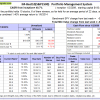

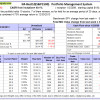

Using our three ETF models, Best(SPY-SH), Best1(Select SPDR) and Best(SSO-TLT) equal weighted in a combination model, we demonstrate that the combo would have produced high annualized returns of 34.3% with a low drawdown of -12.9% and low volatility. Additionally, due to the very high liquidity of its component ETFs, the combo could support a huge portfolio size.

Blog Archives

Best10 Jan 13, 2014

Currently the portfolio holds 10 stocks, 4 of them winners, so far held for an average period of 27 days, and showing combined 1.35% average return to 1/13/2014

Currently the portfolio holds 10 stocks, 4 of them winners, so far held for an average period of 27 days, and showing combined 1.35% average return to 1/13/2014

Read more >

iM Update – Jan 17, 2014

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher from last week’s level, and iM-BCIg is lower from last week’s level. MAC-AU is invested.

Read more >

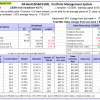

iM-Best(SSO-TLT) Switching System

This model switches between SSO (ProShares Ultra two times daily S&P500 ETF) and TLT (iShares 20 Plus Year Treasury Bond ETF) depending on market direction. Using a web-based trading simulation platform and only market timing buy and sell rules in the algorithm, then this model would have produced an average annual return of about 38% from January 2000 to end of December 2013.

iM Update – Jan 10, 2014

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is lower from last week’s level, and iM-BCIg is also lower from last week’s level. MAC-AU is invested.

Read more >

Best10 Jan 6, 2014

Currently the portfolio holds 10 stocks, 6 of them winners, so far held for an average period of 22 days, and showing combined 1.40% average return to 1/6/2014

Currently the portfolio holds 10 stocks, 6 of them winners, so far held for an average period of 22 days, and showing combined 1.40% average return to 1/6/2014

Read more >

Best10 12-30-13

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 25 days, and showing combined 4.93% average return to 12/30/2013

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 25 days, and showing combined 4.93% average return to 12/30/2013

Read more >

iM Update – Jan 3, 2014

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher from last week’s level, and iM-BCIg is lower from last week’s level. MAC-AU is invested.

Read more >

Estimating Stock Market Returns to 2020 and Beyond: Update January 2014

A major bull market may have commenced in 2009 for which evidence was presented in various 2012 commentaries. Since August 2012 the S&P 500 has gained a real 30% to the end of 2013. So what further gains can we expect?

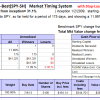

Best(SPY-SH) 12-30-13

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 175 days, and showing 11.99% return to 12/30/2013

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 175 days, and showing 11.99% return to 12/30/2013

Read more >