- This 5-stock trading strategy with the Healthcare Sector stocks of the S&P 500 produces much higher returns than the Healthcare Select Sector SPDR Fund (XLV).

- The universe from which stocks are selected holds point-in-time, the S&P 500 healthcare stocks of FactSet’s Reverse Business Industry Classification System.

- The model ranks the stocks of this custom universe with the Portfolio123 “Greenblatt” ranking system and selects periodically the highest ranked stocks which also satisfy stipulated industry and yield requirements.

- From 1/2/2009 to 9/28/2020 this strategy would have produced an annualized return (CAGR) of 23.6%, significantly more than the 13.8% CAGR of XLV over this period.

Blog Archives

Profiting From Trading Stocks Of The S&P 500 Healthcare Sector (iM-Top5(XLV)Select)

Profiting From Trading Stocks Of The S&P 500 Consumer Staples Sector (iM-Top5(XLP)Select)

- This 5-stock trading strategy with the Consumer Staples Sector stocks of the S&P 500 produces much higher returns than Consumer Staples Select Sector SPDR Fund (XLP).

- The universe from which stocks are selected holds point-in-time, the S&P 500 consumer non-cyclical stocks of FactSet’s Reverse Business Industry Classification System.

- The model ranks the stocks of this custom universe with a modified “Greenblatt” ranking system and selects periodically the highest ranked stocks which also satisfy stipulated yield requirements.

- From 1/2/2009 to 9/23/2020 this strategy would have produced an annualized return (CAGR) of 25.3%, significantly more than the 11.4% CAGR of XLP over this period.

Profiting from Trading Stocks of the Technology Select Sector SPDR Fund (XLK) — iM-Top5(XLK)Select

- This trading strategy with five stocks from those of ETF (XLK), mainly with a dividend yield greater than that of the S&P 500 index, produces much higher returns than XLK.

- The universe from which stocks are selected holds point-in-time, the S&P 500 technology stocks of FactSet’s Reverse Business Industry Classification System and some electronic payments industry stocks, similar to XLK.

- The model ranks the stocks of this custom universe with the Portfolio 123 “Greenblatt” ranking system and selects periodically the highest ranked stocks which also satisfy the stipulated yield requirement.

- From 1/2/2009 to 9/8/2020 this strategy would have produced an annualized return (CAGR) of 31.8%, significantly more than the 20.1% CAGR of XLK over this period.

The analysis was performed on the on-line portfolio simulation platform Portfolio 123.

Read more >

Profiting from the Consensus Stock Holdings of Ten Large Hedge Funds (iM-10LargeHedgeFundSelect)

- This is a copycat trading strategy based on the quarterly 13F filings of 10 large hedge funds with assets under management (AUM) greater than $3.5-Billion.

- The algorithm looks at the top 20 largest holdings from each of the 10 filers and then picks the 15 most frequently held stocks among all of the filers.

- The model selects 12 of the 15 consensus picks from this hedge fund group with a ranking system based on quality.

- Changes in the holdings occur only every three months, about 45 days after the end of a quarter when 13F filings become public information, February, May, August, and November.

- From Feb-2008 to Aug-2020 this strategy would have produced an annualized return (CAGR) of 27.6%, significantly more than the 10.1% CAGR of the S&P 500 ETF (SPY) over this period.

A Dividend Growth Strategy for Perennial Income

- A simulation of this strategy with annual withdrawal rates of up to 10% still showed long-term growth which exceeded that of buy-and-hold the S&P 500 ETF (SPY).

- The backtests use the FactSet stock database and FactSet’s Revere Business Industry Classifications System (RBICS).

- The model holds equal-weight 10 stocks of the Russell 1000 index which are ranked with a simple ranking system to identify shares of the highest “quality” companies.

- The strategy provides a high dividend yield because a minimum yield excess (depending on RBICS sector type) over the yield of SPY is a critirium for stock selection.

- From Jan-2000 to Jun-2020 this strategy without withdrawals would have produced an annualized return (CAGR) of 21.5%, much more than the 5.6% CAGR obtained from SPY over the same period.

Covid-19 Recession — No Sign of a Recovery: The iM-Weekly Unemployment Monitor

- A truer picture of the employment situation is extracted from the Unemployment Insurance Weekly Claims (UIWC) report.

- Persons receiving some form of unemployment benefit account for 18.6% of the labor force and not 13.3% – the official unemployment rate.

- Monitoring of the weekly insured unemployed can provide early indication of recovery from the Covid-19 crisis.

- No meaningful economic recovery is identified from the current UIWC report.

Profiting from the Consensus Stock Holdings of Five Hedge Funds (iM-5HedgeFundSelect)

- This is a copycat trading strategy based on the quarterly 13F filings of five hedge funds.

- The model holds the top 20 consensus picks from a group of five hedge funds.

- Changes in the holdings occur only every three months when the end-of-the-month 13F filings becomes public information.

- From Jan-2007 to May-2020 this strategy would have produced an annualized return (CAGR) of 27.1%, much more than the 7.8% CAGR of the S&P 500 ETF (SPY).

Rational for a Copycat Strategy

Research from Barclay and Novus published in October 2019 found that a stock selection copycat strategy that combines conviction and consensus of fund managers that have longer-term views outperformed the S&P 500 by 3.80% on average annually from Q1 2004 to Q2 2019.

Profiting from the Expected Uptrend of Gold with a Momentum Trading Strategy of Gold Mining Stocks

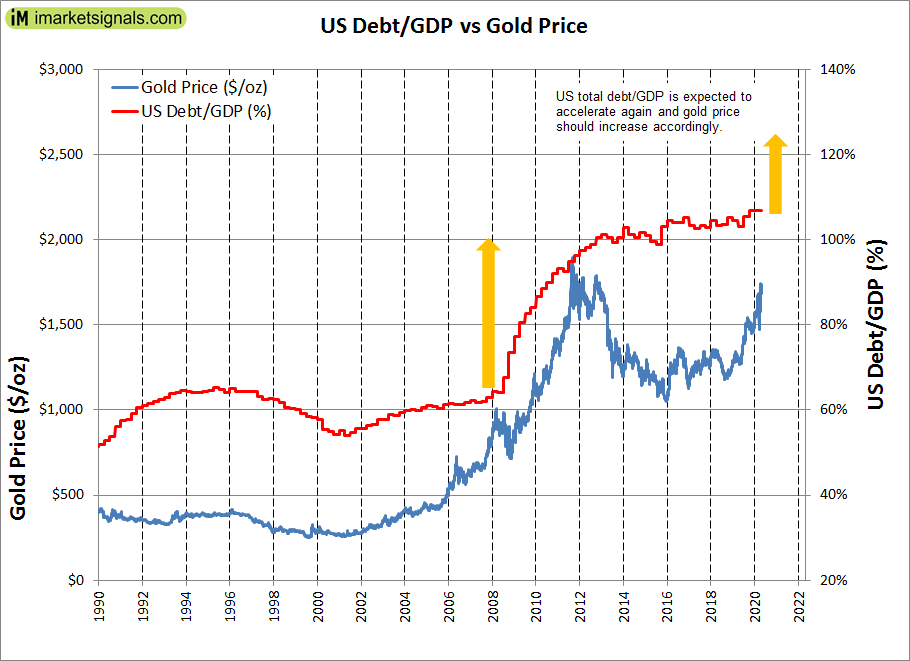

- The ratio of federal debt to the GDP is expected to rise dramatically due to the covid-19 pandemic fiscal stimulus. This should result in a significant gold price rally.

- The analysis shows that a trading strategy for gold miners is preferable to a buy-and-hold investment strategy of individual mining stocks.

- This momentum strategy selects periodically one gold mining stock from a set of three: AngloGold Ashanti Ltd (AU), Newmont Corp. (NEM) and Sibanye-Stillwater Ltd. (SBSW).

- The selection is based on the momentum of the percentage price change and the up/down volume ratio of the stocks.

- From Jan-2016 to Apr-2019 this strategy would have produced an annualized return (CAGR) of 80.6%, much more than that of the best performing single stock of the three considered.

The ratio of federal debt to the economic output of the U.S. is expected to rise dramatically by the end of 2020 as a result of the covid-19 pandemic fiscal stimulus. This, and low interest rates should result in a significant rally in gold, similar to the post 2008 gold price increase, as shown in the figure below.

Posted in blogs

Short-Term Losses for Stocks Could Exceed 30%, But 10-Year Forward Returns Look Good

- The average of S&P500 for March-2020 was 2652. A 12% decline, or 325 point drop, would bring it to 2327, the end of March level of the long-term trend line.

- A recession appears to be imminent. Stocks could lose up to 50% if the S&P reaches the lower prediction band line of the long-term trend.

- If the percentage decline matches the loss during 2009-09 recession then the S&P500 could reach a low of 1560, a decline of about 35% from the current value.

- The Shiller Cyclically Adjusted Price to Earnings Ratio (CAPE) is at a level of 24.5, almost identical to the 35-year moving average (MA35) of the CAPE of 24.3.

- The CAPE-MA35 ratio is 1.01, forecasting a 10-year annualized real return of 7.9%. Should the CAPE-MA35 ratio decline further then 10-year forward returns will be higher.

Posted in blogs

The Anticipated March 2020 Unemployment Rate Will Signal A Recession

- A reliable source for recession forecasting is the unemployment rate (UER), which can provide signals for the beginnings and ends of recessions.

- The February 2020 UER is 3.5%, signifying that no recession was imminent. However, if the March 2020 UER is 3.9% then a recession will be signaled, according to the model.

- According to the Washington Post more than a million workers are expected to lose their jobs by the end of March, a dramatic turnaround from February.

- Goldman Sachs estimates that 2.25 million Americans filed for their first week of unemployment benefits in the week ending March 20.

- If the number of unemployed rises only by one million than the March UER will be 4.1%, if it rises by 2.25 million it will be 4.9%.

Posted in blogs

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer