Unemployment

The 2/3/2023 BLS Employment Situation Report shows that the January unemployment rate dropped to 3.4% (February statistics available 3/10/2023)

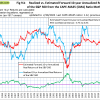

CAPE-Cycle-ID

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from 0 to -2 end of October 2022. This indicator now avoids the markets. This indicator is described here.

Fig 9a depicts the CAPE-Cycle-ID and the year-on-year rate-of-change of the Shiller CAPE; the level switched from 0 to -2 end of October 2022. This indicator now avoids the markets. This indicator is described here.

To avoid the bear market, exit stocks when the spread between the 5-month and 25-month moving averages of S&P-real becomes negative and simultaneously the CAPE-Cycle-ID score is 0 or -2. (read more)

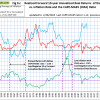

Estimated Forward 10-Year Returns

The estimated forward 10‐year annualized real return is 7.0% (previous month 7.1%) with a 95% confidence interval : 5.7% to 8.3% (5.8% to 8.4%). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate

The estimated forward 10‐year annualized real return is 7.0% (previous month 7.1%) with a 95% confidence interval : 5.7% to 8.3% (5.8% to 8.4%). Also refer to the Realized Forward 10-Year Returns vs. Inflation Rate  We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

We may be in a rising inflation period with a falling CAPE-MA35 ratio similar to 1964-1973. This implies very low or negative 10 year forward annualized real returns, much lower than the returns indicated by regression analysis shown in the Estimated Forward 10-Year Returns.

.

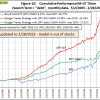

iM-GT Timer

The iM-GT Timer, based on Google Search Trends volume indicator exited the stock markets beginning September 2022. This indicator is described here.

The iM-GT Timer, based on Google Search Trends volume indicator exited the stock markets beginning September 2022. This indicator is described here.

Trade Weighted USD

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

Will be updated later, the weekly FRED data series we used was discontinued and replacement series is daily and runs from 2015. We need to adapt our software and graphics first.

TIAA Real Estate Account

The 1-year rolling return is 3.20%.

The 1-year rolling return is 3.20%.

Leave a Reply

You must be logged in to post a comment.