–

Blog Archives

iM Update – Apr 11, 2014

Posted in pmp free update

Monthly March 2014

The unemployment rate recession model has been updated with the March UER of 6.7%.

The unemployment rate recession model has been updated with the March UER of 6.7%.

Read more >

Posted in month free

Best10 Mar 24, 2014

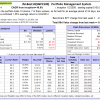

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 24 days, and showing combined 1.55% average return to 3/24/2014

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 24 days, and showing combined 1.55% average return to 3/24/2014

Read more >

Posted in reg bestx

iM Update* – Mar 28, 2014

The BVR-model avoids high beta bonds (long-bonds) and also intermediate duration bonds.

The BVR-model avoids high beta bonds (long-bonds) and also intermediate duration bonds.

Read more >

Posted in pmp paid update

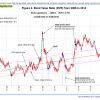

iM-Best(XIU-Cash) Market Timing System for Canada

This model uses the signals from the iM-Best(SPY-SH) Market Timing System, substituting the Canadian ETF XIU for SPY and switches between XIU and Cash instead of SH. XIU tracks the S&P/TSX 60 Index and currency is Canadian Dollar.

Read more >

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer