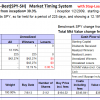

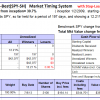

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 225 days, and showing 12.19% return to 2/18/2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 225 days, and showing 12.19% return to 2/18/2014

Read more >

Blog Archives

Best(SPY-SH) and Combo3 – 2/18/2014

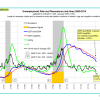

Gold: A Coppock Buy Signal for March 2014

The modified Coppock indicator will produce a buy signal for Gold within a few weeks. This is the result of various projections using random numbers between -$20 and +$30 and -$30 and +$20 for the weekly change of the gold price, representing upward- and downward trends for the metal’s price, respectively.

Read more >

Monthly January 2014

The unemployment rate recession model has been updated with the January UER of 6.6%.

The unemployment rate recession model has been updated with the January UER of 6.6%.

Read more >

iM Update – Feb 7, 2014

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is lower from last week’s level, and iM-BCIg is also lower from last week’s revised level. MAC-AU is invested.

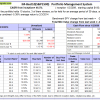

Best10 Feb 3, 2014

Currently the portfolio holds 10 stocks, 3 of them winners, so far held for an average period of 39 days, and showing combined -5.38% average return to 2/3/2014

Currently the portfolio holds 10 stocks, 3 of them winners, so far held for an average period of 39 days, and showing combined -5.38% average return to 2/3/2014

Read more >

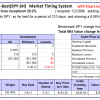

Best(SPY-SH) and Combo3 – 2/3/2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 210 days, and showing 6.06% return to 2/3/2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 210 days, and showing 6.06% return to 2/3/2014

Read more >

iM Update – Jan 31, 2014

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is lower from last week’s level, and iM-BCIg is also lower from last week’s level. MAC-AU is invested.

Best(SPY-SH) 1-27-2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 203 days, and showing 8.45% return to 1/27/2014

Best(SPY-SH) 1-21-2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 197 days, and showing 12.21% return to 1/21/2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 197 days, and showing 12.21% return to 1/21/2014

Read more >