- This ETF trading model uses the Conference Board Leading Economic Index to determine “Risk-On” periods for equities.

- A universe is defined from the SPDR, Vanguard, and PowerShares ETF providers for the sectors healthcare, energy, communication, technology, and general multi-sector funds, holding large-mega cap stocks from the United States.

- The model selects 3 ETFs from the previously defined universe at the beginning of a “Risk-On” period and holds these ETFs continuously until the end of the “Risk-On” period.

- During “Risk-Off” periods for equities it goes to the gold ETF (GLD) to maximize returns. ETF (BND) is also a suitable alternative to GLD.

- The simulation shows that this strategy would have produced over 7-times the total return of SPY with similar risk.

Blog Archives

Timing The Stock Market With The Conference Board Leading Economic Index

Stocks Are Moderately Overvalued but 10-Year Forward Returns Look Good: Update April 2023

- The average of S&P 500 for March-2023 was 3,969 (15% down from Dec-2021 average of 4,675) and is 384 points higher than the corresponding re-calibrated long-term trend value of 3,585.

- For the S&P 500 to reach the corresponding long-trend value would entail a 10% decline from the March average value, indicating that the S&P 500 is not significantly overvalued anymore.

- The Shiller CAPE-ratio is at 27.9, 8% higher than its 35-year moving average (MA35), currently at 25.9, forecasting a relatively high 10-year annualized real return of about 7.3%.

- The long-term trend indicates a forward 10-year annualized real return of 5.5%

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

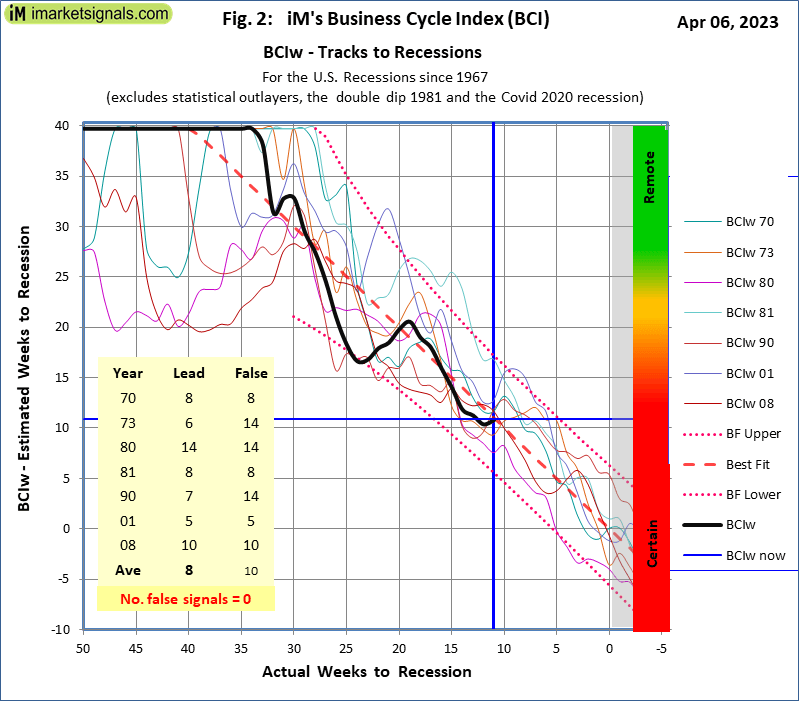

iM’s Business Cycle Index Signals an Imminent Recession – Update 4/7/2023

- Knowing when the U.S. economy is heading for recession is paramount to successful investment decisions.

- Our weekly Business Cycle Index would have provided early reliable warnings for the past seven recessions and signaled the Covid 2020 recession one week late.

- The Department of Labor backward revised nearly two years of seasonal adjusted data.

- The BCIg is now signalling a recession since mid March 2023 with a 12 weeks average lead time.

- The BCIw is now signalling a recession, earliest in 5 weeks but not later than 17 weeks.

Expect Further Losses For Stocks but 10-Year Forward Returns Look Better: Update December2022

- The average of S&P 500 for Nov-2022 was 3,917 (16% down from Dec-2021 average of 4,675) and is 385 points higher than the corresponding re-calibrated long-term trend value of 3,532.

- For the S&P 500 to reach the corresponding long-trend value would entail a 10% decline from the November average value, indicating that the S&P 500 is not significantly overvalued anymore.

- The Shiller CAPE-ratio is at 28.3, 10% higher than its 35-year moving average (MA35), currently at 25.8, forecasting a relatively high 10-year annualized real return of about 7.2%.

- The long-term trend indicates a forward 10-year annualized real return of 5.5%

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

Expect Further Losses For Stocks but 10-Year Forward Returns Look Better: Update November 2022

- The best fit line and prediction band were re-calculated from Jan-1871 to Sep-2022. This added over 10 years of data after July-2012, the end date of the previous regression analysis.

- The average of S&P 500 for Oct-2022 was 3,726 (20% down from Dec-2021 average of 4,675) and is 207 points higher than the corresponding re-calibrated long-term trend value of 3,519.

- For the S&P 500 to reach the long-trend would entail only a 6% decline from the October average value, indicating that the S&P 500 is not significantly overvalued anymore.

- The Shiller CAPE-ratio is at 27.2, only 6% higher than its 35-year moving average (MA35), currently at 25.7, forecasting a relatively high 10-year annualized real return of about 7.5%.

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

Expect Further Losses For Stocks And Very Low 10-Year Forward Returns: Update September 2022

- The average of S&P 500 for September 2022 was 3,853 (18% down from December 2021 average of 4,675) and is still 1,243 points higher than the corresponding long-term trend value of 2,610.

- For the S&P 500 to reach the long-trend would entail a 32% decline from the September average value, possibly over a short period.

- The Shiller CAPE-ratio is at a level of 28.4. That is 10% higher than its 35-year moving average (MA35), currently at 25.7.

- The CAPE-MA35 ratio is at 1.10 (down from the December 2021 level of 1.51), forecasting a relatively high 10-year annualized real return of about 7.1%.

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

- The historic long-term trend indicates a September 2032 value of 4,943; a 10-year forward real annualized return of only 2.5% (up from the December 2021 forecast of 0.2%).

An Upcoming Recession is Signaled by the Forward Rate Ratio

- Prior to recession the yield curve becomes inverted, as indicated by the Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) being less than 1.00.

- The FRR2-10 crosses 1.000 downward signifying that US economic activity is in the boom phase of the business cycle, nearing the next recession.

- The average lead time after FRR2-10 becomes less than 1.00 to the subsequent recession start was 14 months for the seven of the eight last recessions.

Expect Further Losses For Stocks And Very Low 10-Year Forward Returns: Update July 2022

- The average of S&P 500 for May 2022 was 4,040 (14% down from December 2021 average) and is still 1,469 points higher than the corresponding long-term trend value of 2,571.

- For the S&P 500 to reach the long-trend would entail a 36% decline from the May average value, possibly over a short period.

- The Shiller CAPE-ratio is at a level of 31.0. That is 21% higher than its 35-year moving average (MA35), currently at 25.6.

- The CAPE-MA35 ratio is at 1.21 (down from the December 2021 level of 1.51), forecasting a 10-year annualized real return of about 6.3%.

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

- The historic long-term trend indicates a 10-year forward real annualized return of only 1.9% (up from the December 2021 forecast of 0.2%).

Expect Further Losses For Stocks And Very Low 10-Year Forward Returns: Update June 2022

- The average of S&P 500 for May 2022 was 4,040 (14% down from December 2021 average) and is still 1,469 points higher than the corresponding long-term trend value of 2,571.

- For the S&P 500 to reach the long-trend would entail a 36% decline from the May average value, possibly over a short period.

- The Shiller CAPE-ratio is at a level of 31.0. That is 21% higher than its 35-year moving average (MA35), currently at 25.6.

- The CAPE-MA35 ratio is at 1.21 (down from the December 2021 level of 1.51), forecasting a 10-year annualized real return of about 6.3%.

- However, rising inflation with a falling CAPE-MA35 ratio, similar to what occurred in the period 1964-1973, implies very low or negative 10-year forward annualized real returns.

- The historic long-term trend indicates a 10-year forward real annualized return of only 1.9% (up from the December 2021 forecast of 0.2%).

The iM-Inflation Attuned Multi-Model Market Timer

- Investment risk can be reduced by a multi-model market timer whose many components use different and uncorrelated financial and economic data, including inflation.

- This model seeks to determine effective asset allocation for risk-on and risk-off periods for equities considering the effect of inflation.

- Four risk scenarios are possible: risk-on & normal-inflation, risk-on & high-inflation, risk-off & normal-inflation, and risk-off & high-inflation. Different ETF groups apply to each risk scenario.

- From 2000 to 2022, switching accordingly between risk-related ETF groups would have produced an annualized return of about 39% versus 6.5% for buy and hold SPY.

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer