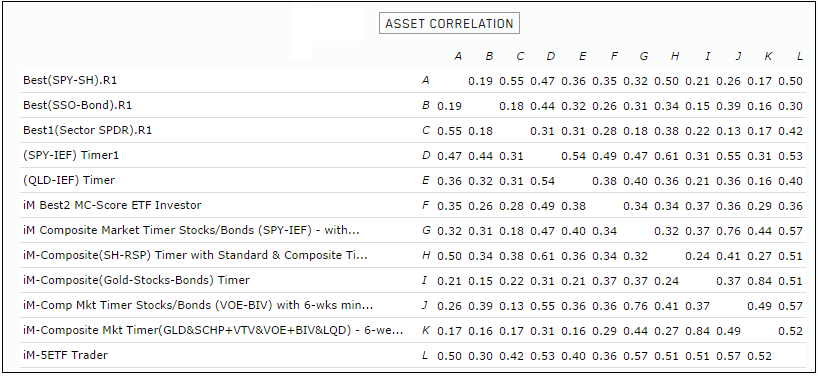

Currently we have 12 different ETF models at iMarketSignals. The various models and their correlation between them are shown below.

Blog Archives

The iM-5 ETF Trader

- This system always holds five ETFs (equity-, fixed income-, leveraged equity-, short equity-, and Gold-ETFs) selected according to stock market climate and rank.

- Typically, during good-equity markets it holds equity-ETFs and/or leveraged-equity ETFs, and during bad-markets fixed income-ETFs and/or short equity-ETFs. Also at times it can hold three gold-ETFs with other ETFs.

- A one factor ranking system selects five ETFs from a preselected list of 33 ETFs. A simulation from 2000 to 2017 shows a 35% annualized return with a maximum drawdown of -13%.

The iM-Minimum Drawdown Combo

In our continued effort to satisfy request for low drawdowns models with reasonable turnover and good returns we provide this model, which combines:

- the iM-Composite Timer (SPY-IEF),

- the iM-Composite Timer(GLD&SCHP+VTV&VOE+BIV&LQD) based on the iM-Composite (Gold-Stocks-Bond) Timer,

- the iM-Composite-(SH-RSP) Timer,

- the iM-Best7(HiD-LoV).

- This combination model always holds four ETFs approximately equal weight at any time and seven S&P 500 stocks.

The combo showed a simulated 22.2% annualized return with a maximum drawdown of -7.7% when backtested from Jan-2000 to Apr-2017.

The iM-Low Turnover Composite Timer Combo

In an effort to satisfy request for low turnover models with low drawdowns and reasonable returns we provide this model, which combines:

- the iM-Comp Mkt Timer Stocks/Bonds (VOE-BIV) based on the iM-Composite Timer (SPY-IEF) which holds only one ETF at any time (33% weight in the combo),

- and the iM-Composite Mkt Timer(GLD&SCHP+VTV&VOE+BIV&LQD) based on the iM-Composite (Gold-Stocks-Bond) Timer which holds two ETFs concurrently (67% weight in the combo).

- This combination model always holds two or three ETFs at any time for a minimum period of six weeks before any of them can be sold.

The combo showed a 17.6% annualized return with a maximum drawdown of -11.2% when backtested from Jan-2000 to Mar-2017 on the simulation platform Portfolio 123.

Updated: Timing the Stock Market with the Inflation Rate

- Stocks usually perform poorly when inflation is on the rise. Using the inflation rate, we developed a market timer according to two simple rules.

- Switching according to the Timer signals between the S&P500 with dividends and a money-market fund would have provided from Aug-1953 to end of Jan-2016 and annualized return of 12.69%.

- Over the same period buy-and-hold of the S&P500 with dividends showed an annualized return of 10.08%, producing about a quarter of the total return of the Timer model.

The MAC-US Timer – a Moving Average Crossover System of the S&P 500

- Switching between stocks and bonds as signaled by a simple moving average crossover system of the S&P 500 – the MAC-US Timer – produces significantly higher returns than buy-and-hold stocks.

- The model has been updated from Aug-1965 to Jan-2017, conservatively assuming that funds are placed in the money market when not in the stock market.

The iM Composite Timer Gold-Stocks-Bonds

- This model uses the rules of the iM-Gold Timer and the iM-Composite Market Timer to signal periodic investments in gold, stocks and bonds.

- From Jan-2000 to Jan-2017 the Gold Timer signaled eight gold investment periods totaling only 9.3 years, while for the remaining periods totaling 7.7 years the model would have been in cash.

- During the “cash periods” the Composite Market Timer provides the signals when to invest in stock and/or bond ETFs. Bond ETFs include the ETF (XLU) are also selected according to the prevailing Market Climate Score (MC-Score) and a ranking system.

Forecasting Stock Market Returns with Shiller’s CAPE Ratio and its 35-Year Moving Average

- Shiller’s Cyclically Adjusted Price to Earnings Ratio (CAPE ratio) is at 27.8, which is 11.1 above its long-term mean of 16.7, signifying overvaluation of stocks and low forward returns.

- The alternative CAPE ratio methodology offered in this article references stock market valuation to a 35-year moving-average of the Shiller CAPE ratio instead of to the 1881-2016 fixed long-term mean.

- The latest CAPE ratio predicts a 10-year annualized real return of only 1.5%, whereas the presented methodology forecasts 5.8%, similar to the long-term market trend expected real return of 5.4%.

Market Timing with ETFs SH and RSP: Using the iM-Composite & Standard Market Timers’ Rules

- This market timing model integrates the iM-Standard Market Timer and the iM-Composite Market Timer.

- This model switches between ETFs SH and RSP providing signals when to be short or long the stock market.

- The model does not utilize Bond ETFs, and is therefore not directly affected by the potential risk of rising interest rates.

- From 2001 to 2016 switching between SH and RSP provided significant benefits. This strategy would have produced an average annual return of 26.2% versus only 8.5% for buy&hold RSP.

Profitable Market Timing Using Performance of the Hi-Beta and Lo-Beta Stocks of the S&P 500

- This market timing model compares the performance of two different types of stock groups over time and provides signals when to invest or not to invest in the stock market.

- When the performance of the Hi-Beta stocks becomes lower than, or equal to Lo-Beta stocks the model exits the stock market and enters the bond market.

- It re-enters the market when the performance of the Hi-Beta stocks becomes higher than Lo-Beta stocks.

- From 2001 to 2016 switching between bonds and stocks provided significant benefits. This strategy would have produced an average annual return of 12.5% versus only 5.2% for buy&hold stocks.

Posted in blogs

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer