Blog Archives

iM-Best Reports – 3/6/2017

Posted in pmp SPY-SH

iM-Best Reports – 2/6/2017

|

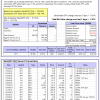

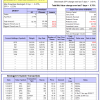

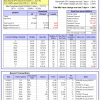

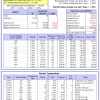

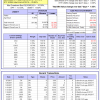

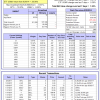

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 3.0%, and for the last 12 months is 1.4%. Over the same period the benchmark SPY performance was 2.4% and 24.4% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.20% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $476,218 which includes $44 cash and excludes $15,358 spent on fees and slippage. | |

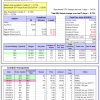

| iM-Combo3.R1: The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 4.4%. Over the same period the benchmark SPY performance was 2.4% and 24.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.86% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $129,675 which includes $437 cash and excludes $3,149 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 2.1%, and since inception 0.7%. Over the same period the benchmark SPY performance was 2.4% and 21.8% respectively. Over the previous week the market value of iM-Combo5 gained 0.72% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $100,730 which includes -$282 cash and excludes $460 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient The model’s out of sample performance YTD is -2.1%, and for the last 12 months is -12.0%. Over the same period the benchmark SPY performance was 2.4% and 24.4% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 1.70% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $385,022 which includes -$43,105 cash and excludes $8,236 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 2.3%, and for the last 12 months is 25.7%. Over the same period the benchmark SPY performance was 2.4% and 24.4% respectively. Since inception, on 7/1/2014, the model gained 49.15% while the benchmark SPY gained 23.13% and VDIGX gained 19.63% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.50% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $149,151 which includes $731 cash and excludes $1,491 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 1.7%, and since inception -1.4%. Over the same period the benchmark SPY performance was 2.4% and 10.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 0.55% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $746 which includes $105 cash and excludes Gain to date spent on fees and slippage. | |

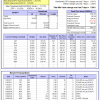

| iM-BESTOGA-3: The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 15.7%. Over the same period the benchmark SPY performance was 2.4% and 24.4% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.22% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $209,984 which includes $21,406 cash and excludes $767 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 1.8%, and since inception 4.6%. Over the same period the benchmark SPY performance was 2.4% and 10.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.94% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $104,629 which includes $61 cash and excludes $487 spent on fees and slippage. | |

| iM-Best10(Short Russell3000): The model’s performance YTD is -4.1%, and for the last 12 months is -40.9%. Over the same period the benchmark SPY performance was 2.4% and 24.4% respectively. Over the previous week the market value of iM-Best10(Short Russell3000) gained -2.23% at a time when SPY gained 0.61%. Over the period 2/3/2014 to 2/6/2017 the starting capital of $100,000 would have grown to $8,200 which includes $13,394 cash and excludes $1,673 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 2.9%, and since inception 1.4%. Over the same period the benchmark SPY performance was 2.4% and 14.5% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 0.75% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $101,390 which includes $540 cash and excludes $488 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 20.4%. Over the same period the benchmark SPY performance was 2.4% and 24.4% respectively. Since inception, on 7/1/2014, the model gained 46.81% while the benchmark SPY gained 23.13% and the ETF USMV gained 29.85% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.64% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $146,808 which includes $196 cash and excludes $2,810 spent on fees and slippage. | |

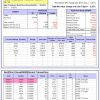

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is 31.3%. Over the same period the benchmark SPY performance was 2.4% and 24.4% respectively. Since inception, on 1/5/2015, the model gained 31.99% while the benchmark SPY gained 18.32% and the ETF USMV gained 19.25% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.15% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $131,993 which includes $195 cash and excludes $662 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 25.3%. Over the same period the benchmark SPY performance was 2.4% and 24.4% respectively. Since inception, on 3/31/2015, the model gained 19.63% while the benchmark SPY gained 14.10% and the ETF USMV gained 15.18% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 1.69% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $119,629 which includes -$8 cash and excludes $573 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is 41.7%. Over the same period the benchmark SPY performance was 2.4% and 24.4% respectively. Since inception, on 7/1/2014, the model gained 60.56% while the benchmark SPY gained 23.13% and the ETF USMV gained 29.85% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.65% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $160,564 which includes -$93 cash and excludes $916 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/30/2014, the model gained 44.96% while the benchmark SPY gained 21.49% and the ETF USMV gained 28.06% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.35% at a time when SPY gained 0.61%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $144,963 which includes $80 cash and excludes $805 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 33.23% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -1.1%, and for the last 12 months is -15.9%. Over the same period the benchmark SPY performance was 2.4% and 24.4% respectively. Over the previous week the market value of iM-Best(Short) gained -0.51% at a time when SPY gained 0.61%. Over the period 1/2/2009 to 2/6/2017 the starting capital of $100,000 would have grown to $95,684 which includes $114,996 cash and excludes $21,291 spent on fees and slippage. |

Posted in pmp SPY-SH

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer