The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is lower from last week’s level and iM-BCIg is unchanged. MAC-AU is also invested. The modified Coppock indicator for the S&P500 generated a buy signal

Blog Archives

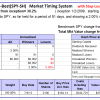

Best10 10-14-13

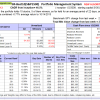

Currently the portfolio holds 10 stocks, 5 of them winners, so far held for an average period of 22 days, and showing combined -0.77% average return to 10/14/2013

Currently the portfolio holds 10 stocks, 5 of them winners, so far held for an average period of 22 days, and showing combined -0.77% average return to 10/14/2013

Read more >

iM Update 10-18-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is lower and iM-BCIg is fractionally higher from last week’s levels. MAC-AU is also invested.

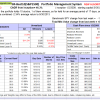

iM-Best1(Sector SPDR) Rotation System

The iM-Best1(Sector SPDR) model periodically selects only one of the nine Select Sector SPDR® ETFs that divide the S&P500 into 9 sectors. During adverse market conditions it switches to SH, or partly to cash. This model would have produced an average annualized return of about 31.4% from January 2000 to end of September 2013.

Best(SPY-SH) 10-14-13

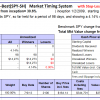

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 98 days, and showing 4.14% return to 10/14/2013

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 98 days, and showing 4.14% return to 10/14/2013

Read more >

Best10 10-7-13

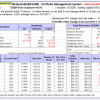

Currently the portfolio holds 10 stocks, 1 of them winners, so far held for an average period of 24 days, and showing combined -2.62% average return to 10/7/2013

Currently the portfolio holds 10 stocks, 1 of them winners, so far held for an average period of 24 days, and showing combined -2.62% average return to 10/7/2013

Read more >

Best(SPY-SH) 10-07-13

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 91 days, and showing 2.00% return to 10/7/2013

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 91 days, and showing 2.00% return to 10/7/2013

Read more >

Best10 9-30-13

Currently the portfolio holds 10 stocks, 1 of them winners, so far held for an average period of 17 days, and showing combined -2.34% average return to 9/30/2013

Currently the portfolio holds 10 stocks, 1 of them winners, so far held for an average period of 17 days, and showing combined -2.34% average return to 9/30/2013

Read more >

iM Update 10-4-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher and iM-BCIg is also higher from last week’s levels. MAC-AU is also invested.