- This Combination Timer seeks to find optimum investment periods for equities. It uses five market timing algorithms, previously described, to periodically invest in three ETFs from a possible 16 available.

- It can hold equity, gold, and fixed income ETFs depending on stock market direction as indicated by a combination of market timers.

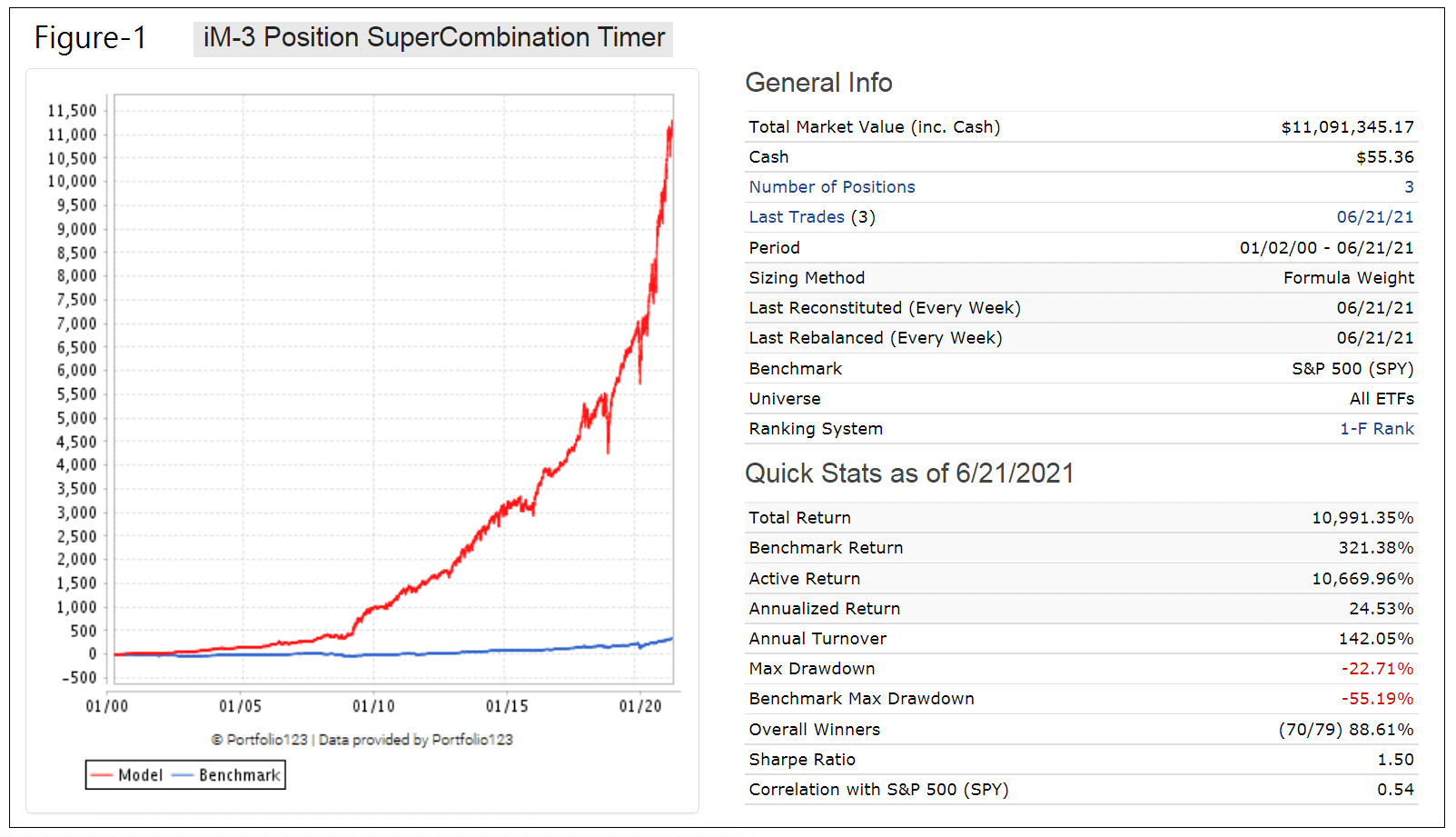

- A backtest from January 2000 to July 2021 shows an annualized return of 24.5% with a maximum drawdown of -23% and low annual turnover of 140%.

This model uses a simple momentum ranking system to periodically select three ETFs. The buy- and sell timers applicable to the various ETFs are given below with links to their respective descriptions.

Buy rule for 3 ETFs:

Buy Timers: SEASONAL, SUPERTIMER & YIELD CURVE.

- Between the months May to October (inclusive) select from XLP, XLU, XLK & QQQ , otherwise select from XLY, XLI, XLB & XLV; or

- If the 1wk-Supertimer or the Yield Curve Timer indicates invested in equity, then also select from XLF & SSO, otherwise select also from IAU, GLD, TLT & VIG.

Sell rule for 3 ETFs:

Sell Timers: SEASONAL, SUPERTIMER, YIELD CURVE, LOW FREQUENCY – & INFLATION

- If the 1wk-SuperTimer or the Yield Curve- or Low Frequency timers indicate to be out of equity then sell XLF & SSO, otherwise sell TLT & VIG when the Inflation timer indicates investment in equities; or

- Sell XLP,XLU,XLK,QQQ at the end of October; or

- Sell XLY,XLI,XLB,XLV at the end of April; or

- If the Yield Curve timer indicates investment in equity then sell GLD & IAU.

Performance and calendar year returns

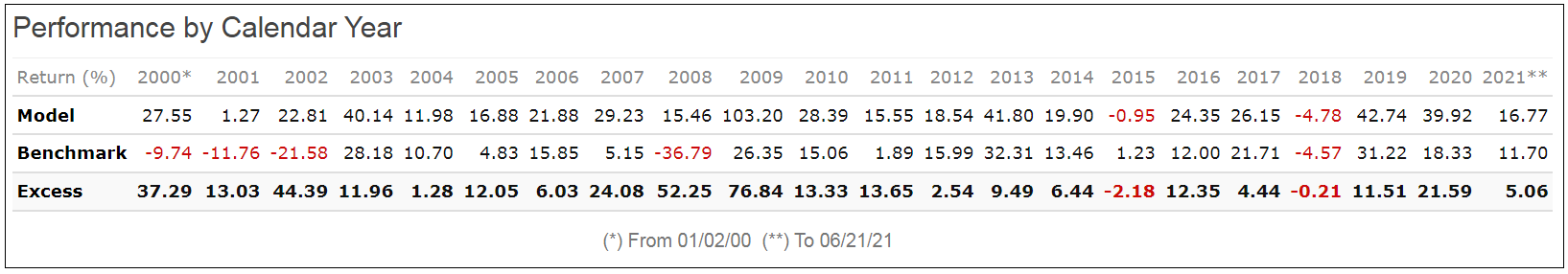

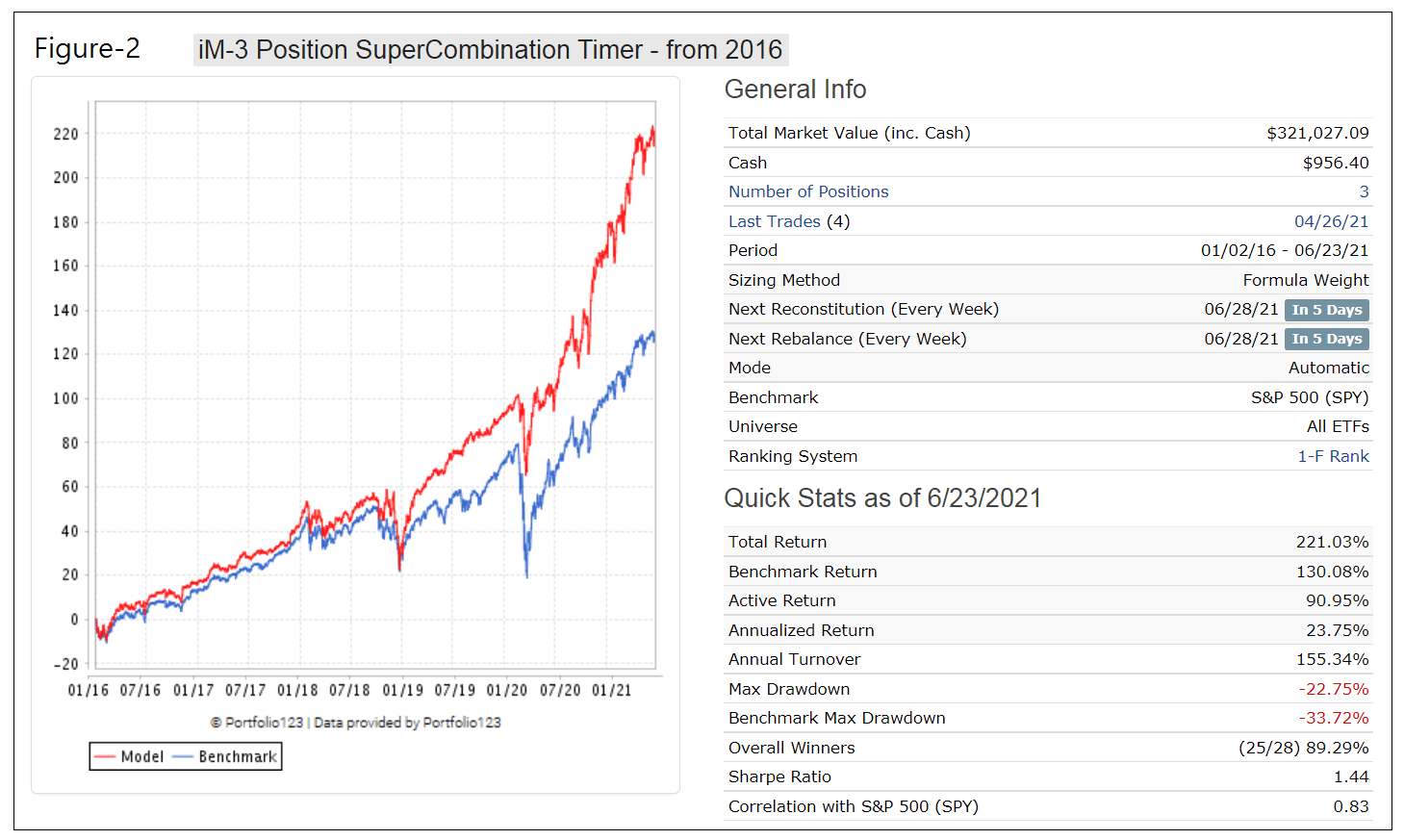

The backtest was performed online at Portfolio 123. For the period January 2000 to June 2021 (Figure-1) the annualized return would have been 24.5% with a maximum drawdown of -23%. Transaction costs of about 0.05% of each trade amount were taken into account. The minimum and average holding period for a position would have been 3 and 10 months, respectively.

Figure-2 shows the performance from January 2016 onward having similar performance statistics as the longer model.

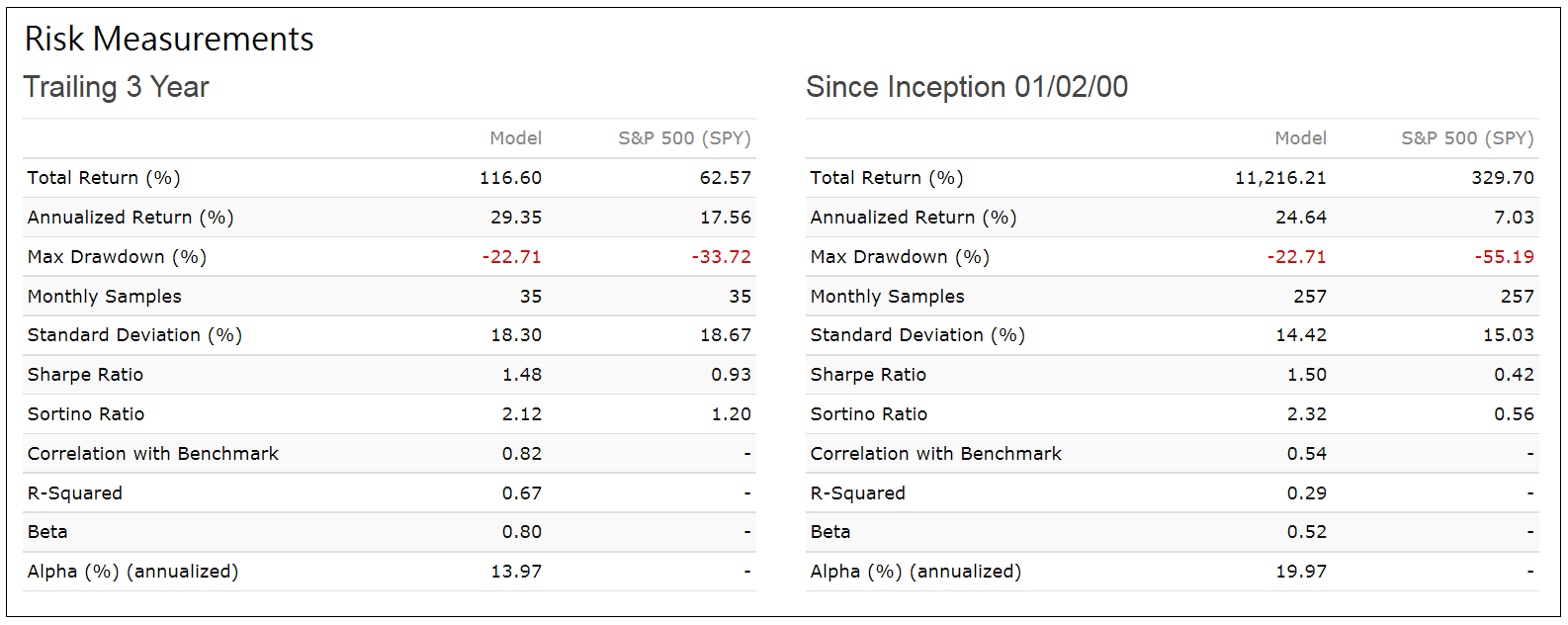

Investment Risk

In the table below are the risk statistics from 2000 to 2021 for the model relative to the benchmark S&P 500 (SPY). It is evident from the risk measures that the trading strategy carries less risk than investing in SPY over the longer term. The Standard Deviation of the monthly returns is less than that of SPY, and the positive alpha indicates that this strategy would have outperformed its risk-adjusted benchmark return on average by 20% per year over the last 21 years, and by 14% over the trailing 3 year period.

Conclusion

This is a low turnover model with only 76 realized trades over the preceding 21 years, and 25 realized trades since January 2016. The minimum holding period is three months, but the model should be rebalanced to equal weight periodically.

It is not anticipated that the models will hold gold ETFs anytime soon because the yield curve has to become inverted first. Current holdings are ETFs SSO, QQQ, and XLU. Note, when the model holds SSO it indicates 1.33 leverage.

At iMarketSignals we will report weekly holdings and performance of this model.

Disclaimer

Note: All performance results are hypothetical and the result of backtesting over the period 2000 to 2021. Since performance is dependent on market-timing rules, the future out-of-sample performance may be significantly less if those rules are not as effective as they were during the backtest period.

I assume this option is only available in the Gold package? Also, when do you envision it to be included in the Model Performance Tables?

what is this model’s correlation to a straight buy-and-hold SPY over the life of the backtest period?

Can you post the trades from 2008?

Trades listed here: iM-3-Position-SuperCombination-Timer.xls

Are you going to post these on the website or are the signals for this combo going to be in email only?

On home page:

Current holdings IEF SSO QQQ XLU

Why is there an IEF, although there is no article about it?

Another question of an ETF in equal shares? How often is rebalancing?

The site is reporting on a combo-model that holds equal weight the iM-3Posiion Super Combination Timer and the iM-ModSum/Yield Curve Timer. This combo has much less volatility with near equal returns. (Article for this combo is under preparation)

how u recommend to get in to the market with this model, it can take forever to be fully invested..

Should the MODSUM signal currently show SPY?

Yes, you are correct,should be SPY not IEF. You are referring to the combo iM-(3 pos SuperCombination+ModSum) Combo Timers.

Thank you for reporting.

Why does the website report that the model bought GLD and TLT and sold QQQ and XLK on 6/27/22 but these trades were not emailed out to members until 10/23/22?

Typo on the website

on 6/27/2022 the model sold IEF and bought SPY

on 10/23/200 the model sold QQQ & XLK and bought GLD & TLT as reported in the email.

website corrected accordingly

Hello

There is no performance update for this strategy in the table “Average Annualized Returns (CAGR).could you keep it updated?

Best regards

richard

Member email shows this model holds GLD, IAU and TLT. The website shows IAU, TLT, and XLY. I never know which to believe, your website or your emails?

Thank you for reporting. The email was correct and the website has now been updated accordingly. Apologies for the slipup.