|

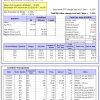

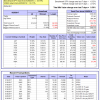

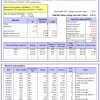

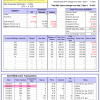

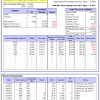

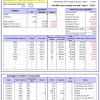

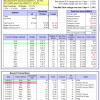

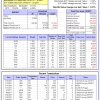

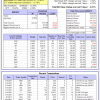

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 13.0%, and for the last 12 months is 17.6%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.31% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $522,428 which includes $4,654 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 12.7%, and for the last 12 months is 15.9%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.77% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $141,617 which includes -$826 cash and excludes $3,437 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 15.5%, and for the last 12 months is 15.2%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of iM-Combo5 gained -1.32% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $113,891 which includes $66 cash and excludes $599 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 15.6%, and for the last 12 months is 28.3%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Since inception, on 7/1/2014, the model gained 68.48% while the benchmark SPY gained 35.79% and VDIGX gained 33.11% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.36% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $168,476 which includes $368 cash and excludes $1,694 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 7.3%, and for the last 12 months is 4.1%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.51% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $217,245 which includes $207 cash and excludes $1,818 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 8.3%, and for the last 12 months is 11.5%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.94% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $111,231 which includes $51 cash and excludes $1,211 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 30.4%, and since inception 37.9%. Over the same period the benchmark SPY performance was 12.9% and 19.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.42% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $134,657 which includes -$1,343 cash and excludes $440 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 6.3%, and for the last 12 months is 11.3%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -0.62% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $104,807 which includes $146 cash and excludes $786 spent on fees and slippage. | |

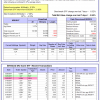

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 16.1%, and for the last 12 months is 15.2%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Since inception, on 6/30/2014, the model gained 62.39% while the benchmark SPY gained 35.79% and the ETF USMV gained 43.97% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.15% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $162,392 which includes -$368 cash and excludes $3,443 spent on fees and slippage. | |

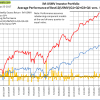

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 18.8%, and for the last 12 months is 22.2%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Since inception, on 1/5/2015, the model gained 49.46% while the benchmark SPY gained 30.49% and the ETF USMV gained 32.22% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.57% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $149,464 which includes -$201 cash and excludes $821 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 15.2%, and for the last 12 months is 18.3%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Since inception, on 3/30/2015, the model gained 32.57% while the benchmark SPY gained 25.83% and the ETF USMV gained 27.70% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -0.01% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $132,570 which includes -$189 cash and excludes $704 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 8.6%, and for the last 12 months is 16.9%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Since inception, on 7/1/2014, the model gained 68.43% while the benchmark SPY gained 35.79% and the ETF USMV gained 43.97% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.36% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $168,432 which includes $492 cash and excludes $1,066 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 67.78% while the benchmark SPY gained 33.74% and the ETF USMV gained 41.98% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.55% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $167,775 which includes $302 cash and excludes $869 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 37.76% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -2.8%, and for the last 12 months is -3.5%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of iM-Best(Short) gained -5.56% at a time when SPY gained -0.32%. Over the period 1/2/2009 to 9/25/2017 the starting capital of $100,000 would have grown to $94,109 which includes $94,109 cash and excludes $22,777 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 9.7%, and for the last 12 months is 8.5%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.95% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $106,346 which includes $399 cash and excludes $111 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 7.5%, and for the last 12 months is 7.2%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.11% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $106,998 which includes $1,729 cash and excludes $00 spent on fees and slippage. | |

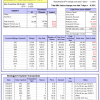

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 10.0%, and for the last 12 months is 17.9%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.15% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,819 which includes $1,074 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 14.5%, and for the last 12 months is 18.8%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.32% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $123,194 which includes $223 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 42.4%, and since inception 42.4%. Over the same period the benchmark SPY performance was 12.9% and 12.9% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained -0.40% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 12/30/2016 would have grown to $142,412 which includes $293 cash and excludes $578 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 24.8%, and for the last 12 months is 27.0%. Over the same period the benchmark SPY performance was 12.9% and 17.6% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.19% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,635 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance from inception is 4.6%. The benchmark SPY performance over the same period is 7.5%. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.08% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $104,628 which includes $847 cash and excludes $69 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance from inception is 4.3%. The benchmark SPY performance over the same period is 7.1%. Over the previous week the market value of the iM-Min Drawdown Combo gained -0.29% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $104,319 which includes $919 cash and excludes $103 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 25.1%, and since inception 41.2%. Over the same period the benchmark SPY performance was 12.9% and 19.5% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -0.68% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $141,193 which includes $672 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 13.4%, and since inception 16.6%. Over the same period the benchmark SPY performance was 12.9% and 19.5% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.15% at a time when SPY gained -0.32%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $116,546 which includes $1,073 cash and excludes $880 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.