Blog Archives

iM-Best Reports – 2/7/2019

Posted in pmp SPY-SH

iM-Best Reports – 1/7/2019

|

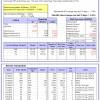

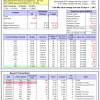

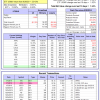

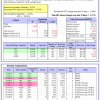

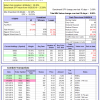

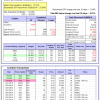

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

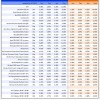

| iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 0.3%, and for the last 12 months is -2.4%. Over the same period the benchmark SPY performance was 1.2% and -2.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.63% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $112,255 which includes $412 cash and excludes $497 spent on fees and slippage. | |

| iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 0.3%, and for the last 12 months is -2.5%. Over the same period the benchmark SPY performance was 1.2% and -2.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.62% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $114,246 which includes $375 cash and excludes $563 spent on fees and slippage. | |

| iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is -2.5%. Over the same period the benchmark SPY performance was 1.2% and -2.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.60% at a time when SPY gained 1.78%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $116,228 which includes $465 cash and excludes $629 spent on fees and slippage. | |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 5.7%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.66% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $612,020 which includes $3,543 cash and excludes $20,123 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is -4.8%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.35% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $155,788 which includes $54,428 cash and excludes $4,602 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is -4.0%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of iM-Combo5 gained 1.36% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $128,064 which includes $28,570 cash and excludes $1,326 spent on fees and slippage. | |

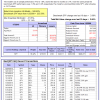

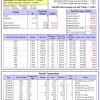

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 2.1%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Since inception, on 7/1/2014, the model gained 84.24% while the benchmark SPY gained 42.13% and VDIGX gained 41.32% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.55% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $184,242 which includes $55 cash and excludes $2,421 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 1.3%, and for the last 12 months is -3.2%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.68% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,722 which includes $645 cash and excludes $2,681 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is -0.4%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.65% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $151,727 which includes $2,018 cash and excludes $790 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is -1.0%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Since inception, on 6/30/2014, the model gained 72.34% while the benchmark SPY gained 42.13% and the ETF USMV gained 54.56% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.26% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $172,340 which includes $464 cash and excludes $4,942 spent on fees and slippage. | |

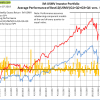

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is -0.8%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Since inception, on 1/5/2015, the model gained 64.22% while the benchmark SPY gained 36.58% and the ETF USMV gained 41.94% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.86% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $164,220 which includes $1,521 cash and excludes $1,393 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 0.5%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Since inception, on 3/30/2015, the model gained 39.88% while the benchmark SPY gained 31.70% and the ETF USMV gained 37.09% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 1.31% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $139,880 which includes $6,784 cash and excludes $1,288 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 0.9%, and for the last 12 months is -6.9%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Since inception, on 7/1/2014, the model gained 68.17% while the benchmark SPY gained 42.13% and the ETF USMV gained 54.56% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.55% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $168,174 which includes $4,156 cash and excludes $1,840 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 76.48% while the benchmark SPY gained 39.98% and the ETF USMV gained 52.43% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.34% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $176,478 which includes -$1,878 cash and excludes $1,696 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 40.26% over SPY. (see iM-USMV Investor Portfolio) | |

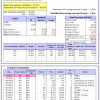

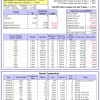

| iM-Best(Short): The model’s out of sample performance YTD is -4.7%, and for the last 12 months is -6.6%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of iM-Best(Short) gained -4.85% at a time when SPY gained 2.68%. Over the period 1/2/2009 to 1/7/2019 the starting capital of $100,000 would have grown to $84,865 which includes $157,520 cash and excludes $25,124 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 1.1%, and for the last 12 months is -5.1%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.45% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $107,288 which includes -$241 cash and excludes $336 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is -1.4%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.71% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $108,508 which includes -$197 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 2.3%, and for the last 12 months is -7.3%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 3.14% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $122,953 which includes $4,511 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is 3.3%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.59% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $141,118 which includes -$55 cash and excludes $1,920 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is 2.4%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 5.53% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $187,826 which includes $3,551 cash and excludes $4,760 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is -15.8%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.31% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $109,848 which includes -$760 cash and excludes $2,428 spent on fees and slippage. | |

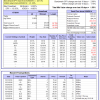

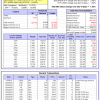

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 1.2%, and for the last 12 months is -9.8%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 1.89% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $97,481 which includes $291 cash and excludes $407 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is -5.0%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 2.28% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $103,589 which includes $3,402 cash and excludes $722 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 0.0%, and for the last 12 months is -18.5%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 0.88% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $138,491 which includes $334 cash and excludes $1,440 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 0.4%, and for the last 12 months is -8.2%. Over the same period the benchmark SPY performance was 1.8% and -5.2% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.87% at a time when SPY gained 2.68%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $117,751 which includes $298 cash and excludes $1,364 spent on fees and slippage. |

Posted in pmp SPY-SH

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer