|

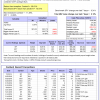

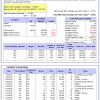

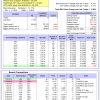

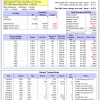

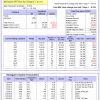

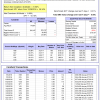

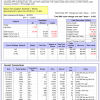

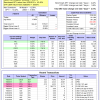

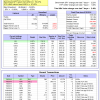

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 5.4%, and for the last 12 months is 15.5%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.31% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $593,153 which includes -$7,596 cash and excludes $17,694 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 7.4%, and for the last 12 months is 21.5%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.12% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $169,508 which includes $331 cash and excludes $4,006 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 9.3%, and for the last 12 months is 23.6%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-Combo5 gained 0.20% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $139,617 which includes $1,724 cash and excludes $983 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 14.3%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Since inception, on 7/1/2014, the model gained 87.16% while the benchmark SPY gained 54.94% and VDIGX gained 48.04% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.37% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $186,654 which includes $130 cash and excludes $2,299 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -15.9%, and for the last 12 months is -14.2%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -2.03% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $194,940 which includes $1,394 cash and excludes $2,787 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is -0.7%, and for the last 12 months is 3.6%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.20% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $112,298 which includes $948 cash and excludes $2,050 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.45% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $154,020 which includes $1,777 cash and excludes $704 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 4.6%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-BestogaX5-System gained -0.05% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $116,701 which includes $639 cash and excludes $1,256 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 7.1%, and for the last 12 months is 18.5%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Since inception, on 6/30/2014, the model gained 83.25% while the benchmark SPY gained 54.94% and the ETF USMV gained 58.78% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.60% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $183,042 which includes $348 cash and excludes $4,364 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 20.7%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Since inception, on 1/5/2015, the model gained 75.51% while the benchmark SPY gained 48.89% and the ETF USMV gained 45.82% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.77% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $175,222 which includes $316 cash and excludes $1,196 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 16.0%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Since inception, on 3/30/2015, the model gained 47.38% while the benchmark SPY gained 43.58% and the ETF USMV gained 40.84% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.39% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $147,225 which includes $269 cash and excludes $1,014 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 3.1%, and for the last 12 months is 13.5%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Since inception, on 7/1/2014, the model gained 83.16% while the benchmark SPY gained 54.94% and the ETF USMV gained 58.78% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.97% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $182,850 which includes $344 cash and excludes $1,538 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 92.18% while the benchmark SPY gained 52.60% and the ETF USMV gained 56.59% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.64% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $192,102 which includes $253 cash and excludes $1,340 spent on fees and slippage. | |

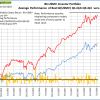

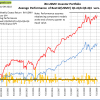

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 42.70% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -2.9%, and for the last 12 months is -11.9%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-Best(Short) gained 0.05% at a time when SPY gained 0.31%. Over the period 1/2/2009 to 7/23/2018 the starting capital of $100,000 would have grown to $88,579 which includes $105,654 cash and excludes $24,418 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.2%, and for the last 12 months is 4.7%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.09% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $111,023 which includes $1,980 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.7%, and for the last 12 months is 2.9%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.36% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,086 which includes $4,783 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is 12.1%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.21% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $134,998 which includes $3,223 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 5.8%, and for the last 12 months is 16.0%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.30% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $140,461 which includes $2,042 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 29.9%, and for the last 12 months is 72.2%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 0.32% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $228,600 which includes $77 cash and excludes $2,429 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -6.1%, and for the last 12 months is -2.7%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.33% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,827 which includes $112 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -1.6%, and for the last 12 months is 2.6%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.57% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $105,364 which includes $2,318 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 5.6%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained -0.33% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $107,888 which includes $3,128 cash and excludes $317 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 32.0%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 0.69% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $182,918 which includes $1,539 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 14.1%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.44% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $131,500 which includes $2,986 cash and excludes $880 spent on fees and slippage. |

Blog Archives

iM-Best Reports – 7/23/2018

Posted in pmp SPY-SH

iM-Best Reports – 7/9/2018

|

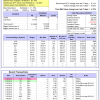

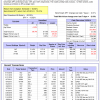

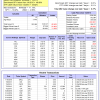

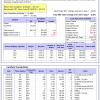

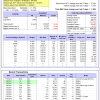

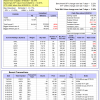

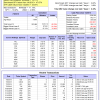

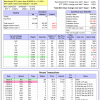

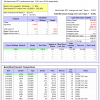

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 4.6%, and for the last 12 months is 16.8%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.24% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $588,222 which includes -$7,596 cash and excludes $17,694 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 6.7%, and for the last 12 months is 23.8%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.47% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $168,362 which includes $331 cash and excludes $4,006 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 8.1%, and for the last 12 months is 27.0%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-Combo5 gained 2.30% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $138,139 which includes $1,724 cash and excludes $983 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is 12.0%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Since inception, on 7/1/2014, the model gained 84.65% while the benchmark SPY gained 53.67% and VDIGX gained 45.94% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.88% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $184,520 which includes $159 cash and excludes $2,296 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -13.7%, and for the last 12 months is -10.5%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 3.63% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $199,399 which includes $649 cash and excludes $2,787 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 8.8%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.92% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $112,416 which includes $569 cash and excludes $2,050 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 22.7%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.11% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $154,457 which includes $1,470 cash and excludes $704 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 4.9%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-BestogaX5-System gained 1.96% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $116,227 which includes $207 cash and excludes $1,256 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 6.7%, and for the last 12 months is 21.2%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Since inception, on 6/30/2014, the model gained 82.54% while the benchmark SPY gained 53.67% and the ETF USMV gained 57.42% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.35% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $182,207 which includes $71 cash and excludes $4,334 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 8.3%, and for the last 12 months is 23.2%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Since inception, on 1/5/2015, the model gained 74.77% while the benchmark SPY gained 47.67% and the ETF USMV gained 44.57% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.33% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $174,365 which includes $139 cash and excludes $1,196 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 7.3%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Since inception, on 3/30/2015, the model gained 45.47% while the benchmark SPY gained 42.40% and the ETF USMV gained 39.63% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 2.81% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $145,223 which includes $133 cash and excludes $1,014 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is 13.4%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Since inception, on 7/1/2014, the model gained 81.13% while the benchmark SPY gained 53.67% and the ETF USMV gained 57.42% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 2.49% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $180,631 which includes $94 cash and excludes $1,538 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 89.03% while the benchmark SPY gained 51.35% and the ETF USMV gained 55.25% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 2.29% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $188,890 which includes $141 cash and excludes $1,340 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 41.89% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -3.4%, and for the last 12 months is -12.5%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of iM-Best(Short) gained -0.08% at a time when SPY gained 2.22%. Over the period 1/2/2009 to 7/9/2018 the starting capital of $100,000 would have grown to $88,098 which includes $106,167 cash and excludes $24,381 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -2.1%, and for the last 12 months is 5.2%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.49% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,030 which includes $1,980 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.6%, and for the last 12 months is 5.2%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.94% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,229 which includes $4,783 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 14.3%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 2.18% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $134,948 which includes $3,223 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 17.4%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 2.18% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $139,325 which includes $2,042 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 26.7%, and for the last 12 months is 70.5%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 5.02% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $223,036 which includes $77 cash and excludes $2,429 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -3.6%, and for the last 12 months is 3.4%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.39% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,059 which includes $77 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 5.5%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 1.27% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $106,702 which includes $2,318 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 9.0%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 1.63% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $108,396 which includes $3,018 cash and excludes $317 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 11.2%, and for the last 12 months is 35.8%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 4.43% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $180,984 which includes $1,539 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 15.5%. Over the same period the benchmark SPY performance was 5.0% and 16.9% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 2.13% at a time when SPY gained 2.22%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $130,421 which includes $2,772 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer