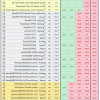

- A truer picture of the employment situation is extracted from the Unemployment Insurance Weekly Claims (UIWC) report.

- Persons receiving some form of unemployment benefit account for 12.6% of the labor force.

- Monitoring of the weekly insured unemployed could provide early indication of recovery from the COVID-19 crisis.

- The current UIWC report shows that the economic recovery from the COVID-19 crisis seems to improve.

The 11/26/2020 DOL Unemployment Insurance indicates a continued improvement in the insured employment situation even though the initial claims remain high and have increased over last week, but seemingly trending towards the long-term average.

Read more >