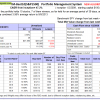

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 39 days, and showing combined 3% average return to 9/9/2013

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 39 days, and showing combined 3% average return to 9/9/2013

Read more >

Blog Archives

Best10 9-9-13

iM Update 9-13-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher and iM-BCIg is lower from last week’s levels. MAC-AU is also invested.

Best(SPY-SH) 9-9-13

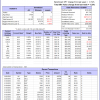

Currently the portfolio holds SPY, so far held for a period of 63 days, and showing 2.19% return to 9/9/2013

Currently the portfolio holds SPY, so far held for a period of 63 days, and showing 2.19% return to 9/9/2013

Read more >

iM-Best(SPY-Cash) Market Timing System: Gains in Up Markets – Cash in Down Markets

This binary model uses the signals from the iM-Best(SPY-SH) Market Timing System, and switches between SPY (SPDR® S&P 500® ETF) and Cash instead of SH. This model would have produced an average annual return of about 16.3% from January 2000 to the end of August 2013, versus 2.6% for a buy-and-hold investment of SPY over the same period, with maximum drawdowns of -15% and 55%, respectively.

Best10 9-3-13

Currently the portfolio holds 10 stocks, 3 of them winners, so far held for an average period of 40 days, and showing combined -1.14% average return to 9/3/2013

Currently the portfolio holds 10 stocks, 3 of them winners, so far held for an average period of 40 days, and showing combined -1.14% average return to 9/3/2013

Read more >

iM Update 9-6-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is a bit higher and iM-BCIg is lower from last week’s level. MAC-AU is also invested.

Best(SPY-SH) 9-3-13

Currently the portfolio holds SPY, so far held for a period of 57 days, and showing 0.19% return to 9/3/2013

Currently the portfolio holds SPY, so far held for a period of 57 days, and showing 0.19% return to 9/3/2013

Read more >

iM-Best(SPY-SH) Market Timing System: Gains for Up and Down Markets

This binary model switches between SPY (SPDR® S&P 500® ETF) and SH (ProShares Short S&P500 ETF) depending on market direction. Using a web-based trading simulation platform, our ranking system, and specific buy and sell rules, this model would have produced an average annual return of about 29.3% from January 2000 to end of August 2013, versus 2.6% for a buy-and-hold investment of SPY over the same period.

Best10 8-26-13

Currently the portfolio holds 10 stocks, 8 of them winners, so far held for an average period of 32 days, and showing combined 1.42% average return to 8/26/2013

Currently the portfolio holds 10 stocks, 8 of them winners, so far held for an average period of 32 days, and showing combined 1.42% average return to 8/26/2013

Read more >