The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher from last week’s level, but iM-BCIg remains unchanged. MAC-AU is invested.

Read more >

Blog Archives

iM Update 11-29-13

Best(SPY-SH) 11-25-13

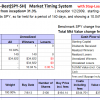

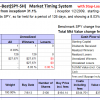

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 140 days, and showing 10.04% return to 11/25/2013

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 140 days, and showing 10.04% return to 11/25/2013

Read more >

Best10 11-18-13

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 23 days, and showing combined 2.14% average return to 11/18/2013

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 23 days, and showing combined 2.14% average return to 11/18/2013

Read more >

iM Update 11-22-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher from last week’s level, but iM-BCIg is basically unchanged. MAC-AU is invested.

Read more >

iM Update 11-15-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is lower from last week’s level, but iM-BCIg is unchanged. MAC-AU is invested.

Read more >

Best10 11-11-13

Currently the portfolio holds 10 stocks, 6 of them winners, so far held for an average period of 17 days, and showing combined 0.58% average return to 11/11/2013

Currently the portfolio holds 10 stocks, 6 of them winners, so far held for an average period of 17 days, and showing combined 0.58% average return to 11/11/2013

Read more >

The Ultimate Death Cross – One Year Later

In July 2012 Albert Edwards, the closely followed investment strategist at Société Générale, warned that the S&P 500 was “on the verge of an ultimate death cross,” foretelling imminent major losses for the stock market, with the S&P 500 possibly seeing its index halved to 666 points. The ultimate death cross occurs when the 50-month moving average of the S&P moves below the 200-month moving average, or put another way, when the difference between these moving averages – the spread – becomes less than zero.

Read more >

Best(SPY-SH) 11-11-13

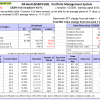

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 126 days, and showing 8.03% return to 11/11/2013

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 126 days, and showing 8.03% return to 11/11/2013

Read more >

iM Update 11-8-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is lower from last week’s level, but iM-BCIg is higher. MAC-AU is invested.

Read more >