Note: Other educational institutions may offer similar retirement schemes, where you can switch between TIAA-CREF and another Fund Provider.

Yale will soon offer all of the current TIAA-CREF and Vanguard investment options through TIAA-CREF making it possible to invest in and switch between funds from both organizations.

At iMarketSignals we have developed several models using the TIAA-CREF and Vanguard investment options to improve investment returns while saving for retirement or managing investments during retirement. All systems are updated monthly on our website.

Systems are:

- Timed TIAA Real Estate Account

- Dynamic Asset Allocation Systems

2.1 Vanguard Funds combination systems

2.2 Vanguard/TIAA-CREF combination systems

1. The Timed TIAA Real Estate Account

A simple timing strategy applied to the TIAA Real Estate Account considerably reduces investment risk and increase returns. Since inception of this account there would only have been one sell- and one subsequent buy-signal.

- Our analysis shows that a sell signal arises when the 1-year rolling return moves below 0%.

- A subsequent buy signal would be given when the 1-year rolling return moves from below to above 0%.

A detail analysis showing the benefits of timing the TIAA Real Estate Account can be found here and the latest performance statistics starting from from Jan-2000 for the timed TIAA Reatl Estate Account can be examined here.

A detail analysis showing the benefits of timing the TIAA Real Estate Account can be found here and the latest performance statistics starting from from Jan-2000 for the timed TIAA Reatl Estate Account can be examined here.

Also the timed TIAA Real Estate Account in combination with other CREF Accounts or Vanguard Funds reduces volatility and risk of the combined investments.

2. The Dynamic Asset Allocation Strategy

Backtests show that a Dynamic Asset Allocation (DAA) strategy applied to bond- and stock-funds increase returns and reduces risk. During up-market periods more money is allocated to stock funds than bond funds, and conversely during down-market periods more money is allocated to bond funds than stock funds.

The up- and down-market periods come from our MAC-US (backtested over 65 years). From 2000 to 2014, the MAC-US signaled only 5 down-market periods and 6 up-market periods, including the current up-market period.

2.1 Better Returns from Vanguard Funds with Dynamic Asset Allocation: System1a, 2a & 3a

A detailed description of the systems can be found here and relevant comments can be found at the bottom of the linked article.

System1a uses Vanguard’s Total Bond Market Index Fund and Total Stock Market Index Fund in combination, echoing the broad based Index approach. Best for the investors that do not want to give too much attention to their investments.

System2a uses six actively managed Vanguard funds with allocations optimized to produce the highest long-term return. Over the last 5 years this system has under-performed System1a and System3a.

System3a uses three actively managed Vanguard funds with allocations optimized to produce high long-term returns and high short returns. This system has a high allocation to the Vanguard Health Care Fund.

The latest performance statistics starting from from Jan-2000 for Systems 1a, 2a and 3a can be examined here, together with current asset allocation and risk measurements.

The latest performance statistics starting from from Jan-2000 for Systems 1a, 2a and 3a can be examined here, together with current asset allocation and risk measurements.

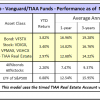

2.2 Better Returns from Vanguard Funds and TIAA-CREF Accounts with Dynamic Asset Allocation: System1b, 2b, 3b & 4b

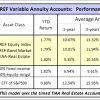

In this article Getting the Most from TIAA-CREF’s Variable Annuity Accounts we analyzed the performance of all TIAA-CREF Accounts and compared them to Dynamic Asset Allocation (DAA) models using the following three TIAA/CREF Accounts in various combinations (similar to System2b):

- CREF Equity Index Account (CREFequi)

- CREF Bond Market Account (CREFbond)

- TIAA Real Estate Account (TIAAreal)

The analysis shows that the DAA strategy increases returns and lowers risk relative to static asset allocation models.

System1b uses Vanguard’s Total Bond Market Index Fund and Total Stock Market Index Fund in combination with TIAA Real Estate-timed (TIAAreal-timed), echoing the broad based Index approach but including TIAAreal-timed to reduce risk. System1b can be directly compared to System1a which does not include TIAAreal-timed. Allocation to TIAAreal-timed remains unchanged during up- and down-market periods.

System2b is similar to System1b but uses the CREF Bond Market Account and CREF Equity Index Account instead of the Vanguard Total Bond Market Index Fund and Total Stock Market Index Fund. One can see that System2b has marginally lower returns and higher risk measurements than System1b, which would one lead to conclude that the Vanguard index funds are preferable to the CREF funds. Allocation to TIAAreal-timed remains unchanged during up- and down-market periods.

System3b uses the Vanguard Total Bond Market Index Fund and three actively managed Vanguard stock funds in combination with TIAAreal-timed, with allocations optimized to produce high long-term returns and high short returns. This system has a high allocation to the Vanguard Health Care Fund. Allocation to TIAAreal-timed remains unchanged during up- and down-market periods.

System4b is similar to System3a but uses the Vanguard Short-Term Investment-Grade Fund (VFSTX) instead of the Vanguard Total Bond Market Index Fund. Including the short-term bond fund reduces historic returns, but this system may be more appropriate for periods when rising interest rates are expected.

The latest performance statistics starting from from Jan-2000 for Systems Systems 1b, 2b, 3b and 4b can be examined here (lower part of page), together with current asset allocation and risk measurements.

The latest performance statistics starting from from Jan-2000 for Systems Systems 1b, 2b, 3b and 4b can be examined here (lower part of page), together with current asset allocation and risk measurements.

Leave a Reply

You must be logged in to post a comment.