|

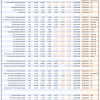

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

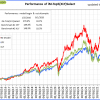

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is 2.5%, and for the last 12 months is 2.5%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 0.56% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $135,955,637 which includes $204,343 cash and excludes $2,824,738 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 1.25% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $559,987 which includes $3,462 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 3.7%, and for the last 12 months is 9.9%. Over the same period the benchmark E60B40 performance was 5.5% and 17.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.10% at a time when SPY gained 0.12%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $160,618 which includes $258 cash and excludes $3,876 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is 11.4%. Over the same period the benchmark E60B40 performance was 5.5% and 17.4% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.10% at a time when SPY gained 0.12%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $167,352 which includes $188 cash and excludes $4,076 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 5.1%, and for the last 12 months is 12.8%. Over the same period the benchmark E60B40 performance was 5.5% and 17.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.10% at a time when SPY gained 0.12%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $174,031 which includes $296 cash and excludes $4,268 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 546.39% while the benchmark SPY gained 195.83% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -0.74% at a time when SPY gained 0.46%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $161,598 which includes $4,966 cash and excludes $2,285 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 398.33% while the benchmark SPY gained 195.83% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.40% at a time when SPY gained 0.46%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $124,584 which includes $76 cash and excludes $1,456 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 909.99% while the benchmark SPY gained 195.83% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 0.78% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,009,993 which includes $1,268 cash and excludes $11,552 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 211.37% while the benchmark SPY gained 195.83% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 1.42% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $311,371 which includes $322 cash and excludes $12,570 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 409.23% while the benchmark SPY gained 195.83% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.84% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $509,235 which includes $1,696 cash and excludes $6,567 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 630.33% while the benchmark SPY gained 195.83% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 1.01% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $730,331 which includes $1,156 cash and excludes $2,149 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 223.45% while the benchmark SPY gained 195.83% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 1.77% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $323,452 which includes $3,075 cash and excludes $2,179 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 341.87% while the benchmark SPY gained 195.83% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.45% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $441,865 which includes $5,874 cash and excludes $12,656 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 133.46% while the benchmark SPY gained 195.83% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 1.68% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $233,458 which includes $2,523 cash and excludes $13,442 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 292.24% while the benchmark SPY gained 195.83% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.31% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $392,244 which includes $2,101 cash and excludes $6,175 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 64.41% while the benchmark SPY gained 53.56% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.57% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $164,407 which includes $3,114 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 10.3%, and for the last 12 months is 23.0%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.47% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $484,083 which includes $2,019 cash and excludes $11,270 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -11.4%, and for the last 12 months is -25.5%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 7.34% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$117 which includes $129,703 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 9.2%, and for the last 12 months is 11.8%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.47% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $292,871 which includes $1,805 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 10.3%, and for the last 12 months is 0.6%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively.. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $63,552 which includes -$151 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 5.6%, and for the last 12 months is 6.2%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.06% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $192,784 which includes $2,267 cash and excludes $8,234 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 7.3%, and for the last 12 months is 18.8%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Since inception, on 7/1/2014, the model gained 236.18% while the benchmark SPY gained 217.55% and VDIGX gained 156.38% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.21% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $336,178 which includes $1,019 cash and excludes $4,856 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is 14.9%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.23% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $267,552 which includes $44,422 cash and excludes $3,173 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is 11.9%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Since inception, on 6/30/2014, the model gained 202.71% while the benchmark SPY gained 217.55% and the ETF USMV gained 169.26% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.20% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $302,706 which includes $2,024 cash and excludes $8,004 spent on fees and slippage. |

|

|

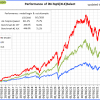

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 13.1%, and for the last 12 months is 34.0%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Since inception, on 1/3/2013, the model gained 865.73% while the benchmark SPY gained 338.36% and the ETF USMV gained 338.36% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.55% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $965,731 which includes $256 cash and excludes $9,435 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -0.4%, and for the last 12 months is -1.0%. Over the same period the benchmark BND performance was -1.4% and 0.9% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.47% at a time when BND gained -0.38%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $136,711 which includes $532 cash and excludes $2,613 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 9.2%, and for the last 12 months is 11.8%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.47% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $292,871 which includes $1,805 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 6.6%, and for the last 12 months is 10.2%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.73% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $160,884 which includes $49 cash and excludes $4,299 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 8.2%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.64% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $165,461 which includes $1,383 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 5.7%, and for the last 12 months is 11.5%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.47% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $199,427 which includes $489 cash and excludes $6,532 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 13.5%. Over the same period the benchmark SPY performance was 10.2% and 29.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 3.42% at a time when SPY gained 0.46%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $211,504 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

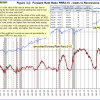

The MAC-US model invested the US stock markets in first week of February 2023.

The MAC-US model invested the US stock markets in first week of February 2023.

The MAC-AU model generated a buy signal end November 2023, and is invested from the Australian stock market.

The MAC-AU model generated a buy signal end November 2023, and is invested from the Australian stock market.

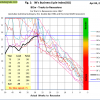

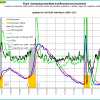

BCIg is not signaling a recession.

BCIg is not signaling a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) inverted beginning August 2022 and is signalling a recession — the average lead time of this signal is 14 months.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) inverted beginning August 2022 and is signalling a recession — the average lead time of this signal is 14 months.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

The 4/5/2024 BLS Employment Situation Report shows that the March 2024 unemployment rate of 3.8% down 0.1% from last month. Our UER model does not signal a recession.

The 4/5/2024 BLS Employment Situation Report shows that the March 2024 unemployment rate of 3.8% down 0.1% from last month. Our UER model does not signal a recession.

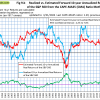

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

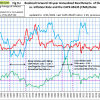

The estimated forward 10‐year annualized real return is 5.6% (previous month 5.8%) with a 95% confidence interval 4.2% to 7.0% (4.4% to 7.2% ). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate

The estimated forward 10‐year annualized real return is 5.6% (previous month 5.8%) with a 95% confidence interval 4.2% to 7.0% (4.4% to 7.2% ). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate  We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.