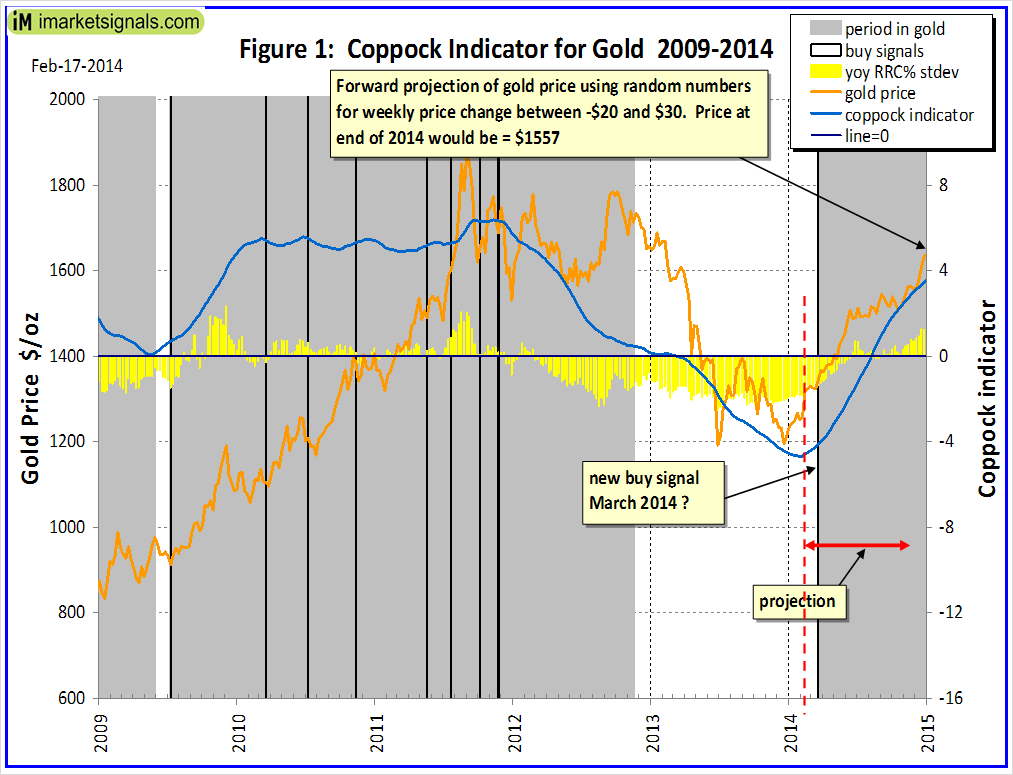

The modified Coppock indicator will produce a buy signal for Gold within a few weeks. This is the result of various projections using random numbers between -$20 and +$30 and -$30 and +$20 for the weekly change of the gold price, representing upward- and downward trends for the metal’s price, respectively.

In this August 2012 article an analysis showed that one could expect a Coppock buy signal possibly as early as December 2013, but not much later than March 2014. The most recent projection now shows that with high probability a buy signal will emerge by the end of March 2014, as shown in Figure 1 below, and that the gold price could approach $1,600 by the end of 2014 assuming an upward trend for the gold price.

Additionally, the iM-Best Gold Timer model has generated a buy signal at the end of December-2013 after being almost three years out of Gold. The model uses the SPDR® Gold Shares ETF: GLD, and the economic indicators Federal Funds Rate, 10-year Treasury Note yield, and the S&P500 Estimated Earnings Yield. The benchmark is the Specialty Index SP1500 Gold, representing the gold miners in the S&P1500. The ETF GLD has already gained about 10% since the date of the buy signal to the middle of February-2014.

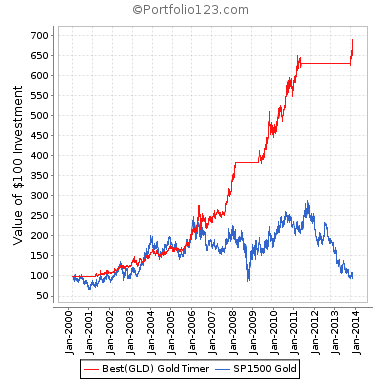

Using the Portfolio123 platform the iM-Best Gold Timer (click for more details) was backtested from Jan-2-2000, as this was the first full year when the algorithm had access to all the required economic indicators from the database of the web-based simulation platform where the backtest was performed. The timing algorithm was partly based on my research reported in this article.

There were three buy signals: 2/20/2001, 5/11/2009 and 12/30/2013. An interesting observation is that the three buy signals always occurred shortly after the normalized benchmark index (blue graph) bottomed near 100, as can be seen from the chart above.

Where can I find the gold timer model listed above?

Click on (click for more details) in the sentence: Using the Portfolio123 platform the iM-Best Gold Timer (click for more details)……… which appear just above the chart of the Gold Timer.

Have you tried a longer testing period on the Gold Timer?

I ran the book sim for Combo3 plus Gold Timer on P123, the annualized return is 28.86% , max drawdown -9.61% and sortino of 2.43!

Maybe it’s time for combo4?

We are trying to get relevant data for a longer period. P123 has data only from March 1999 onwards. For a definitive gold model one needs a longer backtest period. So for the time being the Coppock Gold seems to be a better bet.

Has the Coppock indicator officially produced a buy signal now that March 2014 is over. I read in your article that the buy signal would come at the latest in March 2014.

Yes there was a new buy signal on March 21. If you look at the updated gold chart it is clearly indicated.

Georg, was curious, have you ever worked on a Coppock indicator or other timing vehicle for Crude Oil?

–Tom C