|

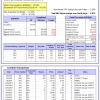

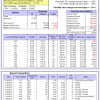

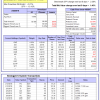

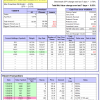

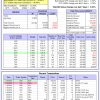

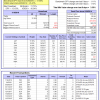

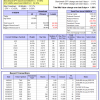

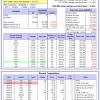

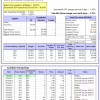

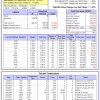

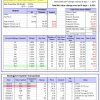

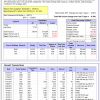

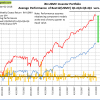

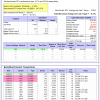

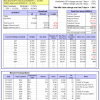

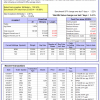

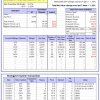

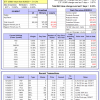

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 17.5%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.28% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $574,784 which includes -$42 cash and excludes $15,368 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 21.7%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.99% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $160,855 which includes -$5,595 cash and excludes $3,554 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is 27.7%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of iM-Combo5 gained 3.30% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $132,544 which includes -$2,175 cash and excludes $661 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 17.6%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Since inception, on 7/1/2014, the model gained 81.19% while the benchmark SPY gained 48.81% and VDIGX gained 40.97% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.50% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $176,767 which includes -$2,527 cash and excludes $1,956 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -3.3%, and for the last 12 months is 3.2%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 0.32% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $223,991 which includes $144 cash and excludes $2,158 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 1.9%, and for the last 12 months is 9.3%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.77% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $115,481 which includes $153 cash and excludes $1,627 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 31.7%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.94% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $153,865 which includes $785 cash and excludes $630 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 12.8%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of iM-BestogaX5-System gained 1.55% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $117,197 which includes $4,871 cash and excludes $966 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 16.7%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Since inception, on 6/30/2014, the model gained 76.57% while the benchmark SPY gained 48.81% and the ETF USMV gained 51.27% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 3.91% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $176,464 which includes -$80 cash and excludes $3,904 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 5.8%, and for the last 12 months is 26.3%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Since inception, on 1/5/2015, the model gained 70.76% while the benchmark SPY gained 43.00% and the ETF USMV gained 38.92% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.57% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $170,715 which includes $456 cash and excludes $986 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 2.9%, and for the last 12 months is 14.4%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Since inception, on 3/30/2015, the model gained 39.57% while the benchmark SPY gained 37.90% and the ETF USMV gained 34.18% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 2.31% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $139,571 which includes $1,062 cash and excludes $874 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 1.0%, and for the last 12 months is 9.0%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Since inception, on 7/1/2014, the model gained 79.39% while the benchmark SPY gained 48.81% and the ETF USMV gained 51.27% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 2.86% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $179,257 which includes -$23 cash and excludes $1,316 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 79.80% while the benchmark SPY gained 46.56% and the ETF USMV gained 49.18% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 3.11% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $179,802 which includes $692 cash and excludes $1,197 spent on fees and slippage. | |

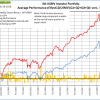

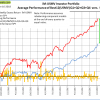

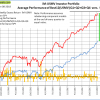

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 42.27% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is 0.9%, and for the last 12 months is -3.9%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of iM-Best(Short) gained 0.00% at a time when SPY gained 2.28%. Over the period 1/2/2009 to 2/20/2018 the starting capital of $100,000 would have grown to $92,070 which includes $92,070 cash and excludes $23,663 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -2.6%, and for the last 12 months is 7.8%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.90% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $109,467 which includes $743 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.9%, and for the last 12 months is 2.5%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.95% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $105,410 which includes $3,320 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is 13.4%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 2.18% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,608 which includes $2,172 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 19.1%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 2.26% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $135,572 which includes $1,500 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 5.9%, and for the last 12 months is 58.7%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 7.98% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $186,462 which includes -$145 cash and excludes $912 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 13.9%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.70% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $131,399 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 0.0%, and since inception 7.1%. Over the same period the benchmark SPY performance was 1.7% and 17.8% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.94% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $107,135 which includes $1,612 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 0.7%, and since inception 8.7%. Over the same period the benchmark SPY performance was 1.7% and 17.3% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 1.46% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $108,700 which includes $1,097 cash and excludes $205 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 2.9%, and for the last 12 months is 36.0%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 4.73% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $167,471 which includes $1,064 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 1.1%, and for the last 12 months is 16.6%. Over the same period the benchmark SPY performance was 1.7% and 17.7% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 2.24% at a time when SPY gained 2.28%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $127,009 which includes $2,002 cash and excludes $880 spent on fees and slippage. |

Blog Archives

iM-Best Reports – 2/20/2018

Posted in pmp SPY-SH

iM-Best Reports – 1/29/2018

|

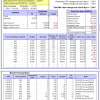

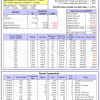

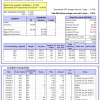

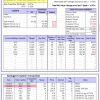

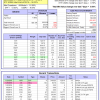

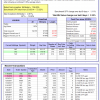

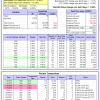

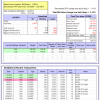

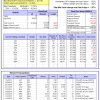

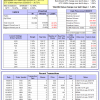

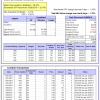

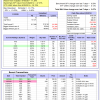

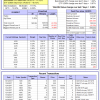

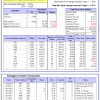

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 6.6%, and for the last 12 months is 27.2%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.69% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $599,356 which includes $7,222 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 9.0%, and for the last 12 months is 33.3%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.73% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $171,946 which includes $2,296 cash and excludes $3,443 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 10.6%, and for the last 12 months is 41.1%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of iM-Combo5 gained 1.06% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $141,292 which includes -$1,645 cash and excludes $606 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 7.8%, and for the last 12 months is 29.0%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Since inception, on 7/1/2014, the model gained 92.19% while the benchmark SPY gained 56.09% and VDIGX gained 49.08% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.92% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $191,954 which includes $1,512 cash and excludes $1,956 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 14.8%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.70% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $237,898 which includes $2,123 cash and excludes $2,007 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 4.9%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.51% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $118,891 which includes $155 cash and excludes $1,500 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 43.6%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.55% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $157,641 which includes $418 cash and excludes $630 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 8.9%, and for the last 12 months is 21.6%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of iM-BestogaX5-System gained 4.93% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $121,987 which includes $5,886 cash and excludes $933 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 25.3%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Since inception, on 6/30/2014, the model gained 81.38% while the benchmark SPY gained 56.09% and the ETF USMV gained 58.33% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.77% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $181,164 which includes $728 cash and excludes $3,822 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 8.4%, and for the last 12 months is 33.7%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Since inception, on 1/5/2015, the model gained 74.92% while the benchmark SPY gained 49.99% and the ETF USMV gained 45.40% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.22% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $174,858 which includes $377 cash and excludes $926 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 21.9%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Since inception, on 3/30/2015, the model gained 43.78% while the benchmark SPY gained 44.65% and the ETF USMV gained 40.44% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.53% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $143,737 which includes $983 cash and excludes $874 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 5.1%, and for the last 12 months is 18.0%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Since inception, on 7/1/2014, the model gained 86.67% while the benchmark SPY gained 56.09% and the ETF USMV gained 58.33% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.94% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $186,613 which includes $660 cash and excludes $1,294 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 81.58% while the benchmark SPY gained 53.73% and the ETF USMV gained 56.14% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.09% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $181,471 which includes $247 cash and excludes $1,197 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 39.60% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -1.2%, and for the last 12 months is -6.6%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of iM-Best(Short) gained 0.00% at a time when SPY gained 0.70%. Over the period 1/2/2009 to 1/29/2018 the starting capital of $100,000 would have grown to $90,125 which includes $90,125 cash and excludes $23,591 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 3.4%, and for the last 12 months is 18.3%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.39% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $116,151 which includes $743 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 10.3%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.09% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,476 which includes $3,320 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 5.5%, and for the last 12 months is 21.9%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.44% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $137,097 which includes $2,172 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 6.6%, and for the last 12 months is 28.9%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.70% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $141,465 which includes $833 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 13.8%, and for the last 12 months is 81.4%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 1.65% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $200,298 which includes $886 cash and excludes $578 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 3.0%, and for the last 12 months is 23.3%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.55% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $132,542 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 2.3%, and since inception 9.6%. Over the same period the benchmark SPY performance was 6.7% and 23.6% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.20% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $109,591 which includes $1,612 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 3.9%, and since inception 12.1%. Over the same period the benchmark SPY performance was 6.7% and 23.1% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 0.12% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $111,966 which includes $424 cash and excludes $173 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 12.1%, and for the last 12 months is 55.1%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 0.96% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $182,426 which includes $1,064 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 25.7%. Over the same period the benchmark SPY performance was 6.7% and 26.7% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.57% at a time when SPY gained 0.70%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $133,025 which includes $1,878 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

iM-Best Reports – 1/16/2018

|

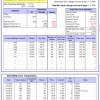

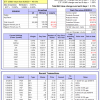

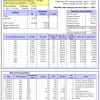

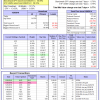

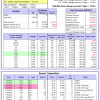

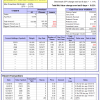

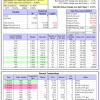

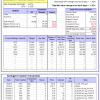

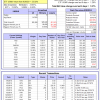

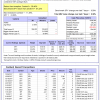

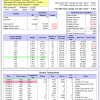

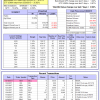

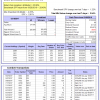

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 3.7%, and for the last 12 months is 24.8%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.09% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $576,975 which includes $878 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 5.1%, and for the last 12 months is 29.5%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.08% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $165,729 which includes $1,808 cash and excludes $3,439 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 35.5%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of iM-Combo5 gained 1.25% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $135,347 which includes -$1,645 cash and excludes $606 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 5.2%, and for the last 12 months is 25.0%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Since inception, on 7/1/2014, the model gained 87.48% while the benchmark SPY gained 51.86% and VDIGX gained 45.47% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 3.35% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $187,300 which includes $1,512 cash and excludes $1,956 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 16.5%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 2.35% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $236,686 which includes $2,123 cash and excludes $2,007 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 12.3%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.04% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $115,708 which includes $341 cash and excludes $1,426 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.0%, and for the last 12 months is 42.4%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.02% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $152,776 which includes $1,565 cash and excludes $559 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 0.40% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $113,752 which includes $1,750 cash and excludes $904 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 23.0%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Since inception, on 6/30/2014, the model gained 76.49% while the benchmark SPY gained 51.86% and the ETF USMV gained 54.30% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.69% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $176,311 which includes $231 cash and excludes $3,796 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 3.1%, and for the last 12 months is 29.5%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Since inception, on 1/5/2015, the model gained 66.37% while the benchmark SPY gained 45.93% and the ETF USMV gained 41.70% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.98% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $166,317 which includes $377 cash and excludes $926 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 2.2%, and for the last 12 months is 17.9%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Since inception, on 3/30/2015, the model gained 38.67% while the benchmark SPY gained 40.72% and the ETF USMV gained 36.86% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.31% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $138,599 which includes $394 cash and excludes $854 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 1.2%, and for the last 12 months is 14.1%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Since inception, on 7/1/2014, the model gained 79.74% while the benchmark SPY gained 51.86% and the ETF USMV gained 54.30% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -0.13% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $179,655 which includes $204 cash and excludes $1,268 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 75.56% while the benchmark SPY gained 49.57% and the ETF USMV gained 52.17% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.24% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $175,371 which includes $419 cash and excludes $1,132 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 37.88% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -0.2%, and for the last 12 months is -5.9%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of iM-Best(Short) gained 0.14% at a time when SPY gained 1.11%. Over the period 1/2/2009 to 1/16/2018 the starting capital of $100,000 would have grown to $91,083 which includes $127,554 cash and excludes $23,552 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 16.5%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.10% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $113,129 which includes $743 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -1.7%, and for the last 12 months is 9.3%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.45% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $109,019 which includes $3,320 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 3.1%, and for the last 12 months is 20.0%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.66% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $133,947 which includes $2,172 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 3.7%, and for the last 12 months is 26.5%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.10% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $137,656 which includes $833 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 8.3%, and for the last 12 months is 80.0%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 4.00% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $190,679 which includes $886 cash and excludes $578 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 2.8%, and for the last 12 months is 22.2%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.41% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $132,346 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 1.7%, and since inception 8.9%. Over the same period the benchmark SPY performance was 3.8% and 20.2% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.63% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $108,903 which includes $1,612 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 2.0%, and since inception 10.1%. Over the same period the benchmark SPY performance was 3.8% and 19.7% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 0.85% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $109,997 which includes $409 cash and excludes $153 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 7.0%, and for the last 12 months is 50.2%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 2.06% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $174,083 which includes $1,064 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 3.3%, and for the last 12 months is 23.7%. Over the same period the benchmark SPY performance was 3.8% and 24.4% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.90% at a time when SPY gained 1.11%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $129,638 which includes $1,878 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

iM-Best Reports – 1/8/2018

|

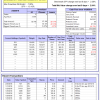

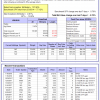

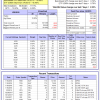

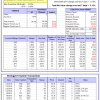

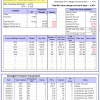

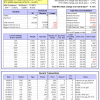

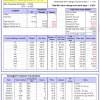

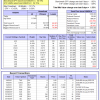

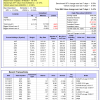

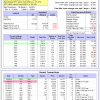

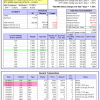

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 23.4%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.88% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $576,975 which includes $7,222 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is 28.4%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.80% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $163,949 which includes $1,808 cash and excludes $3,439 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 34.2%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of iM-Combo5 gained 3.12% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $133,674 which includes -$1,645 cash and excludes $606 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 22.1%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Since inception, on 7/1/2014, the model gained 81.39% while the benchmark SPY gained 50.19% and VDIGX gained 43.83% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.07% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $178,636 which includes -$1,166 cash and excludes $1,956 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -0.2%, and for the last 12 months is 12.8%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.07% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $230,447 which includes $1,589 cash and excludes $1,818 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 1.0%, and for the last 12 months is 10.3%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.75% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $114,141 which includes -$31 cash and excludes $1,426 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.0%, and for the last 12 months is 43.1%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.21% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $152,690 which includes $1,326 cash and excludes $559 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 1.1%, and for the last 12 months is 15.8%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 1.52% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $112,995 which includes $1,453 cash and excludes $904 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 21.3%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Since inception, on 6/30/2014, the model gained 73.57% while the benchmark SPY gained 50.19% and the ETF USMV gained 54.15% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.33% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $173,186 which includes -$33 cash and excludes $3,796 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 28.6%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Since inception, on 1/5/2015, the model gained 64.75% while the benchmark SPY gained 44.33% and the ETF USMV gained 41.56% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.63% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $164,436 which includes $326 cash and excludes $871 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is 17.7%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Since inception, on 3/30/2015, the model gained 38.25% while the benchmark SPY gained 39.17% and the ETF USMV gained 36.73% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 1.40% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $138,078 which includes $356 cash and excludes $803 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is 14.4%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Since inception, on 7/1/2014, the model gained 79.97% while the benchmark SPY gained 50.19% and the ETF USMV gained 54.15% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.76% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $179,876 which includes $107 cash and excludes $1,268 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 74.95% while the benchmark SPY gained 47.92% and the ETF USMV gained 52.02% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.87% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $174,749 which includes -$88 cash and excludes $1,098 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 37.25% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -0.3%, and for the last 12 months is -6.5%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of iM-Best(Short) gained 0.30% at a time when SPY gained 1.92%. Over the period 1/2/2009 to 1/8/2018 the starting capital of $100,000 would have grown to $90,954 which includes $108,452 cash and excludes $23,495 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 15.8%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.10% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $113,237 which includes $743 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.2%, and for the last 12 months is 9.9%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.09% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,628 which includes $3,320 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 19.1%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 1.64% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $133,075 which includes $2,172 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 25.1%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.89% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $136,149 which includes $833 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 4.2%, and for the last 12 months is 76.5%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 3.72% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $183,338 which includes $886 cash and excludes $578 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 1.4%, and for the last 12 months is 23.2%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.14% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,504 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 1.1%, and since inception 8.2%. Over the same period the benchmark SPY performance was 2.6% and 18.9% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.57% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $108,216 which includes $1,415 cash and excludes $69 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 1.2%, and since inception 9.2%. Over the same period the benchmark SPY performance was 2.6% and 18.4% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 0.95% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $108,952 which includes $296 cash and excludes $153 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 47.1%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 3.19% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $170,577 which includes $1,064 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 22.4%. Over the same period the benchmark SPY performance was 2.6% and 22.9% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 1.75% at a time when SPY gained 1.92%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $128,474 which includes $1,878 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

iM-Best Reports – 1/2/2018

|

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 23.1%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.58% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $566,263 which includes $7,222 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 1.1%, and for the last 12 months is 27.1%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.90% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $159,399 which includes $1,731 cash and excludes $3,439 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 31.7%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of iM-Combo5 gained 1.14% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $129,586 which includes $508 cash and excludes $603 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 23.1%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Since inception, on 7/1/2014, the model gained 79.47% while the benchmark SPY gained 47.37% and VDIGX gained 41.29% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.41% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $179,358 which includes $1,403 cash and excludes $1,956 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -0.2%, and for the last 12 months is 14.3%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.39% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $230,614 which includes $1,589 cash and excludes $1,818 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is -0.7%, and for the last 12 months is 9.5%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.04% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $112,042 which includes $332 cash and excludes $1,383 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 43.1%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.75% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $150,852 which includes $1,123 cash and excludes $559 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 13.5%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -0.95% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $111,070 which includes $1,233 cash and excludes $904 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 22.5%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Since inception, on 6/30/2014, the model gained 71.29% while the benchmark SPY gained 47.37% and the ETF USMV gained 52.19% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.07% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $170,920 which includes -$135 cash and excludes $3,796 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 28.8%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Since inception, on 1/5/2015, the model gained 62.12% while the benchmark SPY gained 41.61% and the ETF USMV gained 39.76% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.23% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $161,797 which includes $326 cash and excludes $871 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is 18.5%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Since inception, on 3/30/2015, the model gained 36.34% while the benchmark SPY gained 36.56% and the ETF USMV gained 34.99% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.40% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $136,099 which includes $286 cash and excludes $803 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is 15.2%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Since inception, on 7/1/2014, the model gained 78.62% while the benchmark SPY gained 47.37% and the ETF USMV gained 52.19% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.35% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $178,380 which includes -$33 cash and excludes $1,268 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 71.54% while the benchmark SPY gained 45.14% and the ETF USMV gained 50.09% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.11% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $171,337 which includes -$88 cash and excludes $1,098 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 37.17% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -0.6%, and for the last 12 months is -6.6%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of iM-Best(Short) gained -0.21% at a time when SPY gained 0.59%. Over the period 1/2/2009 to 1/2/2018 the starting capital of $100,000 would have grown to $90,679 which includes $108,727 cash and excludes $23,458 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 15.5%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.35% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $112,002 which includes $743 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 11.1%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.06% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $110,526 which includes $3,320 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 19.2%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.57% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,924 which includes $2,172 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is 24.8%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.58% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $133,605 which includes $833 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 76.8%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 0.51% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $176,467 which includes $587 cash and excludes $578 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is 25.4%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 2.81% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,318 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 0.5%, and since inception 7.6%. Over the same period the benchmark SPY performance was 0.7% and 16.7% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 1.15% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $107,477 which includes $1,284 cash and excludes $69 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 0.2%, and since inception 8.1%. Over the same period the benchmark SPY performance was 0.7% and 16.2% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 0.71% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $107,823 which includes $2,508 cash and excludes $144 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 46.5%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 1.06% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $165,159 which includes $924 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 0.6%, and for the last 12 months is 22.9%. Over the same period the benchmark SPY performance was 0.7% and 22.6% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.50% at a time when SPY gained 0.59%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $126,257 which includes $1,878 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

iM-Best Reports – 12/19/2017

|

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 22.9%, and for the last 12 months is 22.0%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.70% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $565,078 which includes $7,222 cash and excludes $15,358 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 27.2%, and for the last 12 months is 26.2%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.55% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $159,321 which includes -$544 cash and excludes $3,437 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 31.7%, and for the last 12 months is 31.8%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of iM-Combo5 gained 1.85% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $129,580 which includes $409 cash and excludes $603 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 22.3%, and for the last 12 months is 21.4%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Since inception, on 7/1/2014, the model gained 78.28% while the benchmark SPY gained 47.05% and VDIGX gained 41.03% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.84% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $178,102 which includes $1,227 cash and excludes $1,956 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 13.9%, and for the last 12 months is 14.0%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 0.41% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $230,503 which includes $1,589 cash and excludes $1,818 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 12.0%, and for the last 12 months is 9.5%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 2.00% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $114,602 which includes $155 cash and excludes $1,298 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 44.2%, and for the last 12 months is 41.3%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.12% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $152,236 which includes $1,123 cash and excludes $559 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is 14.5%, and for the last 12 months is 13.9%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 1.28% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $112,329 which includes $768 cash and excludes $881 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 23.3%, and for the last 12 months is 23.3%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Since inception, on 6/30/2014, the model gained 72.51% while the benchmark SPY gained 47.05% and the ETF USMV gained 53.24% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.58% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $172,290 which includes $123 cash and excludes $3,772 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 29.7%, and for the last 12 months is 28.5%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Since inception, on 1/5/2015, the model gained 63.15% while the benchmark SPY gained 41.32% and the ETF USMV gained 40.73% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.88% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $162,842 which includes $204 cash and excludes $871 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 18.8%, and for the last 12 months is 18.8%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Since inception, on 3/30/2015, the model gained 36.71% while the benchmark SPY gained 36.27% and the ETF USMV gained 35.92% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.99% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $136,531 which includes $12 cash and excludes $784 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 14.8%, and for the last 12 months is 14.6%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Since inception, on 7/1/2014, the model gained 78.05% while the benchmark SPY gained 47.05% and the ETF USMV gained 53.24% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.55% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $177,810 which includes $136 cash and excludes $1,238 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 72.49% while the benchmark SPY gained 44.83% and the ETF USMV gained 51.12% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.23% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $172,352 which includes $189 cash and excludes $1,076 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 38.99% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -6.2%, and for the last 12 months is -5.7%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of iM-Best(Short) gained -0.12% at a time when SPY gained 1.22%. Over the period 1/2/2009 to 12/18/2017 the starting capital of $100,000 would have grown to $91,059 which includes $91,059 cash and excludes $23,323 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 16.2%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.67% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $112,271 which includes $70 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 12.6%, and for the last 12 months is 13.3%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.00% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $111,589 which includes $2,356 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 18.4%, and for the last 12 months is 17.6%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.49% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,484 which includes $1,593 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 24.5%, and for the last 12 months is 23.7%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.71% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $133,324 which includes $833 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 76.8%, and since inception 76.8%. Over the same period the benchmark SPY performance was 22.3% and 22.3% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 3.41% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $176,799 which includes $587 cash and excludes $578 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 20.0%, and for the last 12 months is 21.7%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.44% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,618 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance from inception is 5.7%. The benchmark SPY performance over the same period is 16.4%. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.80% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $105,699 which includes $1,060 cash and excludes $69 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance from inception is 7.8%. The benchmark SPY performance over the same period is 16.0%. Over the previous week the market value of the iM-Min Drawdown Combo gained 1.07% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $107,487 which includes $2,410 cash and excludes $124 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 46.3%, and for the last 12 months is 45.3%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 2.94% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $165,076 which includes $757 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 22.4%, and for the last 12 months is 22.2%. Over the same period the benchmark SPY performance was 22.3% and 21.5% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 1.02% at a time when SPY gained 1.22%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $125,757 which includes $1,385 cash and excludes $880 spent on fees and slippage. |

Posted in pmp SPY-SH

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer