- The Shiller CAPE (cyclically adjusted price-earnings ratio) is typically regarded as a stock market valuation measure. When the CAPE is high stocks are supposed to be expensive, and vice-versa.

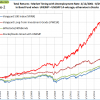

- The CAPE itself is not a good stock market timer. However, the CAPE can indirectly be used for market timing by determining a Cycle-ID as formulated by Theodore Wong.

- Our 1950-2016 backtest of the CAPE-Cycle-ID model, when switching between the S&P500 with dividends and the money market, showed an annualized return of 11.9%, versus 10.4% for buy-and-hold.

Blog Archives

Timing the Stock Market with the Shiller CAPE

Market Timing with ETFs SH and RSP: Using the iM-Composite & Standard Market Timers’ Rules

- This market timing model integrates the iM-Standard Market Timer and the iM-Composite Market Timer.

- This model switches between ETFs SH and RSP providing signals when to be short or long the stock market.

- The model does not utilize Bond ETFs, and is therefore not directly affected by the potential risk of rising interest rates.

- From 2001 to 2016 switching between SH and RSP provided significant benefits. This strategy would have produced an average annual return of 26.2% versus only 8.5% for buy&hold RSP.

Composite Market Timing Increases Returns And Reduces Drawdown.

- Reliance on a single market timer could be risky. The risk can be reduced with a composite timer who’s component timers use different, uncorrelated, financial and economic data.

- From 2001 to 2016 switching between bonds and stocks using a composite timer would have produced an average annual return of 19.7% versus only 5.2% for buy & hold stocks.

Profitable Market Timing with the Unemployment Rate, Backtested to 1974.

- If the unemployment rate is higher than three months ago the model exits the stock market and enters the bond market, and re-enters the market when the unemployment rate is equal or lower than where it was three months ago.

- From 2001 to 2016 switching between bonds and stocks provided significant benefits. This strategy would have produced an average annual return of 13.0% versus only 5.2% for buy&hold stocks.

- Using long-term data from 1973 to 2016 for stocks and bonds confirms the unemployment rate (UNEMP) as a profitable stock market timer.

2.5% Inflation By December 2016; This Negative Inflation Surprise Favors TIPS Over Conventional Bonds!

- If the FED does not change the Federal Funds Rate then the year-on-year inflation rate is set to rise, and we calculate it at 2.5% for December 2016.

- The inflation rate for August was 1.1% and it is predicted rise to 2.5% by December. Accordingly, prices of Treasury Inflation-Protected Securities (TIPS) should rise as well.

- With inflation rising, and markets uncertain, TIPS should be a reasonably safe investment for some time. Conventional bond funds are expected to perform worse than TIPS funds

Improving on Target Date Funds: 14.5% Return from the iM Best4 MC-Score Vanguard ETF Investor System

- An investor who is able to assess stock market climate, and able to adjust asset allocation accordingly, will have an advantage in the market.

- Four different approaches are used to assess market climate which are based on economic, momentum and sentiment indicators. This results in five different market climate segments.

- During up-markets the system is invested in long equity ETFs and then switches progressively to fixed-income ETFs when neutral or negative stock market climates exist.

- This system invests simultaneously in four Vanguard ETFs (or their corresponding mutual funds), appropriately selected for the prevailing market climate, and typically holds them for longer than a year.

- A backtest of the model from Jan-2000 to Aug-2016 shows an average annual return of 15% with a maximum drawdown of -12.6% and a low average annual turnover of 82%.

ETF Investing According to Market Climate: With the iM Best2 MC-Score System

- This system provides investment selections according to stock market climate. During up-markets it is long equity ETFs and switches to bond- and gold ETFs during neutral and negative markets.

- It invests periodically in only two ETFs, appropriately selected for the prevailing market climate.

- A backtest from Jan-2000 to Jul-2016 shows an average annual return of 16% with a maximum drawdown of -17% and only 61 realized trades during this 16.5 year long period.

Trading the High-Yield, Low-Volatility Stocks of the S&P500 With the iM HiD-LoV-7 System

- The system screens for S&P 500 stocks which yield significantly more than the average yield of the index and which also have a low 3-yr beta (low volatility).

- It is shown that holding continuously all the screen-selected high-yielding, low-volatility stocks of the S&P500 would have provided an average annualized return of about 14% from Jan-2000 to Jun-2016.

- Holding only the highest ranked seven stocks of this group and periodically rebalancing would have produced a higher annualized return of about 22% with a maximum drawdown of -34%.

- The iM HiD-LoV-7 System shows much higher returns and less risk than the S&P 500 Low Volatility High Dividend Index.

Franco-Nevada Better Than Gold: Evaluating Royalty Companies With iMarketSignals’ Fund Rating System

- Royalty companies receive a stream, which is an agreed-upon amount of gold, silver, or other precious metal that a mining company is obligated to deliver in exchange for up-front cash.

- From 2008 to 2016, Franco-Nevada produced the best returns of all royalty companies, and better returns than GLD or SPY.

- When compared to GLD as the benchmark, the iM-Rating for FNV is A(A), indicating that the most recent one- and five-year Rolling Returns for the company were higher than for

- Additionally, the one- and five-year rolling return graphs for FNV are sloping upwards near the end, indicating possible further excess gains over the benchmark ETFs, GLD and SPY.

The Dynamic Linearly Detrended Enhanced Aggregate Spread: A Long Leading Recession Indicator

- The DAGS, short for Dynamic Linearly Detrended Enhanced Aggregate Spread, is a derivative of the Enhanced Aggregate Spread (EAS) recession indicator which comes from Robert Dieli.

- The DAGS can signal, as much as nine months ahead when a cycle peak (recession start) is likely to take place.

- Armed with that information, investors can make appropriate plans. As of writing (May 2016), it signals, at least to the end of January 2017, a continuation of the expansion phase of this business cycle.

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer