- Over the last 20 years this Timer provided only two exit periods for the stock market.

- By being out of the stock market during those periods one would have avoided most of the two bear markets and losses of 35% and 43%, respectively.

Rules

The Low Frequency Timer exits the stock market when all of the following three conditions exist:

- the Market Climate Score is greater than 2,

- the unemployment rate is higher than three months ago,

- the performance of the Hi-Beta stocks is lower than, or equal to Lo-Beta stocks of the S&P 500.

The Low Frequency Timer enters the stock market again when the iM-Standard Market Timer signals investments in stocks and at that time the performance of the Hi-Beta stocks must be greater than that of the Lo-Beta stocks of the S&P 500.

Models used

The models used in the Low Frequency Timer’s rules are described in:

- ETF Investing According to Market Climate.

- Profitable Market Timing with the Unemployment Rate

- Profitable Market Timing Using Performance of the Hi-Beta and Lo-Beta Stocks of the S&P 500

- iM-Standard Market Timer

Exit periods signaled

From Jan-1999 onward the model provided only two exit periods for the stock market, 2/5/2001 to 3/31/2003 and 12/24/2007 to 3/23/2009. Over those two periods SPDR ETF (SPY) lost 35.5% and 43.2%, respectively.

Performance

The iM-Low Frequency Timer was modeled on the on-line portfolio simulation platform Portfolio 123.

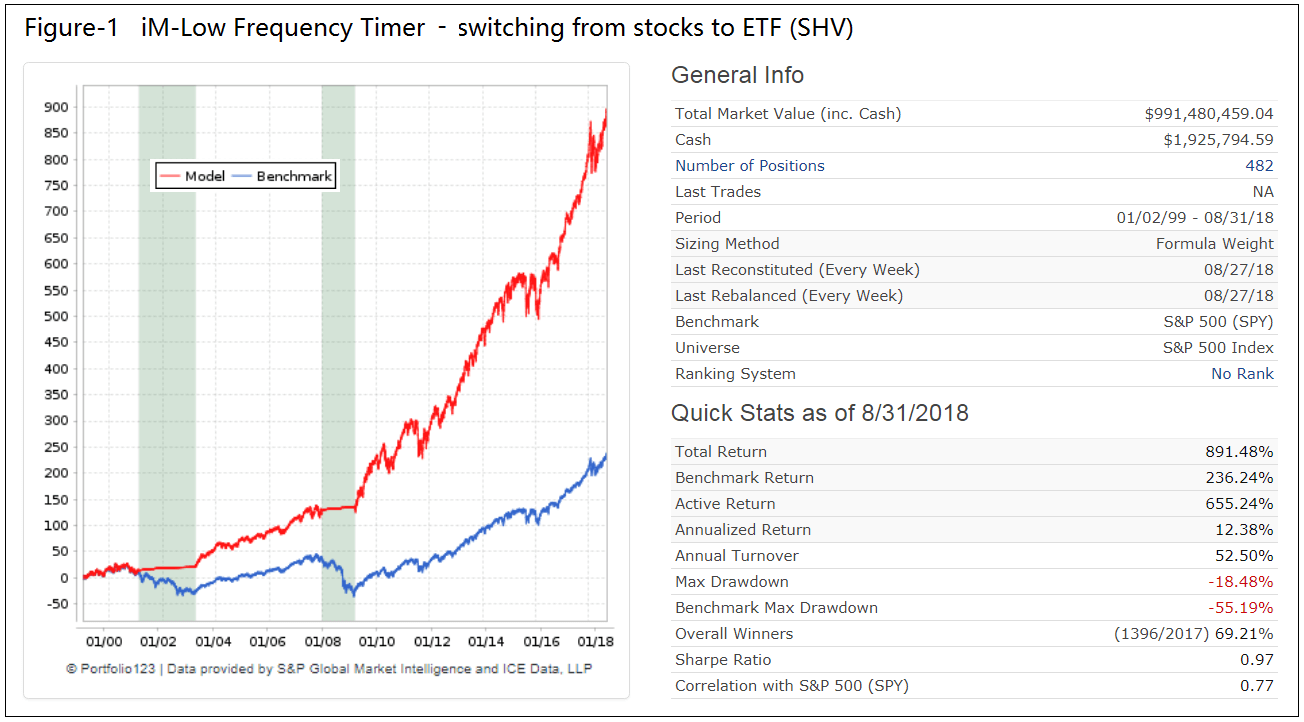

The performance of the model when switching between the stocks of the S&P500 and the iShares Short Treasury Bond ETF (SHV) is shown in Figure-1 below, together with the benchmark ETF (SPY). The periods when the model was in ETF (SHV) are depicted by the near horizontal sections of the performance curve and the vertical grey bars. By avoiding being in stocks during those two periods one would have had from Jan-2-1999 to Aug-31-2018 a total cumulative return of 891% versus 236% for buy-and-hold SPDR ETF (SPY).

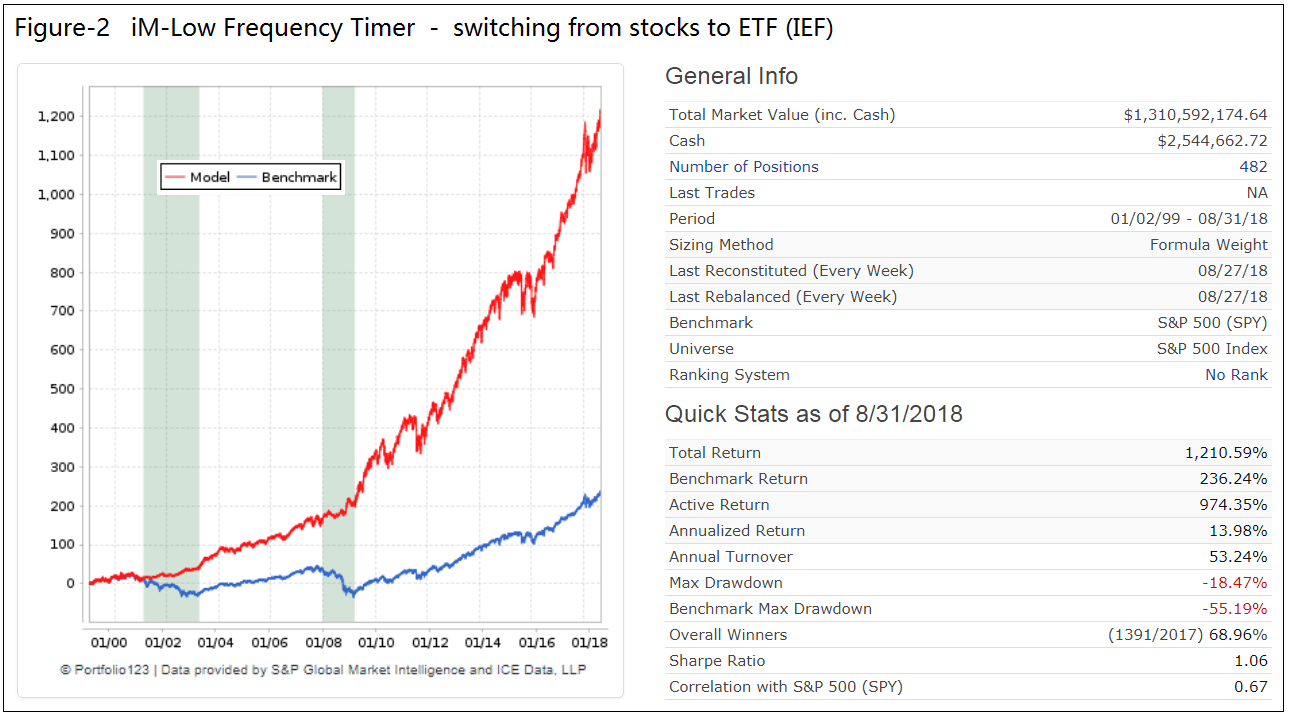

Figure-2 shows the performance when switching to iShares 7-10 Year Treasury Bond ETF (IEF) instead of ETF (SHV). The total cumulative return would have been 1,210%, more than 5-times that for buy-and-hold ETF (SPY).

Conclusion

The backtests suggest that the iM-Low Frequency Timer’s signals could be a useful indicator to avoid bear markets. At iMarketSignals we will provide with the Friday weekly update if this model is invested or in cash, which may in conjunction with our other recession indicators provide advance information on possible market down-turns and, if in a recessionary period, signal a timely market entry.

Disclaimer

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and portfolio value will fluctuate, and future signals from this model may not be as efficient as they were in the past.

Shouldn’t we be short when those three conditions occur?

This Timer attempts to show the periods when definitely not to be in stocks. It is similar to our recession indicators which should only provide signals to exit stocks prior to recessions. The alternative investments could be cash, bonds, or short stocks. We are not trying to provide a backtest for maximum overall returns.

System looks great, where can I find the signal/ how it is invested each week on your site?

thank you

You will find it from next Friday (Sep-14-2018) onward under “Weekly Macro Signals”.

How about 1987? Did this timer also avoid the 1987 massive crash?

We run this on Portfolio 123 which has data only from 1999 onward.

Solid, to answer your question, this model would not have avoided the 1987 crash as many conditions need to be satisfied for this model to exit the market, including a rising unemployment rate, which wasn’t the case during 1987. The unemployment rate continued to decline during the whole of 1987.

Hefer,

thanks for your answer. It confirms the old wisdom, that no timer can guarantee the avoidance of a sudden and dirty crash. 1987 was quite ugly and stocks fell approx. 25% if I recall correctly.

Nevertheless, this timer is a valuable addon to the “arsenal” of timers.

That is correct, but just to say it, getting out in 1987 wasn’t necessarily a good thing for a long term timer model. The S&P gained 6% in 1987 even with the crash, and continued to scream upward.

Georg and Anton,

Am I correct that the Low Frequency Timer will re-enter the market on Thurs due to the Standard Market Timer hedge being “Off” and the Hi-Lo Beta just flipping to “In”?

Thanks

You are correct. The iM-Low Frequency Timer is again in the stock market as of today, 1/22/2019, after having been out of stocks since 1/7/2019.

out of stocks on 1.7 and in stocks on 1.22; pretty loose with the term ‘low frequency’.

Yes, unexpected in and out.

When is this timer normally updated? As of today it still says it’s out of the market.

Thanks

This Timer is updated on Friday when we update the macro signals. So it shows position with the Monday before Friday situation.

Gold members will get the signals earlier, namely on Sunday before Monday. It will be included on our new Stock Market Confidence Level table.

See:

https://imarketsignals.com/2019/im-supertimer-timing-market-im-stock-market-confidence-level/

The chart shows it went out 1/14; should that be 1/7?

In the low frequency timer, would the CAGR show any improvement by going to SH instead of Cash or IEF? No doubt drawdown would go up.

Tom C

I was doing some back of the envelope this weekend. Through 8/31/18, investing in an inverse S&P during the two out periods would have lifted CAGR to a little over 17% in this simulation.

Tom C

…and a max DD of about 23% in January 2009.

Hi Gents,

I really like the objective of this model and have a question related to the Jan 2019 whipsaw exit and re-entry.

Which of the model’s rules triggers most frequently? I’d guess the 3 month unemployment rule. If so, have you considered evaluating a less noisy unemployment signal? Examples might include: 1) a longer timer period as basis for comparison; 2) adding another period for cross-verification e.g., 3 and 6 month; 3) year over year change; or 4) some type of moving average crossover.

If such an approach preserves the lion’s share of drawdown protection with lower whipsaw risk, I’d certainly call that attractive.

Hey guys,

Can you give me a quick explanation of why the Low Frequency Timer isn’t invested? The Hi-Beta / Lo-Beta signal appears to be on, and the Standard Market Timer signals on. Am I missing something?

Thanks,

Tom C

bump.

The Low Frequency Timer went back into equity on 6/15/2020.

Thank you for reporting the discrepancy.

Thanks.

Also, I believe that Combo 3 should be at 75% as of 6/15 for purposes of the Super Timer — it won’t change the SMC score though (still at 60).

Tom C