Blog Archives

iM-Best Reports – 9/17/2018

Posted in pmp SPY-SH

iM-Best Reports – 8/27/2018

|

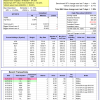

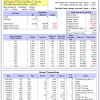

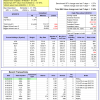

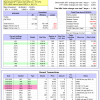

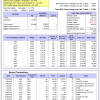

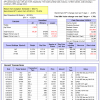

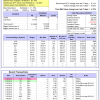

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 9.1%, and for the last 12 months is 20.1%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.45% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $616,363 which includes -$4,925 cash and excludes $17,694 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 10.1%, and for the last 12 months is 25.6%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.30% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $173,927 which includes -$1,649 cash and excludes $4,008 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 12.7%, and for the last 12 months is 29.1%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of iM-Combo5 gained 2.08% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $144,196 which includes $2,018 cash and excludes $983 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 8.9%, and for the last 12 months is 19.4%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Since inception, on 7/1/2014, the model gained 94.05% while the benchmark SPY gained 60.24% and VDIGX gained 52.20% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.29% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $193,630 which includes $104 cash and excludes $2,344 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -15.3%, and for the last 12 months is -11.9%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.64% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $196,225 which includes $111 cash and excludes $2,946 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 6.5%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.94% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $118,622 which includes $220 cash and excludes $2,166 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 23.5%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.70% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $160,544 which includes $756 cash and excludes $712 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 10.8%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of iM-BestogaX5-System gained -2.15% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $114,731 which includes $639 cash and excludes $1,256 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 16.1%, and for the last 12 months is 26.1%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Since inception, on 6/30/2014, the model gained 98.56% while the benchmark SPY gained 60.24% and the ETF USMV gained 64.55% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.66% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $198,371 which includes $200 cash and excludes $4,401 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 13.2%, and for the last 12 months is 23.8%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Since inception, on 1/5/2015, the model gained 82.67% while the benchmark SPY gained 53.99% and the ETF USMV gained 51.12% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.25% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $182,589 which includes $131 cash and excludes $1,252 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 13.2%, and for the last 12 months is 19.9%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Since inception, on 3/30/2015, the model gained 53.52% while the benchmark SPY gained 48.49% and the ETF USMV gained 45.96% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 1.15% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $153,467 which includes $503 cash and excludes $1,014 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 6.5%, and for the last 12 months is 15.6%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Since inception, on 7/1/2014, the model gained 89.19% while the benchmark SPY gained 60.24% and the ETF USMV gained 64.55% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.48% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $189,113 which includes $66 cash and excludes $1,584 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 97.52% while the benchmark SPY gained 57.82% and the ETF USMV gained 62.28% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.77% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $197,521 which includes $327 cash and excludes $1,340 spent on fees and slippage. | |

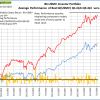

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 45.19% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -2.9%, and for the last 12 months is -12.6%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of iM-Best(Short) gained -0.04% at a time when SPY gained 1.44%. Over the period 1/2/2009 to 8/27/2018 the starting capital of $100,000 would have grown to $88,591 which includes $106,276 cash and excludes $24,493 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 8.2%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.65% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $114,635 which includes $1,980 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 5.3%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.90% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $112,836 which includes $4,783 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 6.8%, and for the last 12 months is 17.7%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.87% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $138,882 which includes $3,223 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 9.4%, and for the last 12 months is 20.5%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.41% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $145,809 which includes $2,658 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 36.3%, and for the last 12 months is 75.9%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 5.07% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $239,800 which includes $77 cash and excludes $2,429 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -7.3%, and for the last 12 months is -6.6%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.67% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $119,323 which includes $89 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -0.9%, and for the last 12 months is 2.8%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.78% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $106,076 which includes $275 cash and excludes $76 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 3.1%, and for the last 12 months is 7.7%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 0.38% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $111,234 which includes -$2,302 cash and excludes $350 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 18.1%, and for the last 12 months is 42.4%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 3.02% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $192,175 which includes $1,539 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 8.1%, and for the last 12 months is 19.3%. Over the same period the benchmark SPY performance was 9.5% and 20.7% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 1.18% at a time when SPY gained 1.44%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $135,798 which includes $3,101 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

iM-Best Reports – 8/20/2018

|

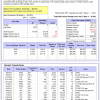

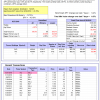

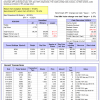

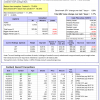

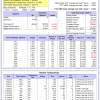

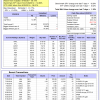

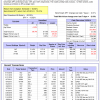

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 7.5%, and for the last 12 months is 19.2%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.28% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $607,551 which includes -$4,925 cash and excludes $17,694 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 25.4%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.63% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $171,694 which includes -$1,649 cash and excludes $4,008 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 10.4%, and for the last 12 months is 27.8%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of iM-Combo5 gained 0.45% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $141,262 which includes $2,018 cash and excludes $983 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 7.5%, and for the last 12 months is 18.3%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Since inception, on 7/1/2014, the model gained 91.57% while the benchmark SPY gained 57.97% and VDIGX gained 51.12% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.34% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $191,153 which includes $70 cash and excludes $2,344 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -14.8%, and for the last 12 months is -10.0%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 2.17% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $197,479 which includes $111 cash and excludes $2,946 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 5.8%, and for the last 12 months is 7.8%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 3.96% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $119,748 which includes $220 cash and excludes $2,166 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 6.7%, and for the last 12 months is 24.5%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 3.36% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $161,474 which includes $554 cash and excludes $712 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 4.6%, and for the last 12 months is 12.6%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of iM-BestogaX5-System gained 1.05% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $117,253 which includes $639 cash and excludes $1,256 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 15.3%, and for the last 12 months is 27.3%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Since inception, on 6/30/2014, the model gained 97.26% while the benchmark SPY gained 57.97% and the ETF USMV gained 64.11% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.69% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $197,157 which includes $200 cash and excludes $4,401 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 12.9%, and for the last 12 months is 24.8%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Since inception, on 1/5/2015, the model gained 82.22% while the benchmark SPY gained 51.80% and the ETF USMV gained 50.71% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.40% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $182,219 which includes $131 cash and excludes $1,252 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 11.9%, and for the last 12 months is 19.9%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Since inception, on 3/30/2015, the model gained 51.78% while the benchmark SPY gained 46.38% and the ETF USMV gained 45.57% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 1.57% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $151,785 which includes $503 cash and excludes $1,014 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 16.0%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Since inception, on 7/1/2014, the model gained 88.28% while the benchmark SPY gained 57.97% and the ETF USMV gained 64.11% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.11% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $188,278 which includes $66 cash and excludes $1,584 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 96.01% while the benchmark SPY gained 55.58% and the ETF USMV gained 61.84% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.94% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $196,013 which includes $327 cash and excludes $1,340 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 45.97% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -2.8%, and for the last 12 months is -12.6%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of iM-Best(Short) gained -0.90% at a time when SPY gained 1.27%. Over the period 1/2/2009 to 8/20/2018 the starting capital of $100,000 would have grown to $88,626 which includes $88,626 cash and excludes $24,474 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 8.8%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 2.60% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $115,382 which includes $1,980 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 7.2%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 2.51% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $113,865 which includes $4,783 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 5.9%, and for the last 12 months is 17.8%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 1.94% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $137,680 which includes $3,223 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 7.8%, and for the last 12 months is 19.7%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.24% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,779 which includes $2,658 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 29.7%, and for the last 12 months is 69.8%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained -0.77% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $228,237 which includes $77 cash and excludes $2,429 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -8.8%, and for the last 12 months is -7.8%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.29% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $117,357 which includes $77 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -1.7%, and for the last 12 months is 2.5%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.66% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $105,254 which includes $275 cash and excludes $76 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 7.8%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 1.91% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $110,809 which includes -$2,302 cash and excludes $350 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 14.6%, and for the last 12 months is 40.4%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 1.99% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $186,541 which includes $1,539 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 6.8%, and for the last 12 months is 18.7%. Over the same period the benchmark SPY performance was 8.0% and 19.9% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 1.58% at a time when SPY gained 1.27%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $134,220 which includes $3,101 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

iM-Best Reports – 8/6/2018

|

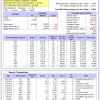

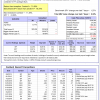

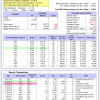

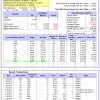

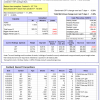

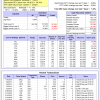

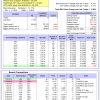

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 7.1%, and for the last 12 months is 16.6%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.69% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $605,343 which includes -$4,925 cash and excludes $17,694 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 8.2%, and for the last 12 months is 22.0%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.77% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $170,830 which includes -$1,759 cash and excludes $4,008 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 10.4%, and for the last 12 months is 24.7%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of iM-Combo5 gained 2.75% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $141,264 which includes $1,965 cash and excludes $983 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 5.8%, and for the last 12 months is 14.2%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Since inception, on 7/1/2014, the model gained 88.63% while the benchmark SPY gained 57.40% and VDIGX gained 49.50% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.03% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $188,259 which includes $426 cash and excludes $2,343 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -14.3%, and for the last 12 months is -9.5%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 0.18% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $198,761 which includes $111 cash and excludes $2,946 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 6.2%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 2.99% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $118,886 which includes $1,106 cash and excludes $2,050 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is 17.9%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 3.72% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $158,666 which includes $554 cash and excludes $712 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 7.4%, and for the last 12 months is 11.7%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of iM-BestogaX5-System gained 1.95% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $120,387 which includes $639 cash and excludes $1,256 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 11.9%, and for the last 12 months is 21.7%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Since inception, on 6/30/2014, the model gained 91.44% while the benchmark SPY gained 57.40% and the ETF USMV gained 61.49% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 3.08% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $191,440 which includes $556 cash and excludes $4,364 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 12.1%, and for the last 12 months is 23.7%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Since inception, on 1/5/2015, the model gained 80.89% while the benchmark SPY gained 51.26% and the ETF USMV gained 48.31% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.83% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $180,891 which includes $599 cash and excludes $1,196 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 10.8%, and for the last 12 months is 17.3%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Since inception, on 3/30/2015, the model gained 50.28% while the benchmark SPY gained 45.85% and the ETF USMV gained 43.24% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 2.05% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $150,241 which includes $429 cash and excludes $1,014 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 5.6%, and for the last 12 months is 14.0%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Since inception, on 7/1/2014, the model gained 87.65% while the benchmark SPY gained 57.40% and the ETF USMV gained 61.49% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.77% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $187,652 which includes $657 cash and excludes $1,538 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 92.98% while the benchmark SPY gained 55.02% and the ETF USMV gained 59.26% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 2.20% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $192,983 which includes $326 cash and excludes $1,340 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 45.04% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -2.0%, and for the last 12 months is -11.1%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of iM-Best(Short) gained 0.00% at a time when SPY gained 1.68%. Over the period 1/2/2009 to 8/6/2018 the starting capital of $100,000 would have grown to $39,815 which includes $39,815 cash and excludes $24,436 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is 7.2%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.77% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $113,799 which includes $1,980 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 5.0%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.79% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $112,543 which includes $4,783 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 5.2%, and for the last 12 months is 14.2%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 1.15% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $136,769 which includes $3,223 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 7.5%, and for the last 12 months is 17.0%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.64% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,270 which includes $2,658 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 32.0%, and for the last 12 months is 67.0%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 6.91% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $232,301 which includes $77 cash and excludes $2,429 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -7.5%, and for the last 12 months is -4.4%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.17% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $119,084 which includes $100 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -1.6%, and for the last 12 months is 2.6%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.08% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $105,232 which includes $142 cash and excludes $76 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 6.8%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 1.36% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $110,337 which includes -$1,024 cash and excludes $321 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 14.1%, and for the last 12 months is 33.9%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 3.47% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $185,638 which includes $1,539 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 6.2%, and for the last 12 months is 15.7%. Over the same period the benchmark SPY performance was 7.6% and 17.2% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 1.40% at a time when SPY gained 1.68%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $133,424 which includes $3,101 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

iM-Best Reports – 7/30/2018

|

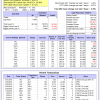

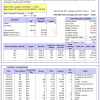

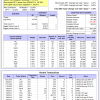

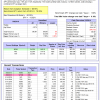

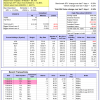

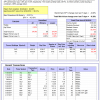

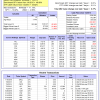

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 5.3%, and for the last 12 months is 15.4%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.09% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $592,617 which includes -$7,596 cash and excludes $17,694 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 6.3%, and for the last 12 months is 20.3%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.06% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $167,709 which includes $331 cash and excludes $4,006 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 7.5%, and for the last 12 months is 21.7%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of iM-Combo5 gained -1.66% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $137,290 which includes $1,724 cash and excludes $983 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 13.8%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Since inception, on 7/1/2014, the model gained 86.70% while the benchmark SPY gained 54.80% and VDIGX gained 48.37% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.24% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $186,330 which includes $118 cash and excludes $2,303 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -14.4%, and for the last 12 months is -9.9%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.78% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $198,407 which includes $1,394 cash and excludes $2,787 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 5.2%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 2.64% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $115,273 which includes $948 cash and excludes $2,050 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.1%, and for the last 12 months is 14.9%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.55% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $153,174 which includes $345 cash and excludes $712 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 5.4%, and for the last 12 months is 9.8%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of iM-BestogaX5-System gained 1.18% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $118,084 which includes $639 cash and excludes $1,256 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 8.6%, and for the last 12 months is 19.5%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Since inception, on 6/30/2014, the model gained 85.73% while the benchmark SPY gained 54.80% and the ETF USMV gained 58.81% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.35% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $185,674 which includes $503 cash and excludes $4,364 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 10.0%, and for the last 12 months is 21.6%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Since inception, on 1/5/2015, the model gained 77.65% while the benchmark SPY gained 48.76% and the ETF USMV gained 45.84% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.22% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $177,592 which includes $545 cash and excludes $1,196 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 8.6%, and for the last 12 months is 14.6%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Since inception, on 3/30/2015, the model gained 47.25% while the benchmark SPY gained 43.45% and the ETF USMV gained 40.86% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -0.09% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $147,206 which includes $382 cash and excludes $1,014 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 12.6%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Since inception, on 7/1/2014, the model gained 84.38% while the benchmark SPY gained 54.80% and the ETF USMV gained 58.81% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.67% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $184,313 which includes $589 cash and excludes $1,538 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 88.82% while the benchmark SPY gained 52.46% and the ETF USMV gained 56.62% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained -1.77% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $188,771 which includes $277 cash and excludes $1,340 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 43.95% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -2.0%, and for the last 12 months is -11.1%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of iM-Best(Short) gained 0.90% at a time when SPY gained -0.09%. Over the period 1/2/2009 to 7/30/2018 the starting capital of $100,000 would have grown to $89,379 which includes $89,379 cash and excludes $24,436 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -0.5%, and for the last 12 months is 5.1%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.72% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $111,825 which includes $1,980 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 3.3%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.44% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,568 which includes $4,783 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 12.5%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.16% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $135,214 which includes $3,223 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 5.7%, and for the last 12 months is 15.9%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.09% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $140,338 which includes $2,042 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 23.5%, and for the last 12 months is 59.8%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained -4.95% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $217,279 which includes $77 cash and excludes $2,429 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -6.4%, and for the last 12 months is -4.1%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.28% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,491 which includes $88 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -1.5%, and for the last 12 months is 2.4%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.08% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $105,452 which includes $2,318 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 1.0%, and for the last 12 months is 6.0%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 0.82% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $108,775 which includes $3,128 cash and excludes $317 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 10.2%, and for the last 12 months is 29.3%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -1.92% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $179,413 which includes $1,539 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 14.2%. Over the same period the benchmark SPY performance was 5.8% and 15.5% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.03% at a time when SPY gained -0.09%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $131,462 which includes $2,986 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

iM-Best Reports – 7/23/2018

|

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 5.4%, and for the last 12 months is 15.5%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.31% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $593,153 which includes -$7,596 cash and excludes $17,694 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 7.4%, and for the last 12 months is 21.5%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.12% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $169,508 which includes $331 cash and excludes $4,006 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 9.3%, and for the last 12 months is 23.6%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-Combo5 gained 0.20% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $139,617 which includes $1,724 cash and excludes $983 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 14.3%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Since inception, on 7/1/2014, the model gained 87.16% while the benchmark SPY gained 54.94% and VDIGX gained 48.04% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.37% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $186,654 which includes $130 cash and excludes $2,299 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -15.9%, and for the last 12 months is -14.2%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -2.03% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $194,940 which includes $1,394 cash and excludes $2,787 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is -0.7%, and for the last 12 months is 3.6%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.20% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $112,298 which includes $948 cash and excludes $2,050 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.45% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $154,020 which includes $1,777 cash and excludes $704 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 4.6%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-BestogaX5-System gained -0.05% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $116,701 which includes $639 cash and excludes $1,256 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 7.1%, and for the last 12 months is 18.5%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Since inception, on 6/30/2014, the model gained 83.25% while the benchmark SPY gained 54.94% and the ETF USMV gained 58.78% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.60% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $183,042 which includes $348 cash and excludes $4,364 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 20.7%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Since inception, on 1/5/2015, the model gained 75.51% while the benchmark SPY gained 48.89% and the ETF USMV gained 45.82% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.77% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $175,222 which includes $316 cash and excludes $1,196 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 16.0%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Since inception, on 3/30/2015, the model gained 47.38% while the benchmark SPY gained 43.58% and the ETF USMV gained 40.84% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.39% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $147,225 which includes $269 cash and excludes $1,014 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 3.1%, and for the last 12 months is 13.5%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Since inception, on 7/1/2014, the model gained 83.16% while the benchmark SPY gained 54.94% and the ETF USMV gained 58.78% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.97% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $182,850 which includes $344 cash and excludes $1,538 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 92.18% while the benchmark SPY gained 52.60% and the ETF USMV gained 56.59% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.64% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $192,102 which includes $253 cash and excludes $1,340 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 42.70% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -2.9%, and for the last 12 months is -11.9%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of iM-Best(Short) gained 0.05% at a time when SPY gained 0.31%. Over the period 1/2/2009 to 7/23/2018 the starting capital of $100,000 would have grown to $88,579 which includes $105,654 cash and excludes $24,418 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.2%, and for the last 12 months is 4.7%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.09% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $111,023 which includes $1,980 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.7%, and for the last 12 months is 2.9%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.36% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,086 which includes $4,783 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is 12.1%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.21% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $134,998 which includes $3,223 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 5.8%, and for the last 12 months is 16.0%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.30% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $140,461 which includes $2,042 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 29.9%, and for the last 12 months is 72.2%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 0.32% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $228,600 which includes $77 cash and excludes $2,429 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -6.1%, and for the last 12 months is -2.7%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.33% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,827 which includes $112 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -1.6%, and for the last 12 months is 2.6%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.57% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $105,364 which includes $2,318 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 5.6%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained -0.33% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $107,888 which includes $3,128 cash and excludes $317 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 32.0%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 0.69% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $182,918 which includes $1,539 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 14.1%. Over the same period the benchmark SPY performance was 5.9% and 15.6% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.44% at a time when SPY gained 0.31%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $131,500 which includes $2,986 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer