|

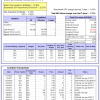

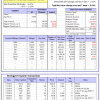

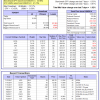

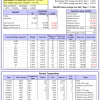

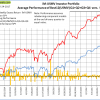

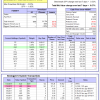

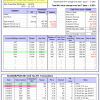

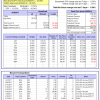

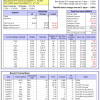

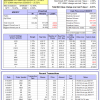

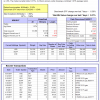

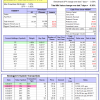

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

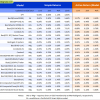

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 11.5%, and for the last 12 months is 16.0%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.52% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $515,578 which includes $2,193 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 11.3%, and for the last 12 months is 14.3%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.78% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $139,814 which includes $338 cash and excludes $3,345 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 15.0%, and for the last 12 months is 14.5%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of iM-Combo5 gained 1.31% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $113,404 which includes $762 cash and excludes $555 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient The model’s out of sample performance YTD is 6.2%, and for the last 12 months is -6.6%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -0.24% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $417,751 which includes $566 cash and excludes $8,444 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 12.3%, and for the last 12 months is 23.8%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Since inception, on 7/1/2014, the model gained 63.75% while the benchmark SPY gained 33.98% and VDIGX gained 29.24% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.96% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $163,751 which includes $6,687 cash and excludes $1,588 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 11.3%, and for the last 12 months is 7.8%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.26% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $225,274 which includes $224 cash and excludes $1,298 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 5.7%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.23% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $107,582 which includes $437 cash and excludes $979 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 23.1%, and since inception 30.2%. Over the same period the benchmark SPY performance was 11.4% and 17.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.04% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $130,180 which includes $1,885 cash and excludes $210 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 13.1%, and for the last 12 months is 15.1%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 0.64% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $111,496 which includes $21 cash and excludes $786 spent on fees and slippage. | |

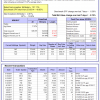

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 10.6%, and for the last 12 months is 4.9%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Since inception, on 6/30/2014, the model gained 54.69% while the benchmark SPY gained 33.98% and the ETF USMV gained 41.74% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.02% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $154,689 which includes $320 cash and excludes $3,210 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 15.2%, and for the last 12 months is 17.5%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Since inception, on 1/5/2015, the model gained 44.98% while the benchmark SPY gained 28.75% and the ETF USMV gained 30.17% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.14% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $144,980 which includes $9 cash and excludes $773 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 10.1%, and for the last 12 months is 8.2%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Since inception, on 3/30/2015, the model gained 26.66% while the benchmark SPY gained 24.16% and the ETF USMV gained 25.72% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -0.11% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $126,660 which includes $57 cash and excludes $660 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 3.7%, and for the last 12 months is 9.2%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Since inception, on 7/1/2014, the model gained 60.78% while the benchmark SPY gained 33.98% and the ETF USMV gained 41.74% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -0.27% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $160,780 which includes $190 cash and excludes $995 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 58.51% while the benchmark SPY gained 31.95% and the ETF USMV gained 39.78% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.00% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $158,505 which includes -$23 cash and excludes $869 spent on fees and slippage. | |

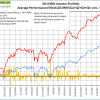

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 33.28% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is 3.6%, and for the last 12 months is 2.3%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of iM-Best(Short) gained 0.00% at a time when SPY gained 0.53%. Over the period 1/2/2009 to 7/24/2017 the starting capital of $100,000 would have grown to $100,231 which includes $100,231 cash and excludes $22,354 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 9.1%, and for the last 12 months is 4.4%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.41% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $105,754 which includes $735 cash and excludes $107 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 7.2%, and for the last 12 months is 4.3%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.48% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $106,627 which includes $1,608 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 9.5%, and for the last 12 months is 17.2%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.39% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,288 which includes $1,074 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 13.0%, and for the last 12 months is 18.0%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.52% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $121,572 which includes $137 cash and excludes $1,389 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 19.6%, and for the last 12 months is 23.7%. Over the same period the benchmark SPY performance was 11.4% and 15.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.78% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,246 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance from inception is 2.6%. The benchmark SPY performance over the same period is 6.1%. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.27% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $102,619 which includes $595 cash and excludes $69 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance from inception is 1.9%. The benchmark SPY performance over the same period is 5.6%. Over the previous week the market value of the iM-Min Drawdown Combo gained 0.67% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $101,923 which includes $541 cash and excludes $44 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 12.2%, and since inception 15.3%. Over the same period the benchmark SPY performance was 11.4% and 17.9% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 1.08% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $138,761 which includes $552 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 12.2%, and since inception 15.3%. Over the same period the benchmark SPY performance was 11.4% and 17.9% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.35% at a time when SPY gained 0.53%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $115,311 which includes $863 cash and excludes $880 spent on fees and slippage. |

Blog Archives

iM-Best Reports – 7/24/2017

Posted in pmp SPY-SH

iM-Best Reports – 6/26/2017

|

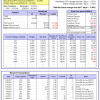

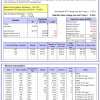

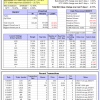

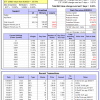

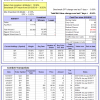

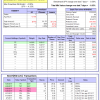

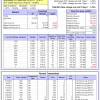

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 10.0%, and for the last 12 months is 22.4%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.56% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $508,236 which includes $2,193 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 9.9%, and for the last 12 months is 13.0%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.05% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $138,100 which includes $271 cash and excludes $3,345 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 12.5%, and for the last 12 months is 12.1%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Over the previous week the market value of iM-Combo5 gained -0.04% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $110,975 which includes $728 cash and excludes $555 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient The model’s out of sample performance YTD is 6.7%, and for the last 12 months is -9.6%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 0.88% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $419,718 which includes $566 cash and excludes $8,444 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 11.8%, and for the last 12 months is 31.0%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Since inception, on 7/1/2014, the model gained 62.94% while the benchmark SPY gained 32.06% and VDIGX gained 28.33% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.58% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $162,935 which includes $382 cash and excludes $1,542 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 9.3%, and for the last 12 months is 9.2%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.75% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $221,105 which includes -$652 cash and excludes $1,298 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 4.9%, and since inception 7.8%. Over the same period the benchmark SPY performance was 9.8% and 18.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -1.05% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $107,822 which includes -$429 cash and excludes $942 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 13.9%, and for the last 12 months is 18.3%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -0.25% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $112,273 which includes $1,681 cash and excludes $662 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 8.8%, and for the last 12 months is 13.0%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Since inception, on 6/30/2014, the model gained 52.22% while the benchmark SPY gained 32.06% and the ETF USMV gained 41.51% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.95% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $152,216 which includes -$138 cash and excludes $3,142 spent on fees and slippage. | |

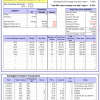

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 13.0%, and for the last 12 months is 25.5%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Since inception, on 1/5/2015, the model gained 42.25% while the benchmark SPY gained 26.91% and the ETF USMV gained 29.96% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.09% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $142,250 which includes $510 cash and excludes $727 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 9.4%, and for the last 12 months is 15.7%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Since inception, on 3/30/2015, the model gained 25.85% while the benchmark SPY gained 22.38% and the ETF USMV gained 25.52% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -0.61% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $125,845 which includes $323 cash and excludes $642 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is 18.3%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Since inception, on 7/1/2014, the model gained 62.57% while the benchmark SPY gained 32.06% and the ETF USMV gained 41.51% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -0.57% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $162,570 which includes $824 cash and excludes $972 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 57.29% while the benchmark SPY gained 30.07% and the ETF USMV gained 39.56% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.56% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $157,290 which includes $765 cash and excludes $827 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 33.94% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 0.6%. Over the same period the benchmark SPY performance was 9.8% and 22.2% respectively. Over the previous week the market value of iM-Best(Short) gained 0.03% at a time when SPY gained -0.56%. Over the period 1/2/2009 to 6/26/2017 the starting capital of $100,000 would have grown to $98,677 which includes $118,070 cash and excludes $22,293 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 9.8%, and since inception 6.4%. Over the same period the benchmark SPY performance was 9.8% and 18.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.33% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $106,434 which includes $457 cash and excludes $107 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 7.4%, and since inception 6.9%. Over the same period the benchmark SPY performance was 9.8% and 18.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.72% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $106,874 which includes $851 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 8.0%, and since inception 18.7%. Over the same period the benchmark SPY performance was 9.8% and 18.5% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained -0.20% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $118,656 which includes $1,074 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 11.3%, and since inception 19.8%. Over the same period the benchmark SPY performance was 9.8% and 18.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.56% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $119,836 which includes $137 cash and excludes $1,389 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 18.5%, and since inception 23.1%. Over the same period the benchmark SPY performance was 9.8% and 18.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.11% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $123,136 which includes $269 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance from inception is 2.0%. The benchmark SPY performance over the same period is 4.5%. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.07% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $102,038 which includes -$376 cash and excludes $00 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance from inception is 1.5%. The benchmark SPY performance over the same period is 4.1%. Over the previous week the market value of the iM-Min Drawdown Combo gained -0.30% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $101,516 which includes -$40 cash and excludes $00 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 19.3%, and since inception 34.7%. Over the same period the benchmark SPY performance was 9.8% and 16.2% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -0.71% at a time when SPY gained -0.56%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $134,695 which includes $359 cash and excludes $1,030 spent on fees and slippage. |

Posted in pmp SPY-SH

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer