|

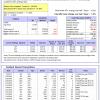

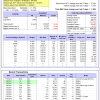

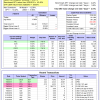

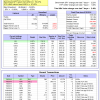

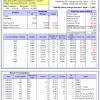

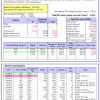

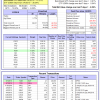

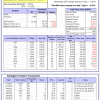

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 4.6%, and for the last 12 months is 16.8%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.24% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $588,222 which includes -$7,596 cash and excludes $17,694 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 6.7%, and for the last 12 months is 23.8%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.47% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $168,362 which includes $331 cash and excludes $4,006 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 8.1%, and for the last 12 months is 27.0%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-Combo5 gained 2.30% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $138,139 which includes $1,724 cash and excludes $983 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is 12.0%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Since inception, on 7/1/2014, the model gained 84.65% while the benchmark SPY gained 53.67% and VDIGX gained 45.94% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.88% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $184,520 which includes $159 cash and excludes $2,296 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -13.7%, and for the last 12 months is -10.5%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 3.63% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $199,399 which includes $649 cash and excludes $2,787 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 8.8%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.92% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $112,416 which includes $569 cash and excludes $2,050 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 22.7%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.11% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $154,457 which includes $1,470 cash and excludes $704 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 4.9%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-BestogaX5-System gained 1.96% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $116,227 which includes $207 cash and excludes $1,256 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 6.7%, and for the last 12 months is 21.2%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Since inception, on 6/30/2014, the model gained 82.54% while the benchmark SPY gained 53.67% and the ETF USMV gained 57.42% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.35% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $182,207 which includes $71 cash and excludes $4,334 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 8.3%, and for the last 12 months is 23.2%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Since inception, on 1/5/2015, the model gained 74.77% while the benchmark SPY gained 47.67% and the ETF USMV gained 44.57% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.33% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $174,365 which includes $139 cash and excludes $1,196 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 7.3%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Since inception, on 3/30/2015, the model gained 45.47% while the benchmark SPY gained 42.40% and the ETF USMV gained 39.63% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 2.81% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $145,223 which includes $133 cash and excludes $1,014 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is 13.4%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Since inception, on 7/1/2014, the model gained 81.13% while the benchmark SPY gained 53.67% and the ETF USMV gained 57.42% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 2.49% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $180,631 which includes $94 cash and excludes $1,538 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 89.03% while the benchmark SPY gained 51.35% and the ETF USMV gained 55.25% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 2.29% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $188,890 which includes $141 cash and excludes $1,340 spent on fees and slippage. | |

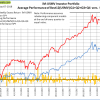

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 41.89% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -3.4%, and for the last 12 months is -12.5%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-Best(Short) gained -0.08% at a time when SPY gained 2.22%. Over the period 1/2/2009 to 7/9/2018 the starting capital of $100,000 would have grown to $88,098 which includes $106,167 cash and excludes $24,381 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -2.1%, and for the last 12 months is 5.2%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.49% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,030 which includes $1,980 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.6%, and for the last 12 months is 5.2%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.94% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,229 which includes $4,783 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 14.3%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 2.18% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $134,948 which includes $3,223 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 17.4%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 2.18% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $139,325 which includes $2,042 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 26.7%, and for the last 12 months is 70.5%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 5.02% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $223,036 which includes $77 cash and excludes $2,429 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -3.6%, and for the last 12 months is 3.4%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.39% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,059 which includes $77 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 5.5%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 1.27% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $106,702 which includes $2,318 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 9.0%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 1.63% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $108,396 which includes $3,018 cash and excludes $317 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 11.2%, and for the last 12 months is 35.8%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 4.43% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $180,984 which includes $1,539 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 15.5%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 2.13% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $130,421 which includes $2,772 cash and excludes $880 spent on fees and slippage. |

Blog Archives

iM-Best Reports – 7/9/2018

Posted in pmp SPY-SH

iM-Best Reports – 5/7/2018

|

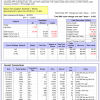

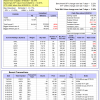

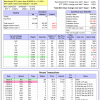

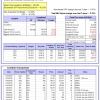

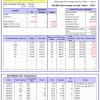

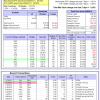

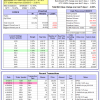

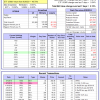

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 13.3%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.91% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $567,612 which includes $140 cash and excludes $15,371 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 2.2%, and for the last 12 months is 18.5%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.22% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $161,408 which includes -$374 cash and excludes $3,670 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 19.7%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-Combo5 gained 2.79% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $130,236 which includes $688 cash and excludes $820 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -2.1%, and for the last 12 months is 8.1%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Since inception, on 7/1/2014, the model gained 74.44% while the benchmark SPY gained 46.94% and VDIGX gained 40.09% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.26% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $174,144 which includes $130 cash and excludes $2,100 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -12.8%, and for the last 12 months is -5.4%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -6.82% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $202,201 which includes -$157 cash and excludes $2,464 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is -8.3%, and for the last 12 months is -2.3%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.83% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $103,809 which includes $1,230 cash and excludes $1,780 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -3.3%, and for the last 12 months is 18.4%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.22% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $146,653 which includes $570 cash and excludes $704 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 0.0%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-BestogaX5-System gained -3.55% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $107,811 which includes $893 cash and excludes $1,123 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 14.6%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Since inception, on 6/30/2014, the model gained 74.04% while the benchmark SPY gained 46.94% and the ETF USMV gained 50.86% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.25% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $173,972 which includes $63 cash and excludes $4,247 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 4.2%, and for the last 12 months is 21.0%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Since inception, on 1/5/2015, the model gained 68.24% while the benchmark SPY gained 41.21% and the ETF USMV gained 38.54% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.39% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $168,238 which includes $331 cash and excludes $1,170 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 3.3%, and for the last 12 months is 12.8%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Since inception, on 3/30/2015, the model gained 40.06% while the benchmark SPY gained 36.16% and the ETF USMV gained 33.81% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -0.66% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $140,026 which includes $242 cash and excludes $976 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 7.6%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Since inception, on 7/1/2014, the model gained 77.85% while the benchmark SPY gained 46.94% and the ETF USMV gained 50.86% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.01% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $177,848 which includes $358 cash and excludes $1,486 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 80.34% while the benchmark SPY gained 44.72% and the ETF USMV gained 48.78% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.12% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $180,337 which includes $271 cash and excludes $1,306 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 42.65% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is 0.3%, and for the last 12 months is -3.2%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-Best(Short) gained 0.00% at a time when SPY gained 0.91%. Over the period 1/2/2009 to 5/7/2018 the starting capital of $100,000 would have grown to $91,456 which includes $91,456 cash and excludes $24,051 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -6.9%, and for the last 12 months is 0.4%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.99% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $104,646 which includes $1,285 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.7%, and for the last 12 months is 1.2%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.05% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $105,680 which includes $3,960 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -0.6%, and for the last 12 months is 10.6%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.15% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,214 which includes $2,714 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 13.4%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.90% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $133,901 which includes $2,042 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 7.7%, and for the last 12 months is 51.6%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 2.35% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $189,532 which includes $3,285 cash and excludes $1,630 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 4.3%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.01% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,759 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 6.1%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.09% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $106,602 which includes $1,986 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is -3.0%, and for the last 12 months is 4.7%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained -0.08% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $104,569 which includes $941 cash and excludes $244 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 26.7%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 2.99% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $165,468 which includes $1,298 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -0.2%, and for the last 12 months is 12.0%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.54% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $125,324 which includes $2,520 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer