|

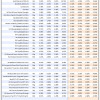

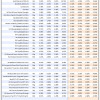

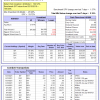

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

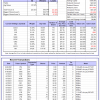

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 9.9%, and for the last 12 months is 24.5%. Over the same period the benchmark E60B40 performance was 8.1% and 24.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.32% at a time when SPY gained 1.02%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $151,672 which includes $648 cash and excludes $1,784 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 11.2%, and for the last 12 months is 27.4%. Over the same period the benchmark E60B40 performance was 8.1% and 24.8% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.42% at a time when SPY gained 1.02%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $155,937 which includes $374 cash and excludes $1,919 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 12.5%, and for the last 12 months is 30.3%. Over the same period the benchmark E60B40 performance was 8.1% and 24.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.51% at a time when SPY gained 1.02%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $160,104 which includes $513 cash and excludes $2,047 spent on fees and slippage. |

|

|

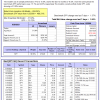

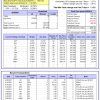

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 446.40% while the benchmark SPY gained 132.45% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 3.03% at a time when SPY gained 1.57%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $136,600 which includes -$811 cash and excludes $1,403 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 417.36% while the benchmark SPY gained 132.45% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 2.52% at a time when SPY gained 1.57%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $129,340 which includes $722 cash and excludes $812 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 522.40% while the benchmark SPY gained 132.45% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 3.89% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $622,397 which includes $3,301 cash and excludes $7,782 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 125.79% while the benchmark SPY gained 132.45% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -1.03% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $226,185 which includes $2,653 cash and excludes $6,209 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 272.07% while the benchmark SPY gained 132.45% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.61% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $372,070 which includes $2,369 cash and excludes $3,426 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 500.42% while the benchmark SPY gained 132.45% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 1.31% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $600,418 which includes $997 cash and excludes $1,607 spent on fees and slippage. |

|

|

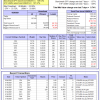

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 186.86% while the benchmark SPY gained 132.45% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.76% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $286,862 which includes $302 cash and excludes $1,391 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 327.44% while the benchmark SPY gained 132.45% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.96% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $427,437 which includes $877 cash and excludes $5,263 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 92.07% while the benchmark SPY gained 132.45% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.25% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $192,068 which includes $649 cash and excludes $7,411 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 213.17% while the benchmark SPY gained 132.45% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 4.07% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $313,170 which includes $1,075 cash and excludes $2,884 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 21.47% while the benchmark SPY gained 20.67% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 1.43% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $121,469 which includes $2,071 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 19.0%, and for the last 12 months is 59.5%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 0.89% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $402,748 which includes $2,374 cash and excludes $6,681 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 9.6%, and for the last 12 months is 34.2%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 0.24% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $01 which includes $66,124 cash and excludes Gain to date spent on fees and slippage. |

|

|

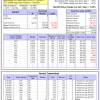

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 13.3%, and for the last 12 months is 40.7%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.07% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $293,244 which includes $3,044 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 15.0%, and for the last 12 months is 45.2%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.55% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $761,664 which includes $8,034 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 9.1%, and for the last 12 months is 32.8%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.29% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $187,256 which includes $5,275 cash and excludes $7,036 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 15.3%, and for the last 12 months is 51.3%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of iM-Combo5 gained 2.19% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $204,771 which includes $4,379 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 9.4%, and for the last 12 months is 28.0%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Since inception, on 7/1/2014, the model gained 196.24% while the benchmark SPY gained 149.53% and VDIGX gained 132.95% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.12% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $296,322 which includes $1,008 cash and excludes $3,890 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 13.7%, and for the last 12 months is 57.2%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.28% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $213,870 which includes $38,777 cash and excludes $1,764 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 11.6%, and for the last 12 months is 25.9%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Since inception, on 6/30/2014, the model gained 150.43% while the benchmark SPY gained 149.53% and the ETF USMV gained 127.37% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.74% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $250,429 which includes $1,190 cash and excludes $7,328 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 20.7%, and for the last 12 months is 63.9%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Since inception, on 1/3/2013, the model gained 444.82% while the benchmark SPY gained 244.45% and the ETF USMV gained 244.45% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.65% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $544,815 which includes $2,858 cash and excludes $4,708 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 12.9%. Over the same period the benchmark BND performance was -1.9% and -0.5% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.35% at a time when BND gained 0.20%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $152,235 which includes $6,551 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 13.3%, and for the last 12 months is 40.7%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.07% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $293,244 which includes $3,044 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 6.9%, and for the last 12 months is 17.1%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.06% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $140,262 which includes $2,781 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 12.8%, and for the last 12 months is 31.9%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.23% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $151,574 which includes $4,061 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 14.9%, and for the last 12 months is 27.8%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.55% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $180,191 which includes $2,364 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is 20.7%. Over the same period the benchmark SPY performance was 15.1% and 44.6% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.24% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $168,447 which includes $99 cash and excludes $6,883 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.