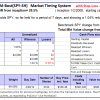

The BVR-model avoids high beta bonds (long-bonds) and also intermediate duration bonds. The Bond Value Ratio is shown in Fig 4. The BVR is a bit lower than last week’s level. According to the model, only when BVR turns upward after having been lower than the lower offset-line should one consider long bonds again.

The BVR-model avoids high beta bonds (long-bonds) and also intermediate duration bonds. The Bond Value Ratio is shown in Fig 4. The BVR is a bit lower than last week’s level. According to the model, only when BVR turns upward after having been lower than the lower offset-line should one consider long bonds again.

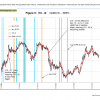

The yield curve model shows the generally steepening trend of the 10-year and 2-year Treasuries yield spread. Figure 5 charts (i10 – i2). The general trend is up, as one can see, although the yield curve has flattened recently. FLAT and STPP are ETNs. STPP profits from a steepening yield curve and FLAT increases in value when the yield curve flattens. This model confirms the direction of the BVR.

The yield curve model shows the generally steepening trend of the 10-year and 2-year Treasuries yield spread. Figure 5 charts (i10 – i2). The general trend is up, as one can see, although the yield curve has flattened recently. FLAT and STPP are ETNs. STPP profits from a steepening yield curve and FLAT increases in value when the yield curve flattens. This model confirms the direction of the BVR.