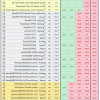

We offer three categories of membership – bronze, silver and gold at $20, $40 and $80 per month respectively, or discounted on a per year basis. The table to the left (just click on it) lists what you can access depending on the membership level you choose. All information not listed will remain free, however selected key articles could in future be restricted to a paid membership category.

We offer three categories of membership – bronze, silver and gold at $20, $40 and $80 per month respectively, or discounted on a per year basis. The table to the left (just click on it) lists what you can access depending on the membership level you choose. All information not listed will remain free, however selected key articles could in future be restricted to a paid membership category.

Please select your membership level here.

Most Recent Updates

February 20, 2026

Stock-markets:

The MAC-US model is invested since mid June 2025,

The MAC-US model is invested since mid June 2025,

.

The MAC-AU model is dis-invested from the Australian stock market sine end April 2025.

The MAC-AU model is dis-invested from the Australian stock market sine end April 2025.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

BCIg is not signaling a recession.

BCIg is not signaling a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession, yet

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession, yet

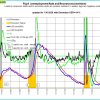

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is no longer inverted and the curve is steepening.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is no longer inverted and the curve is steepening.

A description of this indicator can be found here.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

A description of this indicator can be found here.

Monthly Updates

January 9, 2026

Unemployment

The 1/9/2025 BLS Employment Situation Report reports that the December 2025 unemployment rate decreased by 0.1% to 4.4%.

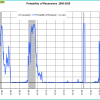

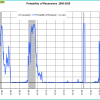

Our UER model does signal a recession with a recession probability of 40% (see graph).

CAPE-Cycle-ID

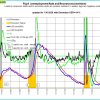

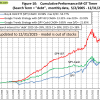

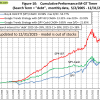

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

To avoid the bear market, exit stocks when the spread between the 5-month and 25-month moving averages of S&P-real becomes negative and simultaneously the CAPE-Cycle-ID score is 0 or -2. (read more)

Estimated Forward 10-Year Returns

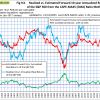

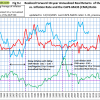

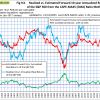

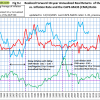

The estimated forward 10‐year annualized real return is 4.3% (previous month 4.4%) with a 95% confidence interval 2.8% to 5.8% (2.9% to 5.9%). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate

The estimated forward 10‐year annualized real return is 4.3% (previous month 4.4%) with a 95% confidence interval 2.8% to 5.8% (2.9% to 5.9%). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate  We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

.

iM-GT Timer

The iM-GT Timer, based on Google Search Trends volume indicator is invested in the stock markets since beginning November 2025. This indicator is described here.

The iM-GT Timer, based on Google Search Trends volume indicator is invested in the stock markets since beginning November 2025. This indicator is described here.

Trade Weighted USD

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

TIAA Real Estate Account

The 1-year rolling return is =2.8% (previous month 2.8%) and is invested in the TIAA Real Estate Account since beginning May 2025.

The 1-year rolling return is =2.8% (previous month 2.8%) and is invested in the TIAA Real Estate Account since beginning May 2025.

Other Member Updates

February 20, 2026

Bond-market:

The Yield Curve:

Silver:

Weekly Updates

February 20, 2026

Bond-market:

The Yield Curve:

Silver:

February 20, 2026

Stock-markets:

The MAC-US model is invested since mid June 2025,

The MAC-US model is invested since mid June 2025,

.

The MAC-AU model is dis-invested from the Australian stock market sine end April 2025.

The MAC-AU model is dis-invested from the Australian stock market sine end April 2025.

This model and its application is described in MAC-Australia: A Moving Average Crossover System for Superannuation Asset Allocations.

Recession:

BCIg is not signaling a recession.

BCIg is not signaling a recession.

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession, yet

The growth of the Conference Board’s Leading Economic Indicator does not signal a recession, yet

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is no longer inverted and the curve is steepening.

The Forward Rate Ratio between the 2-year and 10-year U.S. Treasury yields (FRR2-10) is no longer inverted and the curve is steepening.

A description of this indicator can be found here.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

The iM-Low Frequency Timer switched to bonds on 9/26/2022.

A description of this indicator can be found here.

Monthly Updates

January 9, 2026

Unemployment

The 1/9/2025 BLS Employment Situation Report reports that the December 2025 unemployment rate decreased by 0.1% to 4.4%.

Our UER model does signal a recession with a recession probability of 40% (see graph).

CAPE-Cycle-ID

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from -2 to 0 end of June 2023 generating a buy signal. This indicator now invested in the markets. This indicator is described here.

To avoid the bear market, exit stocks when the spread between the 5-month and 25-month moving averages of S&P-real becomes negative and simultaneously the CAPE-Cycle-ID score is 0 or -2. (read more)

Estimated Forward 10-Year Returns

The estimated forward 10‐year annualized real return is 4.3% (previous month 4.4%) with a 95% confidence interval 2.8% to 5.8% (2.9% to 5.9%). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate

The estimated forward 10‐year annualized real return is 4.3% (previous month 4.4%) with a 95% confidence interval 2.8% to 5.8% (2.9% to 5.9%). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate  We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

.

iM-GT Timer

The iM-GT Timer, based on Google Search Trends volume indicator is invested in the stock markets since beginning November 2025. This indicator is described here.

The iM-GT Timer, based on Google Search Trends volume indicator is invested in the stock markets since beginning November 2025. This indicator is described here.

Trade Weighted USD

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

TIAA Real Estate Account

The 1-year rolling return is =2.8% (previous month 2.8%) and is invested in the TIAA Real Estate Account since beginning May 2025.

The 1-year rolling return is =2.8% (previous month 2.8%) and is invested in the TIAA Real Estate Account since beginning May 2025.