Blog Archives

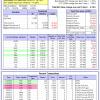

iM-Best Reports – 5/14/2018

Posted in pmp SPY-SH

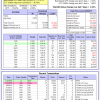

iM-Best Reports – 5/7/2018

|

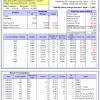

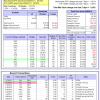

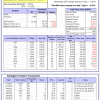

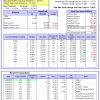

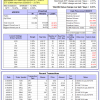

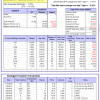

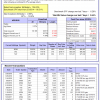

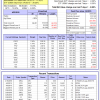

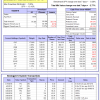

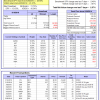

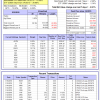

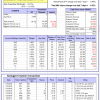

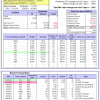

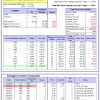

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

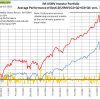

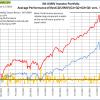

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 13.3%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.91% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $567,612 which includes $140 cash and excludes $15,371 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 2.2%, and for the last 12 months is 18.5%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.22% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $161,408 which includes -$374 cash and excludes $3,670 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 19.7%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-Combo5 gained 2.79% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $130,236 which includes $688 cash and excludes $820 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -2.1%, and for the last 12 months is 8.1%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Since inception, on 7/1/2014, the model gained 74.44% while the benchmark SPY gained 46.94% and VDIGX gained 40.09% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.26% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $174,144 which includes $130 cash and excludes $2,100 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -12.8%, and for the last 12 months is -5.4%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -6.82% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $202,201 which includes -$157 cash and excludes $2,464 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is -8.3%, and for the last 12 months is -2.3%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.83% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $103,809 which includes $1,230 cash and excludes $1,780 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -3.3%, and for the last 12 months is 18.4%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.22% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $146,653 which includes $570 cash and excludes $704 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 0.0%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-BestogaX5-System gained -3.55% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $107,811 which includes $893 cash and excludes $1,123 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 14.6%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Since inception, on 6/30/2014, the model gained 74.04% while the benchmark SPY gained 46.94% and the ETF USMV gained 50.86% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.25% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $173,972 which includes $63 cash and excludes $4,247 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 4.2%, and for the last 12 months is 21.0%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Since inception, on 1/5/2015, the model gained 68.24% while the benchmark SPY gained 41.21% and the ETF USMV gained 38.54% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.39% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $168,238 which includes $331 cash and excludes $1,170 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 3.3%, and for the last 12 months is 12.8%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Since inception, on 3/30/2015, the model gained 40.06% while the benchmark SPY gained 36.16% and the ETF USMV gained 33.81% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -0.66% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $140,026 which includes $242 cash and excludes $976 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 7.6%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Since inception, on 7/1/2014, the model gained 77.85% while the benchmark SPY gained 46.94% and the ETF USMV gained 50.86% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.01% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $177,848 which includes $358 cash and excludes $1,486 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 80.34% while the benchmark SPY gained 44.72% and the ETF USMV gained 48.78% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.12% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $180,337 which includes $271 cash and excludes $1,306 spent on fees and slippage. | |

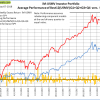

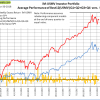

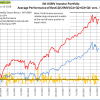

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 42.65% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is 0.3%, and for the last 12 months is -3.2%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of iM-Best(Short) gained 0.00% at a time when SPY gained 0.91%. Over the period 1/2/2009 to 5/7/2018 the starting capital of $100,000 would have grown to $91,456 which includes $91,456 cash and excludes $24,051 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -6.9%, and for the last 12 months is 0.4%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.99% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $104,646 which includes $1,285 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.7%, and for the last 12 months is 1.2%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.05% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $105,680 which includes $3,960 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -0.6%, and for the last 12 months is 10.6%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.15% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,214 which includes $2,714 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 13.4%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.90% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $133,901 which includes $2,042 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 7.7%, and for the last 12 months is 51.6%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 2.35% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $189,532 which includes $3,285 cash and excludes $1,630 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 4.3%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.01% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,759 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 6.1%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.09% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $106,602 which includes $1,986 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is -3.0%, and for the last 12 months is 4.7%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained -0.08% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $104,569 which includes $941 cash and excludes $244 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 26.7%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 2.99% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $165,468 which includes $1,298 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -0.2%, and for the last 12 months is 12.0%. Over the same period the benchmark SPY performance was 0.4% and 13.5% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.54% at a time when SPY gained 0.91%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $125,324 which includes $2,520 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

iM-Best Reports – 4/30/2018

|

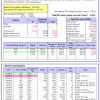

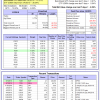

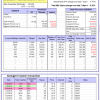

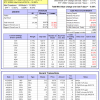

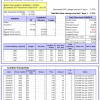

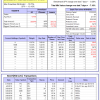

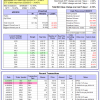

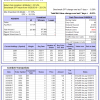

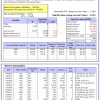

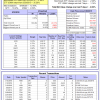

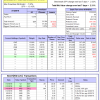

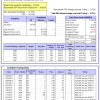

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -0.5%, and for the last 12 months is 13.1%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.77% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $562,513 which includes $2,545 cash and excludes $15,369 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is 17.2%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.08% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $157,895 which includes -$374 cash and excludes $3,670 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is -1.0%, and for the last 12 months is 17.9%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of iM-Combo5 gained -1.07% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $126,705 which includes $688 cash and excludes $820 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 11.6%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Since inception, on 7/1/2014, the model gained 78.48% while the benchmark SPY gained 45.61% and VDIGX gained 41.05% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.62% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $178,083 which includes $29 cash and excludes $2,100 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -6.4%, and for the last 12 months is 0.4%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -3.40% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $216,998 which includes -$270 cash and excludes $2,324 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is -7.5%, and for the last 12 months is -1.3%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.20% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $104,476 which includes $1,023 cash and excludes $1,780 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -3.5%, and for the last 12 months is 18.0%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.24% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $146,324 which includes $570 cash and excludes $704 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is -0.2%, and for the last 12 months is 6.3%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of iM-BestogaX5-System gained -0.36% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $111,793 which includes -$1,269 cash and excludes $1,098 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 15.3%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Since inception, on 6/30/2014, the model gained 73.61% while the benchmark SPY gained 45.61% and the ETF USMV gained 50.80% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -1.12% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $173,486 which includes $280 cash and excludes $4,220 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 4.6%, and for the last 12 months is 22.0%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Since inception, on 1/5/2015, the model gained 68.90% while the benchmark SPY gained 39.93% and the ETF USMV gained 38.49% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.06% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $168,849 which includes $297 cash and excludes $1,146 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 13.7%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Since inception, on 3/30/2015, the model gained 40.99% while the benchmark SPY gained 34.93% and the ETF USMV gained 33.76% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.61% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $140,910 which includes $74 cash and excludes $955 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is -0.9%, and for the last 12 months is 6.7%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Since inception, on 7/1/2014, the model gained 76.07% while the benchmark SPY gained 45.61% and the ETF USMV gained 50.80% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -0.39% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $176,001 which includes $290 cash and excludes $1,486 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 80.12% while the benchmark SPY gained 43.41% and the ETF USMV gained 48.72% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.03% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $180,072 which includes -$29 cash and excludes $1,278 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 43.20% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is 0.3%, and for the last 12 months is -4.7%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of iM-Best(Short) gained 1.15% at a time when SPY gained -0.77%. Over the period 1/2/2009 to 4/30/2018 the starting capital of $100,000 would have grown to $91,456 which includes $91,456 cash and excludes $24,051 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -5.9%, and for the last 12 months is 1.6%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.24% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $105,697 which includes $1,285 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.6%, and for the last 12 months is 1.1%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.01% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $105,728 which includes $3,960 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -0.7%, and for the last 12 months is 10.9%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained -0.55% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,025 which includes $2,714 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -0.5%, and for the last 12 months is 13.2%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.76% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $132,710 which includes $2,042 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 5.2%, and for the last 12 months is 49.0%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 0.58% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $185,187 which includes $3,285 cash and excludes $1,630 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 5.2%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.80% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,769 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 5.4%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.46% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $106,700 which includes $1,867 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is -3.0%, and for the last 12 months is 4.6%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained -0.42% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $104,589 which includes $820 cash and excludes $244 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is -1.3%, and for the last 12 months is 24.0%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -1.76% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $160,659 which includes $1,298 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -0.8%, and for the last 12 months is 11.9%. Over the same period the benchmark SPY performance was -0.5% and 13.2% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.94% at a time when SPY gained -0.77%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $124,652 which includes $2,520 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

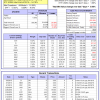

iM-Best Reports – 4/23/2018

|

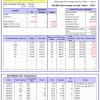

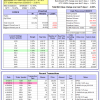

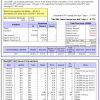

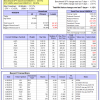

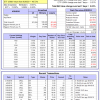

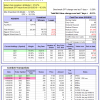

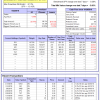

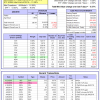

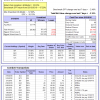

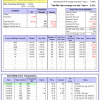

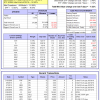

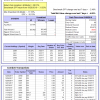

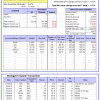

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 0.3%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.28% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $564,551 which includes $222 cash and excludes $15,369 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 1.0%, and for the last 12 months is 21.3%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.74% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $159,407 which includes -$592 cash and excludes $3,670 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 22.7%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of iM-Combo5 gained -0.81% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $127,869 which includes $478 cash and excludes $820 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -0.5%, and for the last 12 months is 15.7%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Since inception, on 7/1/2014, the model gained 77.39% while the benchmark SPY gained 46.75% and VDIGX gained 41.59% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.85% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $176,990 which includes $174 cash and excludes $2,100 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -3.1%, and for the last 12 months is 4.8%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 0.64% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $224,632 which includes -$270 cash and excludes $2,324 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is -7.3%, and for the last 12 months is -1.0%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -7.18% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $104,687 which includes $1,023 cash and excludes $1,780 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -2.3%, and for the last 12 months is 22.8%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -3.60% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $147,948 which includes $1,732 cash and excludes $630 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 7.4%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of iM-BestogaX5-System gained -6.91% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $112,201 which includes -$2,885 cash and excludes $1,072 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 18.2%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Since inception, on 6/30/2014, the model gained 75.56% while the benchmark SPY gained 46.75% and the ETF USMV gained 51.58% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.01% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $175,289 which includes $125 cash and excludes $4,220 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 24.1%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Since inception, on 1/5/2015, the model gained 69.01% while the benchmark SPY gained 41.02% and the ETF USMV gained 39.20% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.88% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $168,857 which includes $199 cash and excludes $1,146 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 3.3%, and for the last 12 months is 15.2%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Since inception, on 3/30/2015, the model gained 40.14% while the benchmark SPY gained 35.98% and the ETF USMV gained 34.45% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -0.10% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $140,096 which includes $74 cash and excludes $955 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is -0.5%, and for the last 12 months is 8.4%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Since inception, on 7/1/2014, the model gained 76.75% while the benchmark SPY gained 46.75% and the ETF USMV gained 51.58% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -0.37% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $176,558 which includes $165 cash and excludes $1,486 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 80.02% while the benchmark SPY gained 44.53% and the ETF USMV gained 49.49% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained -0.56% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $179,969 which includes -$29 cash and excludes $1,278 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 42.61% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -0.9%, and for the last 12 months is -5.5%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of iM-Best(Short) gained 0.64% at a time when SPY gained -0.28%. Over the period 1/2/2009 to 4/23/2018 the starting capital of $100,000 would have grown to $90,420 which includes $108,043 cash and excludes $24,034 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -5.7%, and for the last 12 months is 2.5%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.76% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $105,956 which includes $1,285 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -5.6%, and for the last 12 months is -0.2%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.52% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $104,672 which includes $3,960 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -0.2%, and for the last 12 months is 12.7%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained -0.19% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,733 which includes $2,714 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 0.3%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.28% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $133,186 which includes $1,500 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 4.6%, and for the last 12 months is 53.7%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 2.69% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $184,120 which includes $3,285 cash and excludes $1,630 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 8.2%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.60% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,820 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 6.5%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.74% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $107,191 which includes $1,867 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is -2.6%, and for the last 12 months is 5.7%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained -2.77% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $104,955 which includes $743 cash and excludes $244 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 0.5%, and for the last 12 months is 30.2%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -0.62% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $163,543 which includes $1,298 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 14.5%. Over the same period the benchmark SPY performance was 0.3% and 15.8% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.27% at a time when SPY gained -0.28%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $125,734 which includes $2,419 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

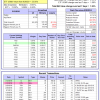

iM-Best Reports – 3/19/2018

|

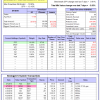

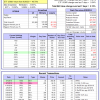

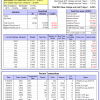

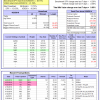

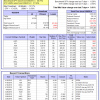

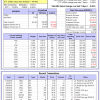

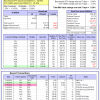

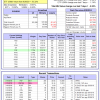

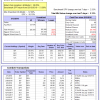

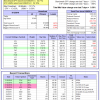

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 16.7%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of Best(SPY-SH) gained -2.49% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $572,856 which includes -$42 cash and excludes $15,368 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 22.0%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.87% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $161,879 which includes -$2,678 cash and excludes $3,557 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 27.5%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of iM-Combo5 gained -3.15% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $133,633 which includes -$1,764 cash and excludes $665 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 0.9%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Since inception, on 7/1/2014, the model gained 79.87% while the benchmark SPY gained 48.90% and VDIGX gained 41.07% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.57% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $179,362 which includes $416 cash and excludes $2,067 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -1.0%, and for the last 12 months is 3.8%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -2.33% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $228,664 which includes $563 cash and excludes $2,158 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 5.6%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -2.22% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $112,997 which includes $20 cash and excludes $1,673 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is 27.4%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.88% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $152,013 which includes $1,253 cash and excludes $630 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 6.8%, and for the last 12 months is 14.8%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of iM-BestogaX5-System gained -3.01% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $119,399 which includes $4,973 cash and excludes $966 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 14.7%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Since inception, on 6/30/2014, the model gained 74.55% while the benchmark SPY gained 48.90% and the ETF USMV gained 52.42% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.20% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $174,200 which includes $49 cash and excludes $4,118 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 4.5%, and for the last 12 months is 23.0%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Since inception, on 1/5/2015, the model gained 68.77% while the benchmark SPY gained 43.09% and the ETF USMV gained 39.98% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.91% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $168,167 which includes -$9 cash and excludes $1,064 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 3.5%, and for the last 12 months is 14.3%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Since inception, on 3/30/2015, the model gained 40.41% while the benchmark SPY gained 37.99% and the ETF USMV gained 35.20% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -0.62% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $140,212 which includes $508 cash and excludes $893 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 8.2%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Since inception, on 7/1/2014, the model gained 78.42% while the benchmark SPY gained 48.90% and the ETF USMV gained 52.42% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -1.62% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $178,117 which includes $840 cash and excludes $1,359 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 82.58% while the benchmark SPY gained 46.65% and the ETF USMV gained 50.32% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained -0.35% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $182,519 which includes -$725 cash and excludes $1,255 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 42.16% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is 2.0%, and for the last 12 months is -3.7%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of iM-Best(Short) gained 0.00% at a time when SPY gained -2.49%. Over the period 1/2/2009 to 3/19/2018 the starting capital of $100,000 would have grown to $93,060 which includes $93,060 cash and excludes $23,817 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -3.4%, and for the last 12 months is 5.2%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -1.90% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $108,268 which includes $743 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.6%, and for the last 12 months is 1.8%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.79% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $105,482 which includes $3,320 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 13.4%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained -1.95% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,304 which includes $2,172 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 18.2%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -2.46% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $135,122 which includes $1,500 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 6.5%, and for the last 12 months is 57.5%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained -4.54% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $187,455 which includes -$1,015 cash and excludes $1,288 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 1.0%, and for the last 12 months is 12.7%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.50% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,018 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -0.2%, and since inception 6.9%. Over the same period the benchmark SPY performance was 1.8% and 17.9% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.77% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $106,895 which includes $1,612 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 0.1%, and since inception 8.0%. Over the same period the benchmark SPY performance was 1.8% and 17.4% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained -1.60% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $107,691 which includes $889 cash and excludes $215 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 35.7%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -4.69% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $168,907 which includes $1,064 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 1.2%, and for the last 12 months is 16.4%. Over the same period the benchmark SPY performance was 1.8% and 16.3% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -2.20% at a time when SPY gained -2.49%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $127,101 which includes $2,002 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

iM-Best Reports – 3/12/2018

|

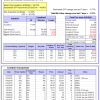

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is 19.3%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.33% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $589,864 which includes -$42 cash and excludes $15,368 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 4.6%, and for the last 12 months is 24.3%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.04% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $165,354 which includes -$2,678 cash and excludes $3,557 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 8.1%, and for the last 12 months is 31.8%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of iM-Combo5 gained 3.13% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $138,285 which includes -$1,764 cash and excludes $665 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is 19.4%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Since inception, on 7/1/2014, the model gained 84.62% while the benchmark SPY gained 52.71% and VDIGX gained 43.67% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.09% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $184,114 which includes $416 cash and excludes $2,067 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 1.4%, and for the last 12 months is 6.8%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 5.21% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $234,754 which includes $340 cash and excludes $2,158 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 9.2%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 2.31% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $115,691 which includes $136 cash and excludes $1,673 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 2.5%, and for the last 12 months is 29.3%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.16% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $154,935 which includes $998 cash and excludes $630 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 10.1%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of iM-BestogaX5-System gained 1.97% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $123,352 which includes $4,973 cash and excludes $966 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 14.4%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Since inception, on 6/30/2014, the model gained 74.20% while the benchmark SPY gained 52.71% and the ETF USMV gained 54.18% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.39% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $174,022 which includes -$8 cash and excludes $4,093 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 5.5%, and for the last 12 months is 25.1%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Since inception, on 1/5/2015, the model gained 70.32% while the benchmark SPY gained 46.76% and the ETF USMV gained 41.59% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.18% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $170,117 which includes -$62 cash and excludes $1,064 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 4.2%, and for the last 12 months is 14.8%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Since inception, on 3/30/2015, the model gained 41.29% while the benchmark SPY gained 41.51% and the ETF USMV gained 36.76% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 2.23% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $141,078 which includes $460 cash and excludes $893 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 9.5%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Since inception, on 7/1/2014, the model gained 81.35% while the benchmark SPY gained 52.71% and the ETF USMV gained 54.18% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.98% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $181,154 which includes $828 cash and excludes $1,359 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 83.15% while the benchmark SPY gained 50.40% and the ETF USMV gained 52.05% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.36% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $183,080 which includes $265 cash and excludes $1,227 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 40.92% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is 2.0%, and for the last 12 months is -3.0%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of iM-Best(Short) gained -0.91% at a time when SPY gained 2.33%. Over the period 1/2/2009 to 3/12/2018 the starting capital of $100,000 would have grown to $93,060 which includes $93,060 cash and excludes $23,817 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.5%, and for the last 12 months is 7.6%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.10% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,673 which includes $743 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 3.9%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.05% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $106,614 which includes $3,320 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 15.8%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 2.09% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $133,454 which includes $2,172 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 4.3%, and for the last 12 months is 20.8%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 2.30% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $139,089 which includes $1,500 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 11.6%, and for the last 12 months is 66.2%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 2.49% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $196,379 which includes -$1,015 cash and excludes $1,288 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 15.5%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.30% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,675 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 0.6%, and since inception 7.7%. Over the same period the benchmark SPY performance was 4.4% and 20.9% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.69% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $107,728 which includes $1,612 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 1.7%, and since inception 9.8%. Over the same period the benchmark SPY performance was 4.4% and 20.4% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 1.55% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $109,632 which includes $866 cash and excludes $215 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 8.9%, and for the last 12 months is 44.4%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 4.81% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $177,218 which includes $1,064 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 3.5%, and for the last 12 months is 20.2%. Over the same period the benchmark SPY performance was 4.4% and 19.5% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 2.17% at a time when SPY gained 2.33%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $130,067 which includes $2,002 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer