|

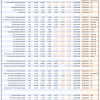

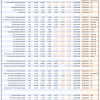

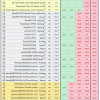

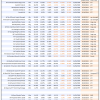

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -1.9%, and for the last 12 months is -3.1%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -3.13% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $130,155,648 which includes $204,343 cash and excludes $2,824,738 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -3.21% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $536,579 which includes $3,462 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 7.8%. Over the same period the benchmark E60B40 performance was 2.6% and 13.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.37% at a time when SPY gained -2.15%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $157,745 which includes $258 cash and excludes $3,876 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 2.5%, and for the last 12 months is 9.1%. Over the same period the benchmark E60B40 performance was 2.6% and 13.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -1.37% at a time when SPY gained -2.15%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $164,355 which includes $188 cash and excludes $4,076 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 10.5%. Over the same period the benchmark E60B40 performance was 2.6% and 13.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.37% at a time when SPY gained -2.15%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $170,919 which includes $296 cash and excludes $4,268 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 525.26% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -3.95% at a time when SPY gained -2.75%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $156,315 which includes $3,242 cash and excludes $2,289 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 380.70% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -3.03% at a time when SPY gained -2.75%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $120,174 which includes $99 cash and excludes $1,460 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 896.19% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -1.65% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $996,191 which includes $2,784 cash and excludes $11,552 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 195.25% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -3.58% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $295,250 which includes $322 cash and excludes $12,570 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 393.85% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -2.18% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $493,850 which includes $1,696 cash and excludes $6,567 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 607.09% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -3.04% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $707,093 which includes $2,989 cash and excludes $2,149 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 206.11% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -3.51% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $306,114 which includes $3,075 cash and excludes $2,179 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 322.15% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -2.72% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $422,155 which includes $1,079 cash and excludes $12,662 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 128.94% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -2.83% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $228,940 which includes $2,523 cash and excludes $13,442 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 269.98% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -3.18% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $369,976 which includes -$371 cash and excludes $6,346 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 57.02% while the benchmark SPY gained 48.36% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -2.86% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $157,018 which includes $2,401 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 5.2%, and for the last 12 months is 17.5%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -3.26% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $461,669 which includes $2,863 cash and excludes $11,270 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -6.5%, and for the last 12 months is -31.1%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -2.44% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $02 which includes $129,703 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 7.1%, and for the last 12 months is 9.6%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.29% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $287,238 which includes $1,805 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 6.5%, and for the last 12 months is -2.3%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively.. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $61,392 which includes -$151 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 2.5%, and for the last 12 months is 3.5%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of iM-Combo3.R1 gained -2.10% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $187,128 which includes $2,267 cash and excludes $8,234 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 11.5%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Since inception, on 7/1/2014, the model gained 221.54% while the benchmark SPY gained 206.78% and VDIGX gained 148.17% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -3.35% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $321,541 which includes $608 cash and excludes $4,868 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.4%, and for the last 12 months is 11.0%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -2.35% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $259,926 which includes $45,145 cash and excludes $3,173 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 6.1%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Since inception, on 6/30/2014, the model gained 191.26% while the benchmark SPY gained 206.78% and the ETF USMV gained 158.59% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -2.04% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $291,264 which includes $722 cash and excludes $8,054 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 7.4%, and for the last 12 months is 27.2%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Since inception, on 1/3/2013, the model gained 816.74% while the benchmark SPY gained 323.49% and the ETF USMV gained 323.49% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -4.74% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $916,737 which includes -$1,991 cash and excludes $10,076 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -2.3%, and for the last 12 months is -2.9%. Over the same period the benchmark BND performance was -3.0% and -0.8% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.30% at a time when BND gained -1.24%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $134,076 which includes $532 cash and excludes $2,613 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 7.1%, and for the last 12 months is 9.6%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.29% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $287,238 which includes $1,805 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 5.7%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.17% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $154,866 which includes $61 cash and excludes $4,301 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -2.0%, and for the last 12 months is 3.6%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -3.41% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $158,922 which includes $1,383 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 3.7%, and for the last 12 months is 8.5%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -1.30% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $195,577 which includes $489 cash and excludes $6,532 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 15.6%, and for the last 12 months is 18.6%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 2.05% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $224,833 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

We offer three categories of membership – bronze, silver and gold at $20, $40 and $80 per month respectively, or discounted on a per year basis. The table to the left (just click on it) lists what you can access depending on the membership level you choose. All information not listed will remain free, however selected key articles could in future be restricted to a paid membership category.

We offer three categories of membership – bronze, silver and gold at $20, $40 and $80 per month respectively, or discounted on a per year basis. The table to the left (just click on it) lists what you can access depending on the membership level you choose. All information not listed will remain free, however selected key articles could in future be restricted to a paid membership category. The MAC-US model invested the US stock markets in first week of February 2023.

The MAC-US model invested the US stock markets in first week of February 2023.

The MAC-AU model generated a buy signal end November 2023, and is invested from the Australian stock market.

The MAC-AU model generated a buy signal end November 2023, and is invested from the Australian stock market.

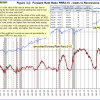

BCIg is not signaling a recession.

BCIg is not signaling a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.

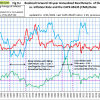

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) inverted beginning August 2022 and is signalling a recession — the average lead time of this signal is 14 months.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) inverted beginning August 2022 and is signalling a recession — the average lead time of this signal is 14 months.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

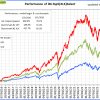

Performance comparison of the iM-Best models hosted on P123 and on iMarketSignals.

Performance comparison of the iM-Best models hosted on P123 and on iMarketSignals.

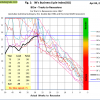

Performance graphs for iM-FlipSavers

Performance graphs for iM-FlipSavers

Performance graphs for iM-3mo-SuperTimer(SPY-IEF)

Performance graphs for iM-3mo-SuperTimer(SPY-IEF)

Performance graphs for iM-1mo-SuperTimer(SPY-IEF)

Performance graphs for iM-1mo-SuperTimer(SPY-IEF)

Performance graphs for iM-1wk-SuperTimer(SPY-IEF)

Performance graphs for iM-1wk-SuperTimer(SPY-IEF)

The 4/5/2024 BLS Employment Situation Report shows that the March 2024 unemployment rate of 3.8% down 0.1% from last month. Our UER model does not signal a recession.

The 4/5/2024 BLS Employment Situation Report shows that the March 2024 unemployment rate of 3.8% down 0.1% from last month. Our UER model does not signal a recession.

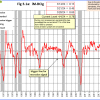

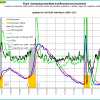

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

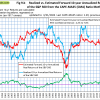

The estimated forward 10‐year annualized real return is 5.6% (previous month 5.8%) with a 95% confidence interval 4.2% to 7.0% (4.4% to 7.2% ). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate

The estimated forward 10‐year annualized real return is 5.6% (previous month 5.8%) with a 95% confidence interval 4.2% to 7.0% (4.4% to 7.2% ). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate  We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.