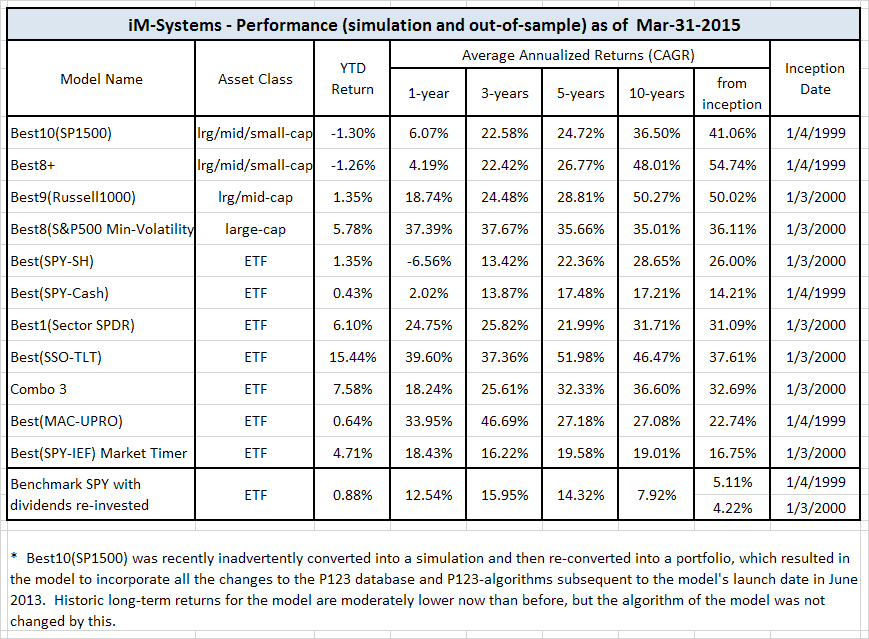

iM-Best Systems

Quick Comparison

Quick Links to Model Descriptions

R2G & iM(Silver) iM-Best10(S&P 1500): A Portfolio Management System for High Returns from the S&P 1500

R2G iM-Best9(Russell 1000) – Large-Cap Portfolio Management System

R2G iM-Best8+ Portfolio Management System

iM(Gold) iM’s Best12(USMV)-Trader Minimum Volatility Stocks

iM(Gold) iM’s Best12(USMV)Q1..4-Investor Minimum Volatility Stocks (The Q3 model available to Silver)

iM(Silver) iM-Best10(VDIGX) Trading the Dividend Growth Stocks VDIGX

R2G & iM(Silver) iM-Best(SPY-SH) Market Timing System: Gains for Up and Down Markets

R2G & iM(Gold) iM-Best1(Sector SPDR) Rotation System

R2G & iM(Gold) iM-Best(SSO-TLT) Switching System

iM(Gold) iM-Best Combo3: Best(SPY-SH) + Best1(Sector SPDR) + Best(SSO-TLT)

iM-Best(SPY-Cash) Market Timing System

iM-Best(SSO-SDS): Beating the Market with Leveraged ETFs

Survivorship Bias: neither Myth nor Fact

Quick Links to Ready-2-Go Models

Best(SPY-SH) Gains for Up & Down Markets

When subscribing to P123 please use this link or enter token IMARKETSIGNALS when registering to obtain 30 days free membership.

Disclaimer: The opinions in this document are for informational and educational purposes only and are obtained from a mathematical algorithm and should not be construed as a recommendation to buy or sell the stocks mentioned. Past performance of the companies may not continue and the companies’ stock values may decline. The information in this document is believed to be accurate and represents the output of a mathematical algorithm, and under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation. Also see our Terms of Use/Disclaimer.

Leave a Reply

You must be logged in to post a comment.