–

Blog Archives

iM Update* – June 16, 2023

Posted in pmp paid update

iM’s Business Cycle Index Recovers but still Signals a Recession – Update 6/9/2023

- Knowing when the U.S. economy is heading for recession is paramount to successful investment decisions.

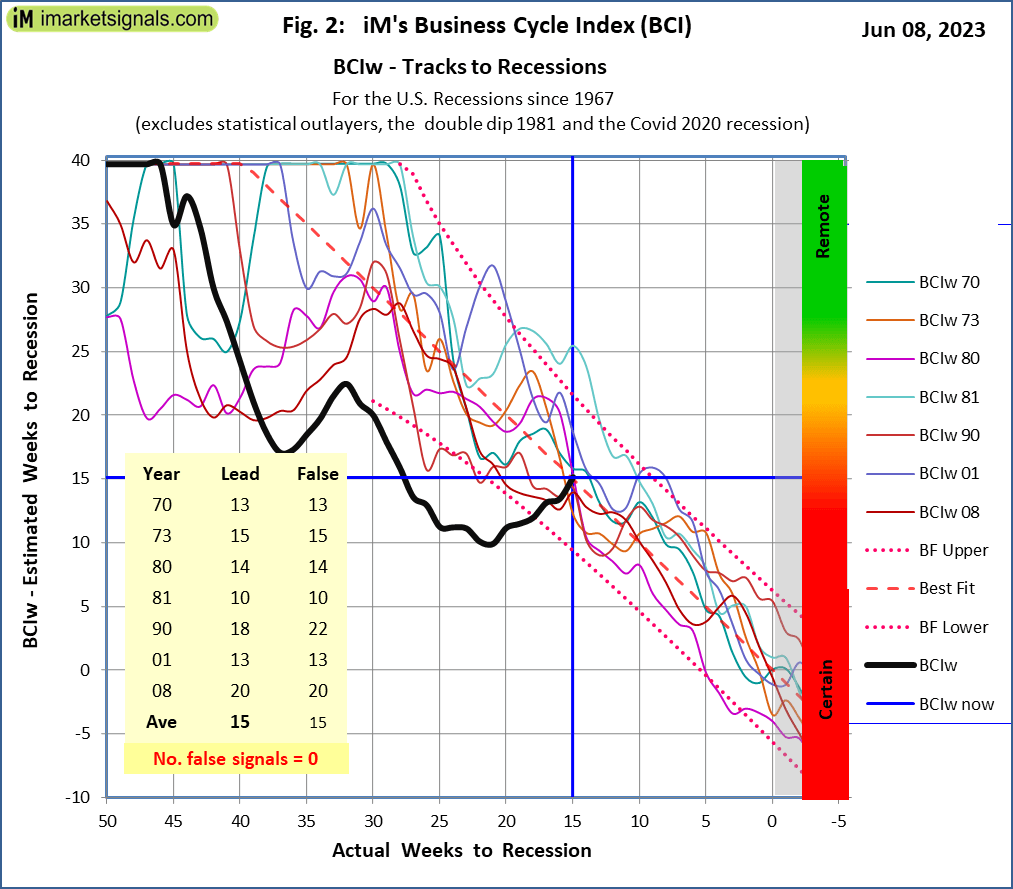

- Our weekly Business Cycle Index would have provided early reliable warnings for the past seven recessions and signaled the Covid 2020 recession one week late.

- The BCIg has signaled a recession warning mid March 2023, but BCIg recovered and is no longer signalling a recession.

- However the BCIw, also on recovery path, continues to signal a recession which now is estimated to begin in 9 to 22 weeks.

- It is too early to say if a recession has been averted, more likely is it is delayed towards the end the end of 2023 or begin 2024.

With reference to Section 202(a)(11)(D) of the Investment Advisers Act:

We are Engineers and not Investment Advisers,

read more ...

By the mere act of reading this page and navigating this site you acknowledge, agree to, and abide by the

Terms of Use / Disclaimer