|

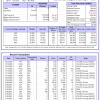

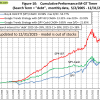

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

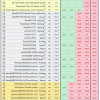

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 26.8%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 1.32% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $156,733,096 which includes $294,502 cash and excludes $3,953,990 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 1.10% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $686,039 which includes $25,403 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 6.1%. Over the same period the benchmark E60B40 performance was 1.2% and 16.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.38% at a time when SPY gained 0.67%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $180,677 which includes $2,320 cash and excludes $5,249 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 5.6%. Over the same period the benchmark E60B40 performance was 1.2% and 16.4% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.38% at a time when SPY gained 0.67%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $188,185 which includes $2,459 cash and excludes $5,507 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 5.0%. Over the same period the benchmark E60B40 performance was 1.2% and 16.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.38% at a time when SPY gained 0.67%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $195,606 which includes $2,565 cash and excludes $5,756 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 947.44% while the benchmark SPY gained 302.32% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 0.37% at a time when SPY gained 1.08%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $257,063 which includes $6,972 cash and excludes $2,979 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 671.82% while the benchmark SPY gained 302.32% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.68% at a time when SPY gained 1.08%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $192,955 which includes $77 cash and excludes $1,941 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 1762.36% while the benchmark SPY gained 302.32% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 6.65% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,862,362 which includes $1,298 cash and excludes $21,950 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 255.70% while the benchmark SPY gained 302.32% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 4.21% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $355,699 which includes $753 cash and excludes $17,322 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 450.68% while the benchmark SPY gained 302.32% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 4.09% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $550,684 which includes $3,824 cash and excludes $8,409 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 784.14% while the benchmark SPY gained 302.32% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -0.74% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $884,142 which includes $3,017 cash and excludes $3,071 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 278.60% while the benchmark SPY gained 302.32% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 7.61% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $378,605 which includes $879 cash and excludes $3,099 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 431.63% while the benchmark SPY gained 302.32% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.91% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $531,632 which includes $1,223 cash and excludes $19,935 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 201.40% while the benchmark SPY gained 302.32% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.51% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $301,400 which includes -$4,143 cash and excludes $18,234 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 379.32% while the benchmark SPY gained 302.32% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 5.08% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $479,317 which includes $1,561 cash and excludes $7,623 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 119.32% while the benchmark SPY gained 108.85% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 3.78% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $219,316 which includes $3,015 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 5.9%, and for the last 12 months is 16.0%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 3.81% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $564,316 which includes $1,331 cash and excludes $14,456 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 18.2%, and for the last 12 months is 368.0%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 11.23% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $01 which includes $171,911 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 0.0%, and for the last 12 months is 20.8%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.19% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $383,048 which includes $4,580 cash and excludes $2,213 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is -1.5%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.07% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $70,277 which includes $761 cash and excludes $2,818 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is -6.1%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.02% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $195,538 which includes $7,798 cash and excludes $8,524 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is 10.6%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Since inception, on 7/1/2014, the model gained 274.57% while the benchmark SPY gained 331.87% and VDIGX gained 51.54% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.36% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $374,566 which includes -$528 cash and excludes $5,657 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.2%, and for the last 12 months is -1.6%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 3.55% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $267,682 which includes $3,938 cash and excludes $4,323 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 2.2%, and for the last 12 months is 29.0%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Since inception, on 6/30/2014, the model gained 336.57% while the benchmark SPY gained 331.87% and the ETF USMV gained 215.31% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.27% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $436,569 which includes $2,792 cash and excludes $8,744 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 3.0%, and for the last 12 months is 26.2%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Since inception, on 1/3/2013, the model gained 1125.48% while the benchmark SPY gained 496.16% and the ETF USMV gained 496.16% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.74% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $1,225,478 which includes -$1,252 cash and excludes $15,146 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 0.0%, and for the last 12 months is 7.7%. Over the same period the benchmark BND performance was 0.2% and 8.3% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.20% at a time when BND gained 0.06%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $149,130 which includes $1,493 cash and excludes $2,855 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 0.0%, and for the last 12 months is 20.8%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.19% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $383,048 which includes $4,580 cash and excludes $2,213 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 11.0%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 2.27% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $191,842 which includes $1,225 cash and excludes $5,761 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 1.1%, and for the last 12 months is 9.4%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.06% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $184,945 which includes $3,863 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 0.0%, and for the last 12 months is 1.6%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.19% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $216,595 which includes $2,594 cash and excludes $8,216 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 6.5%, and for the last 12 months is 70.2%. Over the same period the benchmark SPY performance was 1.9% and 21.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 3.31% at a time when SPY gained 1.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $430,235 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

We offer three categories of membership – bronze, silver and gold at $20, $40 and $80 per month respectively, or discounted on a per year basis. The table to the left (just click on it) lists what you can access depending on the membership level you choose. All information not listed will remain free, however selected key articles could in future be restricted to a paid membership category.

We offer three categories of membership – bronze, silver and gold at $20, $40 and $80 per month respectively, or discounted on a per year basis. The table to the left (just click on it) lists what you can access depending on the membership level you choose. All information not listed will remain free, however selected key articles could in future be restricted to a paid membership category. The MAC-US model is invested since mid June 2025,

The MAC-US model is invested since mid June 2025,

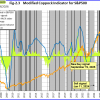

The 3-mo Hi-Lo Index Index of the S&P500 is at 4.70% (last week 3.62%) and is invested in the markets..

The 3-mo Hi-Lo Index Index of the S&P500 is at 4.70% (last week 3.62%) and is invested in the markets..

The Coppock indicator for the S&P500 invested the the US stock markets mid August 2024. This indicator is described here.

The Coppock indicator for the S&P500 invested the the US stock markets mid August 2024. This indicator is described here.

The MAC-AU model is dis-invested from the Australian stock market sine end April 2025.

The MAC-AU model is dis-invested from the Australian stock market sine end April 2025.

BCIg is not signaling a recession. (due to government shutdown, still lacking data)

BCIg is not signaling a recession. (due to government shutdown, still lacking data)

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.(due to government shutdown, still lacking data)

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.(due to government shutdown, still lacking data)

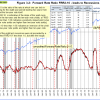

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is no longer inverted and the curve is steepening.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is no longer inverted and the curve is steepening.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

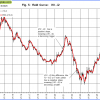

The BVR-model favors high beta bonds (long-bonds) and intermediate duration bonds when the BVR rises. The Bond Value Ratio as shown in Fig 4 is above last week’s value, and according to the model, only when BVR turns upward after having been lower than the lower offset-line should one consider long bonds again.

The BVR-model favors high beta bonds (long-bonds) and intermediate duration bonds when the BVR rises. The Bond Value Ratio as shown in Fig 4 is above last week’s value, and according to the model, only when BVR turns upward after having been lower than the lower offset-line should one consider long bonds again.

The yield curve model indicates the trend of the 10-year and 2-year Treasuries yield spread. Figure 5 charts (i10 – i2), the yield curve is near last week’s level. This model confirms the direction of the BVR.

The yield curve model indicates the trend of the 10-year and 2-year Treasuries yield spread. Figure 5 charts (i10 – i2), the yield curve is near last week’s level. This model confirms the direction of the BVR.

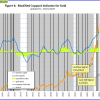

The modified Coppock Gold indicator, shown in Fig 6, generated a buy signal mid July 2025 and is invested in gold.

The modified Coppock Gold indicator, shown in Fig 6, generated a buy signal mid July 2025 and is invested in gold.

The iM GOLD-TIMER Rev-1 This model generated a new a buy signal mid August 2021 after being in cash for two weeks and thus invested in gold.

The iM GOLD-TIMER Rev-1 This model generated a new a buy signal mid August 2021 after being in cash for two weeks and thus invested in gold.

The modified Coppock Silver indicator shown in Fig 7. iM-coppock model regenerated a buy signal end mid May 2024 and is invested in Silver.

The modified Coppock Silver indicator shown in Fig 7. iM-coppock model regenerated a buy signal end mid May 2024 and is invested in Silver.

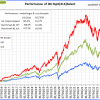

Performance comparison of the iM-Best models hosted on P123 and on iMarketSignals.

Performance comparison of the iM-Best models hosted on P123 and on iMarketSignals.

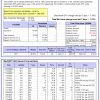

Performance graphs for iM-FlipSavers

Performance graphs for iM-FlipSavers

Performance graphs for iM-3mo-SuperTimer(SPY-IEF)

Performance graphs for iM-3mo-SuperTimer(SPY-IEF)

Performance graphs for iM-1mo-SuperTimer(SPY-IEF)

Performance graphs for iM-1mo-SuperTimer(SPY-IEF)

Performance graphs for iM-1wk-SuperTimer(SPY-IEF)

Performance graphs for iM-1wk-SuperTimer(SPY-IEF)

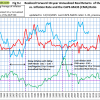

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

The estimated forward 10‐year annualized real return is 4.3% (previous month 4.4%) with a 95% confidence interval 2.8% to 5.8% (2.9% to 5.9%). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate

The estimated forward 10‐year annualized real return is 4.3% (previous month 4.4%) with a 95% confidence interval 2.8% to 5.8% (2.9% to 5.9%). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate  We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

The iM-GT Timer, based on Google Search Trends volume indicator is invested in the stock markets since beginning November 2025. This indicator is described here.

The iM-GT Timer, based on Google Search Trends volume indicator is invested in the stock markets since beginning November 2025. This indicator is described here. Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

The 1-year rolling return is =2.8% (previous month 2.8%) and is invested in the TIAA Real Estate Account since beginning May 2025.

The 1-year rolling return is =2.8% (previous month 2.8%) and is invested in the TIAA Real Estate Account since beginning May 2025.