- The system screens for high dividend, low volatility S&P 500 stocks yielding significantly more than the average yield of the index and which also have a low 3-yr beta.

- Market timing rules related to our long-period backtest models, the MAC-US Timer, CAPE-Cycle-ID, and Inflation Timer have been incorporated into the model’s algorithm, and turnover has been modestly increased by introducing an additional sell signal based on volatility.

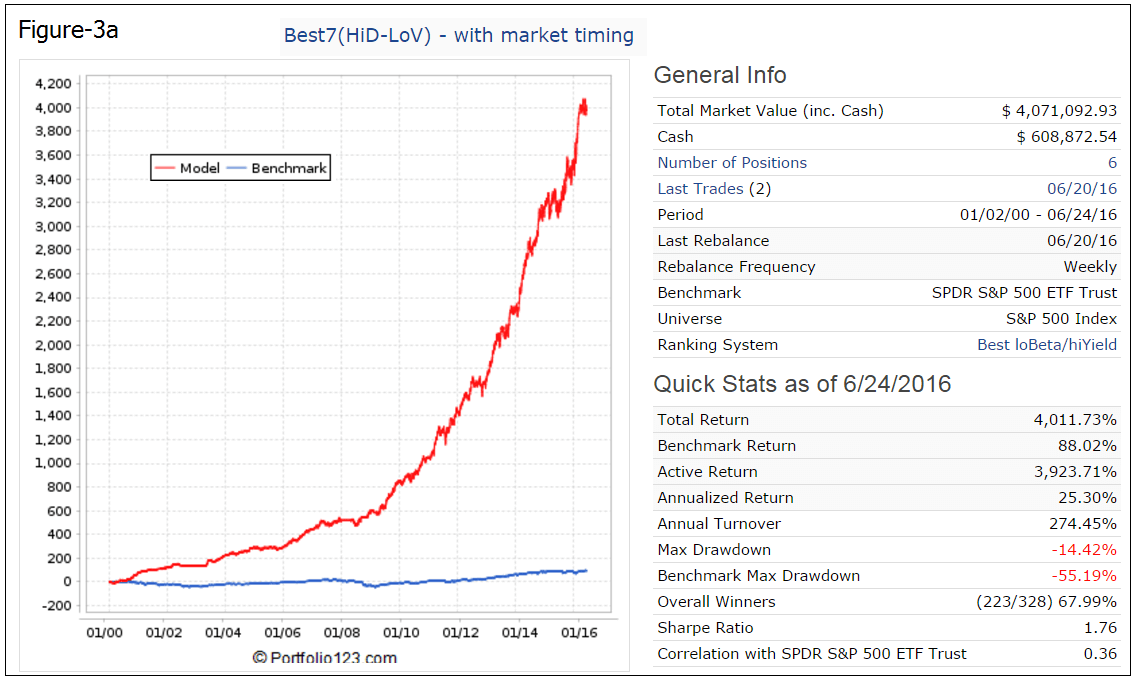

- The 16.5 year backtest of the original iM HiD-LoV-7 System produced annualized return of about 22% with a maximum drawdown of -34%, whereas the improved model provided annualized return of about 25% with a maximum drawdown of -14% over the same backtest period. (Figure-3a)

Performance Results

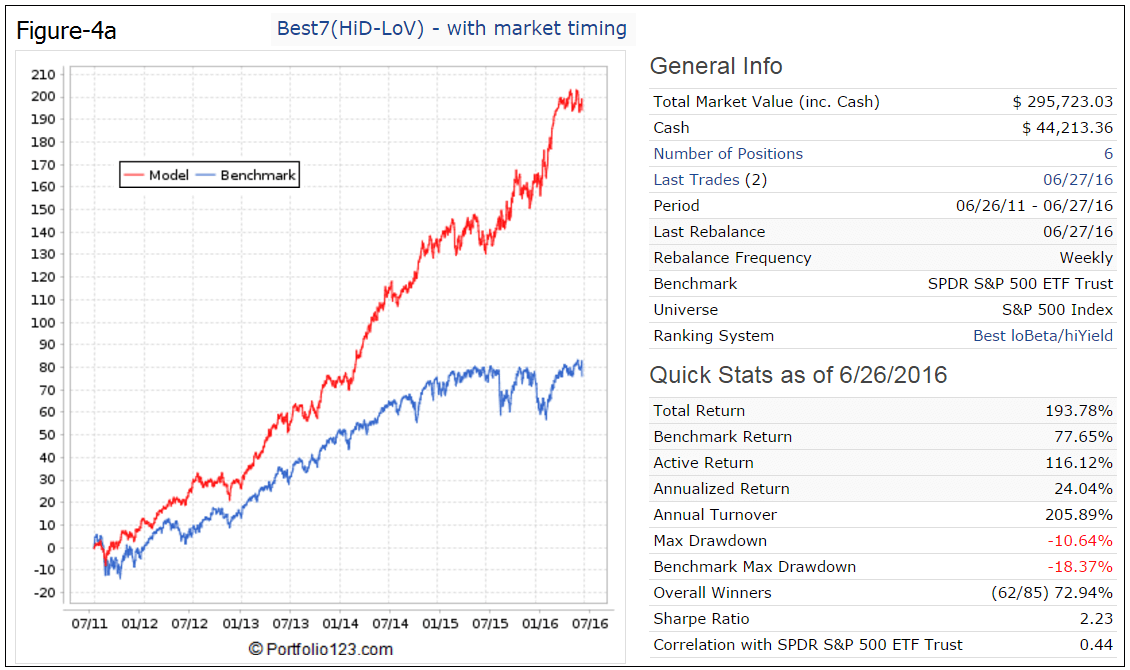

In the Figures-3a and 4a the red graph represents the model and the blue graph shows the performance of benchmark SPY. These figures can be directly compared to Figures-3 and 4 in the original model description.

Figure-3a: Simulated Performance 2000-2016:

Annualized Return= 25.3% (21.6%), Max DD= -14.4% (-32.4%). The backtest period was from Jan-2000 to Jun-2016. Values in (–) refer to original model.

Figure-4a: Simulated Performance 2011-2016:

Annualized Return= 24.0% (20.2%), Max DD= -10.6% (-11.0%). The backtest period was from Jun-2011 to Jun-2016. Values in (–) refer to original model.

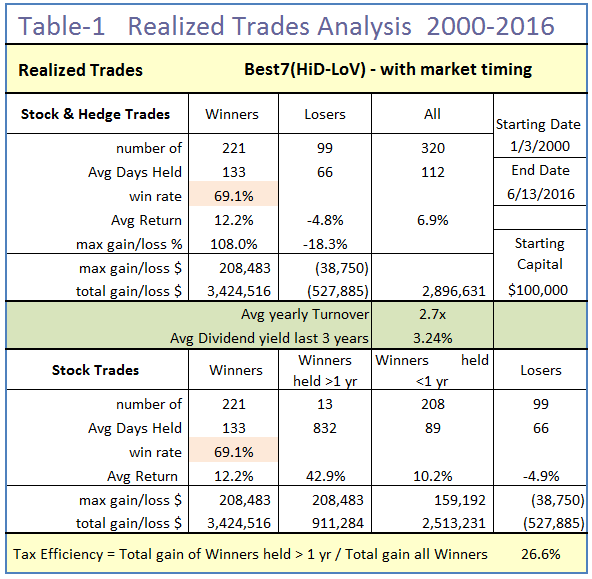

Realized Trades Analysis

An analysis of all the model’s realized trades is shown in Table-1. There were 221 (169) winning trades out of 320 (255) completed trades, resulting in a win rate of 69% (66%). The average yearly turnover was about 2.7 (2.4) times the annual end of year portfolio value. On average a position was held for 112 (162 days). There were 13 (15) winners held longer than one year, resulting in a Tax Efficiency of 27% (29%) for this model. Values in (–) refer to original model.

Following the Model

The backtests confirm that a successful strategy is to invest in high-yielding, low-volatility stocks of the S&P500 according to the HiD-LoV-7 System. This improved model can be followed live at iMarketSignals, where it will be updated weekly together with our other trading models.

Disclaimer

One should be aware that all results shown for the HiD-LoV-7 System are from a simulation and not from actual trading.

All information for this model and its index prior to their launch dates is back-tested, based on the methodology that was in effect on the launch dates. Back-tested performance, which is hypothetical and not actual performance, is subject to inherent limitations because it reflects application of a methodology and selection criteria in hindsight. Actual returns may differ from, and be lower than, back-tested returns.

All results are presented for informational and educational purposes only and shall not be construed as advice to invest in any assets. Backtesting results should be interpreted in light of differences between simulated performance and actual trading, and an understanding that past performance is no guarantee of future results. All investors should make investment choices based upon their own analysis of the asset, its expected returns and risks, or consult a financial adviser.

Hey Georg and Anton:

Nice improvement….Note on the backtests, Figures 3A and 4A, the “# of positions” states 6. Is this in error as the # of positions for this strategy is 7…………..?

I’ve used this strategy with good results by hedging 50% when the Standard or Composite Market Timer is ‘on’.

Thanks

Vman

6 positions is correct. Normally the model holds 7 positions, but sometimes less when it cannot find enough stocks to satisfy buy rules.

Hi Georg

This strategy seems to improve it’s performance with hedging – a lot.

Could you please run a test from 2000 where: When the Composite Market Timer (SPY-IEF) switches to IEF, the strategy would sell 33% of it’s equity holdings and use it to buy SDS. Many thanks,

Vman

Anton / George

Could you please share the turnover for this model for 2018 ?

Quick question: as I understand it, the HiD-LoV model doesn’t buy if there’s not a buy candidate that meets the rules. So for purposes of the backtest, what is the lowest number of positions this model has held? Has it ever gotten to all cash?

Thanks.

Tom C