Using the investment periods determined for the US market with the iM-Best(SPY-SH) Market Timing System, we calculated performance figures for 9 major country indices. The system, if followed, would have improved returns from all markets. From January 2000 to August 2013 with market timing, the best performing index in local currency was IBOVESPA – Brazil, and in US-dollars the DAX – Germany, closely followed by Brazil.

Blog Archives

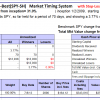

Best(SPY-SH) 9-30-13

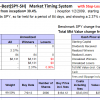

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 84 days, and showing 2.37% return to 9/30/2013

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 84 days, and showing 2.37% return to 9/30/2013

Read more >

iM Update 9-27-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher and iM-BCIg is also higher from last week’s levels. MAC-AU is also invested.

Best10 9-23-13

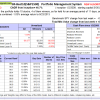

Currently the portfolio holds 10 stocks, 4 of them winners, so far held for an average period of 11 days, and showing combined -1.03% average return to 9/23/2013

Currently the portfolio holds 10 stocks, 4 of them winners, so far held for an average period of 11 days, and showing combined -1.03% average return to 9/23/2013

Read more >

Best(SPY-SH) 9-23-13

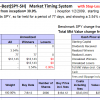

Currently the portfolio holds SPY, so far held for a period of 77 days, and showing 3.54% return to 9/23/2013

Currently the portfolio holds SPY, so far held for a period of 77 days, and showing 3.54% return to 9/23/2013

Read more >

(Deprecated) iM-Best Combo: High Performance Models in Combination with iM-Best(SPY-SH)

This Combo was presented as an example to demonstrate the risk reduction when combining simulation models with Best(SPY-SH). It was not an invitation to subscribe to the stock models at P123. The Combo is not available for subscription at iM, but could be simulated in a “book” at P123. This would require a membership at P123 and subscriptions to the relevant R2G models as well.

Read more >

Best10 9-17-13

Currently the portfolio holds 10 stocks, 4 of them winners, so far held for an average period of 19 days, and showing combined 0.90% average return to 9/17/2013

Currently the portfolio holds 10 stocks, 4 of them winners, so far held for an average period of 19 days, and showing combined 0.90% average return to 9/17/2013

Read more >

iM Update 9-20-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher and iM-BCIg is also higher from last week’s levels. MAC-AU is also invested.

Read more >

iM-Best(SSO-SDS): Beating the Market with Leveraged ETFs

Using the simulated investment periods determined with the iM-Best(SPY-SH) Market Timing System, we calculated performance figures resulting from the model switching between the ETFs SSO and SDS, instead of SPY and SH. This alternative system would have produced an average annual return of about 55.6% from January 2000 to the end of August 2013, versus 2.6% for a buy-and-hold investment of SPY over the same period.

Best(SPY-SH) 9-16-13

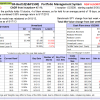

Currently the portfolio holds SPY, so far held for a period of 70 days, and showing 3.77% return to 9/16/2013

Currently the portfolio holds SPY, so far held for a period of 70 days, and showing 3.77% return to 9/16/2013

Read more >