Currently the portfolio holds 10 stocks, 5 of them winners, so far held for an average period of 26 days, and showing combined 2.12% average return to 3/10/2014

Blog Archives

Monthly February 2014

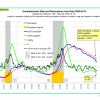

The unemployment rate recession model has been updated with the February UER of 6.7%.

The unemployment rate recession model has been updated with the February UER of 6.7%.

Read more >

iM Update – Mar 7, 2014

The IBH stock market model is out of the market. The MAC stock market model is invested, The recession indicator COMP is higher from last week’s level, and iM-BCIg is also higherd from last week’s level. MAC-AU is invested. The bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested.

iM Update* – Mar 7, 2014

The BVR-model avoids high beta bonds (long-bonds) and also intermediate duration bonds.

The BVR-model avoids high beta bonds (long-bonds) and also intermediate duration bonds.

Read more >

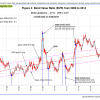

Is the TIAA Real Estate Account about to Roll Over?

The TIAA Real Estate Account, despite showing good returns over the last four years, is a typical example of a fund with disappointing performance over the longer term. In order to maximize one’s returns one has to know when to enter and exit the fund. My analysis shows that TIAA Real Estate may peak in the second half of 2014 which would provide an early indication to reduce one’s exposure. A firm sell signal would arise when its 1-year rolling return moves below 0%.