.

- The simulation shows that this strategy would have produced over 7-times the total return of SPY with similar risk.

Posted in blogs, featured

6 Comments

Stocks Are Moderately Overvalued but 10-Year Forward Returns Look Good: Update April 2023

- The average of S&P 500 for March-2023 was 3,969 (15% down from Dec-2021 average of 4,675) and is 384 points higher than the corresponding re-calibrated long-term trend value of 3,585.

- For the S&P 500 to reach the corresponding long-trend value would entail a 10% decline from the March average value, indicating that the S&P 500 is not significantly overvalued anymore.

- The Shiller CAPE-ratio is at 27.9, 8% higher than its 35-year moving average (MA35), currently at 25.9, forecasting a relatively high 10-year annualized real return of about 7.3%.

- The long-term trend indicates a forward 10-year annualized real return of 5.5%

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

Posted in 2020, blogs, featured

Leave a comment

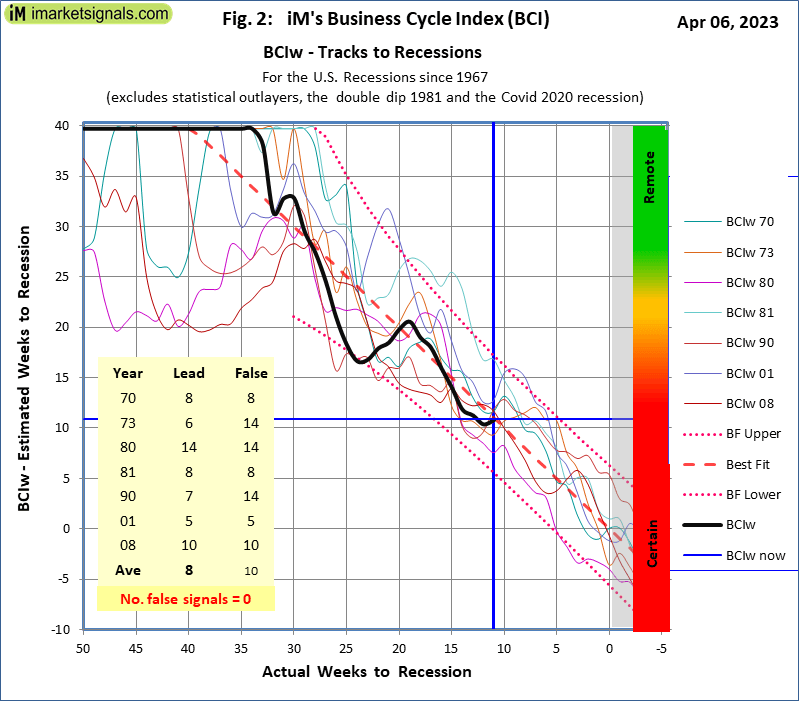

iM’s Business Cycle Index Signals an Imminent Recession – Update 4/7/2023

- Knowing when the U.S. economy is heading for recession is paramount to successful investment decisions.

- Our weekly Business Cycle Index would have provided early reliable warnings for the past seven recessions and signaled the Covid 2020 recession one week late.

- The Department of Labor backward revised nearly two years of seasonal adjusted data.

- The BCIg is now signalling a recession since mid March 2023 with a 12 weeks average lead time.

- The BCIw is now signalling a recession, earliest in 5 weeks but not later than 17 weeks.

Expect Further Losses For Stocks but 10-Year Forward Returns Look Better: Update December2022

- The average of S&P 500 for Nov-2022 was 3,917 (16% down from Dec-2021 average of 4,675) and is 385 points higher than the corresponding re-calibrated long-term trend value of 3,532.

- For the S&P 500 to reach the corresponding long-trend value would entail a 10% decline from the November average value, indicating that the S&P 500 is not significantly overvalued anymore.

- The Shiller CAPE-ratio is at 28.3, 10% higher than its 35-year moving average (MA35), currently at 25.8, forecasting a relatively high 10-year annualized real return of about 7.2%.

- The long-term trend indicates a forward 10-year annualized real return of 5.5%

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

Posted in 2020, blogs, featured

Leave a comment

Expect Further Losses For Stocks but 10-Year Forward Returns Look Better: Update November 2022

- The best fit line and prediction band were re-calculated from Jan-1871 to Sep-2022. This added over 10 years of data after July-2012, the end date of the previous regression analysis.

- The average of S&P 500 for Oct-2022 was 3,726 (20% down from Dec-2021 average of 4,675) and is 207 points higher than the corresponding re-calibrated long-term trend value of 3,519.

- For the S&P 500 to reach the long-trend would entail only a 6% decline from the October average value, indicating that the S&P 500 is not significantly overvalued anymore.

- The Shiller CAPE-ratio is at 27.2, only 6% higher than its 35-year moving average (MA35), currently at 25.7, forecasting a relatively high 10-year annualized real return of about 7.5%.

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

Posted in 2020, blogs

Leave a comment

Expect Further Losses For Stocks And Very Low 10-Year Forward Returns: Update September 2022

- The average of S&P 500 for September 2022 was 3,853 (18% down from December 2021 average of 4,675) and is still 1,243 points higher than the corresponding long-term trend value of 2,610.

- For the S&P 500 to reach the long-trend would entail a 32% decline from the September average value, possibly over a short period.

- The Shiller CAPE-ratio is at a level of 28.4. That is 10% higher than its 35-year moving average (MA35), currently at 25.7.

- The CAPE-MA35 ratio is at 1.10 (down from the December 2021 level of 1.51), forecasting a relatively high 10-year annualized real return of about 7.1%.

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

- The historic long-term trend indicates a September 2032 value of 4,943; a 10-year forward real annualized return of only 2.5% (up from the December 2021 forecast of 0.2%).

Posted in 2020, blogs

Leave a comment

An Upcoming Recession is Signaled by the Forward Rate Ratio

- Prior to recession the yield curve becomes inverted, as indicated by the Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) being less than 1.00.

- The FRR2-10 crosses 1.000 downward signifying that US economic activity is in the boom phase of the business cycle, nearing the next recession.

- The average lead time after FRR2-10 becomes less than 1.00 to the subsequent recession start was 14 months for the seven of the eight last recessions.

Expect Further Losses For Stocks And Very Low 10-Year Forward Returns: Update July 2022

- The average of S&P 500 for May 2022 was 4,040 (14% down from December 2021 average) and is still 1,469 points higher than the corresponding long-term trend value of 2,571.

- For the S&P 500 to reach the long-trend would entail a 36% decline from the May average value, possibly over a short period.

- The Shiller CAPE-ratio is at a level of 31.0. That is 21% higher than its 35-year moving average (MA35), currently at 25.6.

- The CAPE-MA35 ratio is at 1.21 (down from the December 2021 level of 1.51), forecasting a 10-year annualized real return of about 6.3%.

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

- The historic long-term trend indicates a 10-year forward real annualized return of only 1.9% (up from the December 2021 forecast of 0.2%).

Posted in 2020, blogs, featured

Leave a comment

Expect Further Losses For Stocks And Very Low 10-Year Forward Returns: Update June 2022

- The average of S&P 500 for May 2022 was 4,040 (14% down from December 2021 average) and is still 1,469 points higher than the corresponding long-term trend value of 2,571.

- For the S&P 500 to reach the long-trend would entail a 36% decline from the May average value, possibly over a short period.

- The Shiller CAPE-ratio is at a level of 31.0. That is 21% higher than its 35-year moving average (MA35), currently at 25.6.

- The CAPE-MA35 ratio is at 1.21 (down from the December 2021 level of 1.51), forecasting a 10-year annualized real return of about 6.3%.

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

- The historic long-term trend indicates a 10-year forward real annualized return of only 1.9% (up from the December 2021 forecast of 0.2%).

Posted in 2020, blogs

Leave a comment

The iM-Inflation Attuned Multi-Model Market Timer

- Investment risk can be reduced by a multi-model market timer whose many components use different and uncorrelated financial and economic data, including inflation.

- This model seeks to determine effective asset allocation for risk-on and risk-off periods for equities considering the effect of inflation.

- Four risk scenarios are possible: risk-on & normal-inflation, risk-on & high-inflation, risk-off & normal-inflation, and risk-off & high-inflation. Different ETF groups apply to each risk scenario.

- From 2000 to 2022, switching accordingly between risk-related ETF groups would have produced an annualized return of about 39% versus 6.5% for buy and hold SPY.

Posted in blogs, featured

51 Comments

Evaluating Popular Asset Classes for Inflation Protection

- We tested nine asset classes which are supposed to provide protection against inflation according to an Investopedia article. The test period was from January 2005 to May 2022.

- Investopedia provides no definition for inflationary environment, but this analysis uses the 6-month moving average of the inflation rate and the University of Michigan: Inflation Expectation© series to define it.

- For this investigation we consider separately the inflationary periods which fall within the Risk-on and Risk-off phases for equities, as defined by the iM-Multi-Model Market Timer.

- From the asset classes listed by Investopedia only the Vanguard Real Estate ETF (VNQ) provided some inflation protection relative to the SPDR S&P 500 ETF (SPY).

- Better inflation protection is provided by energy sector ETFs XLE and PXE, but energy sector funds were not among the asset classes listed in the Investopedia article.

The Stock Market Has Peaked, S&P 500 Death Cross For The Ides Of March: Update March 2022

- The average of S&P 500 for February 2022 was 4436 (5% down from December 2021 average) and is still 1896 points higher than the corresponding long-term trend value of 2540.

- A reversal to the long-trend would entail a 43% decline, possibly over a short period aggravated by the imminent S&P500 death cross.

- The Shiller CAPE-ratio is at a level of 35.9 (down 7.2% from its recent peak of 38.7). That is 41% higher than its 35-year moving average (MA35), currently at 25.5.

- The CAPE-MA35 ratio is 1.41 (down from the end of December 2021 level of 1.51), forecasting a 10-year annualized real return of about 4.6%.

- The historic long-term trend indicates a 10-year forward real annualized return of only 0.8% (up from the end of December 2021 forecast of 0.2%).

Posted in blogs, featured

Leave a comment

The iM-Multi-Model Market Timer – Not Your Daddy’s Old Moving Average Crossover System

- Reliance on a single market timer is risky. The risk can be reduced by a multi-model market timer whose many components use different and uncorrelated financial and economic data.

- This model seeks to determine reliable risk-on and risk-off periods for the stock market. When there is no definite signal for risk-on or risk-off then the investment is considered risk-neutral.

- From 2000 to 2022, switching between ETFs RSP, VGT, SH, TIP, BIV and IEF would have produced an annualized return of 34.2% versus 7.0% for buy and hold SPY.

- The model is not a binary indicator between risk-on and risk-off and does not rely on leveraged ETFs to produce such high returns.

Posted in 2020, blogs, featured

27 Comments

The Stock Market Is Overpriced, Expect Very Low 10-Year Forward Returns And Zero Real Returns By 2028: Update December 2021

- The average of S&P 500 for December 2021 was 4675 (previous month 4670). This is 2155 points higher than the long-term trend value of 2520.

- The current percentage difference of S&P 500 level relative to the current long-term trend level is 85%, a value not exceeded in the recent past since 2001.

- The Shiller Cyclically Adjusted Price to Earnings Ratio (CAPE) is at a level of 38.4. That is 51% higher than its 35-year moving average (MA35), currently at 25.4.

- The CAPE-MA35 ratio is 1.51, forecasting a 10-year annualized real return of about 3.8%. Should the CAPE-MA35 ratio increase further, then 10-year forward returns will be even lower.

- The historic long-term trend indicates a 10-year forward real annualized return of only 0.2%, and the current condition of overvaluation suggest zero returns by the end of 2028.

Posted in 2020, blogs, featured

Leave a comment

Don’t Buy The 25 S&P 500 Stocks That Have Made The Largest Contribution To The Index’s YTD Return – Higher Ranked Is Not Better

- Goldman Sachs reported that only 25 stocks accounted for 58% of the index’s 2021 gains, including reinvested dividends, through Dec-9-2021.

- One can verify the accuracy of this list by ranking the S&P 500 stocks on the factor “Market Capitalization x 1-year Rate-of-Change”, with higher being better.

- Backtesting to Jan-2000 shows that buying the 25 highest ranked stocks every year at the end of December would have approximately matched the performance of SPY over the backtest period.

- However, investing similarly in the 25 highest ranked stocks of the lower two terciles of the ranked S&P 500 would have provided over 3-times the total return of SPY.

- The list of 25 S&P 500 stocks to hold during 2022 is given in Appendix-2, which is expected to provide higher returns to Dec-2022 than the Goldman Sachs list.

Posted in blogs, featured

6 Comments

Consumer Sentiment And The Cyclically Adjusted Risk Premium Work Together As A Profitable Stock Market Timer

- Consumer Sentiment, when expressed as the difference in return of the Consumer Staples- and the Consumer Discretionary sectors, can provide risk-on and risk-off signals for equity investment.

- Also a reasonably reliable risk indicator is the Cyclically Adjusted Risk Premium (CARP), defined as the inverse of the Shiller CAPE Ratio (CAPE) in percent minus the 10-year note yield.

- The Consumer Sentiment Timer can be improved by including the value of the CARP in its rules to provide more profitable risk-on and risk-off signals for equity investment.

- From 5/1/1999 to 10/15/2021 the Consumer Sentiment & CARP Timer, when accordingly switching between ETFs SPY and IEF, would have produced 18.5% annualized return with a maximum drawdown of -27%.

Consumer Staples/Discretionary Spending As A Reliable And Profitable Stock Market Timer

- The difference in return of the Consumer Staples- and the Consumer Discretionary sectors can provide risk-on and risk-off signals for equity investment.

- Four time series sets are used: ETFs XLP & XLY, Portfolio 123 Specialty SP1500 Consumer Staples & Consumer Discretion, Aggregate Series Non-Cyclical & Cyclicals, and ETFs RHS & RCD.

- Investment in equities is signaled when the 15 week return of the discretionary sector outperformed the staples sector’s return.

- From 5/1/1999 to 10/1/2021 this strategy, when accordingly switching between ETF SPY and ETF IEF, would have produced a 14.9% annualized return with a maximum drawdown of -17%.

Posted in blogs, featured

15 Comments