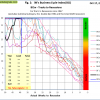

We offer three categories of membership – bronze, silver and gold at $20, $40 and $80 per month respectively, or discounted on a per year basis. The table to the left (just click on it) lists what you can access depending on the membership level you choose. All information not listed will remain free, however selected key articles could in future be restricted to a paid membership category.

We offer three categories of membership – bronze, silver and gold at $20, $40 and $80 per month respectively, or discounted on a per year basis. The table to the left (just click on it) lists what you can access depending on the membership level you choose. All information not listed will remain free, however selected key articles could in future be restricted to a paid membership category.

Please select your membership level here.

Most Recent Updates

October 18, 2024

Stock-markets:

The MAC-US model invested the US stock markets in first week of February 2023.

The MAC-US model invested the US stock markets in first week of February 2023.

The MAC-AU model generated a buy signal end November 2023, and is invested from the Australian stock market.

The MAC-AU model generated a buy signal end November 2023, and is invested from the Australian stock market.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

BCIg is not signaling a recession.

BCIg is not signaling a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.

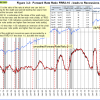

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is an inverted state since beginning August 2022 and is progressing to a non-iverted state in a week or two.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is an inverted state since beginning August 2022 and is progressing to a non-iverted state in a week or two.

A description of this indicator can be found here.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

A description of this indicator can be found here.

Monthly Updates

October 4, 2024

Unemployment

The 10/4/2024 BLS Employment Situation Report shows that the September 2024 unemployment rate decreased by 0.1% to 4.1% from last month. Our UER model does signal a recession.

The 10/4/2024 BLS Employment Situation Report shows that the September 2024 unemployment rate decreased by 0.1% to 4.1% from last month. Our UER model does signal a recession.

CAPE-Cycle-ID

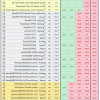

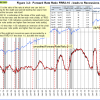

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

To avoid the bear market, exit stocks when the spread between the 5-month and 25-month moving averages of S&P-real becomes negative and simultaneously the CAPE-Cycle-ID score is 0 or -2. (read more)

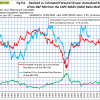

Estimated Forward 10-Year Returns

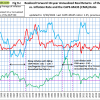

The estimated forward 10‐year annualized real return is 5.1% (previous month 5.4%) with a 95% confidence interval 3.7% to 6.6% (3.9% to 6.8% ). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate

The estimated forward 10‐year annualized real return is 5.1% (previous month 5.4%) with a 95% confidence interval 3.7% to 6.6% (3.9% to 6.8% ). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate  We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

.

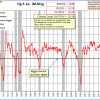

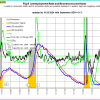

iM-GT Timer

The iM-GT Timer, based on Google Search Trends volume indicator entered the stock markets beginning September 2023. This indicator is described here.

The iM-GT Timer, based on Google Search Trends volume indicator entered the stock markets beginning September 2023. This indicator is described here.

Trade Weighted USD

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

TIAA Real Estate Account

Other Member Updates

October 18, 2024

Bond-market:

The Yield Curve:

Silver:

Weekly Updates

October 18, 2024

Bond-market:

The Yield Curve:

Silver:

October 18, 2024

Stock-markets:

The MAC-US model invested the US stock markets in first week of February 2023.

The MAC-US model invested the US stock markets in first week of February 2023.

The MAC-AU model generated a buy signal end November 2023, and is invested from the Australian stock market.

The MAC-AU model generated a buy signal end November 2023, and is invested from the Australian stock market.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

BCIg is not signaling a recession.

BCIg is not signaling a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is an inverted state since beginning August 2022 and is progressing to a non-iverted state in a week or two.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is an inverted state since beginning August 2022 and is progressing to a non-iverted state in a week or two.

A description of this indicator can be found here.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

A description of this indicator can be found here.

Monthly Updates

October 4, 2024

Unemployment

The 10/4/2024 BLS Employment Situation Report shows that the September 2024 unemployment rate decreased by 0.1% to 4.1% from last month. Our UER model does signal a recession.

The 10/4/2024 BLS Employment Situation Report shows that the September 2024 unemployment rate decreased by 0.1% to 4.1% from last month. Our UER model does signal a recession.

CAPE-Cycle-ID

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

To avoid the bear market, exit stocks when the spread between the 5-month and 25-month moving averages of S&P-real becomes negative and simultaneously the CAPE-Cycle-ID score is 0 or -2. (read more)

Estimated Forward 10-Year Returns

The estimated forward 10‐year annualized real return is 5.1% (previous month 5.4%) with a 95% confidence interval 3.7% to 6.6% (3.9% to 6.8% ). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate

The estimated forward 10‐year annualized real return is 5.1% (previous month 5.4%) with a 95% confidence interval 3.7% to 6.6% (3.9% to 6.8% ). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate  We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

.

iM-GT Timer

The iM-GT Timer, based on Google Search Trends volume indicator entered the stock markets beginning September 2023. This indicator is described here.

The iM-GT Timer, based on Google Search Trends volume indicator entered the stock markets beginning September 2023. This indicator is described here.

Trade Weighted USD

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

TIAA Real Estate Account