- This 5-stock trading strategy with the Industrial Sector stocks of the S&P 500 produces much higher returns than the Industrial Select Sector SPDR Fund (XLI).

- The universe from which stocks are selected holds point-in-time the S&P 500 industrial stocks of FactSet’s Reverse Business Industry Classification System.

- The model ranks the stocks of this custom universe with the Portfolio123 “Greenblatt” ranking system and selects periodically the highest ranked stocks which also satisfy stipulated yield requirements.

- From 1/2/2009 to 10/2/2020 this strategy would have produced an annualized return (CAGR) of 20.6%, significantly more than the 12.7% CAGR of XLI over this period.

Previous articles described profitable trading strategies with the stocks of the Technology Select Sector SPDR Fund (XLK) (article-1), the Consumer Staples Select Sector SPDR Fund (XLP) (article-2), and the Healthcare Select Sector SPDR Fund (XLV) (article-3). Similarly, a trading strategy with the industrial stocks of the S&P 500 can be profitably employed to provide better returns than XLI.

Emulating the Industrial Select Sector SPDR Fund (XLI).

The analysis was performed on the on-line portfolio simulation platform Portfolio 123.

Since historic holdings of XLI are not published a custom universe was constructed from the S&P 500 industrial stocks of FactSet’s Revere Business Industry Classifications System

The rule to set up the custom universe “S&P 500 (INDU)” in Portfolio 123 is: RBICS(INDUSTRIAL).

Currently 56 stocks of the 59 holdings of S&P 500 (INDU) are also holdings of XLI (73 stocks).

Backtesting of S&P 500 (INDU) universe

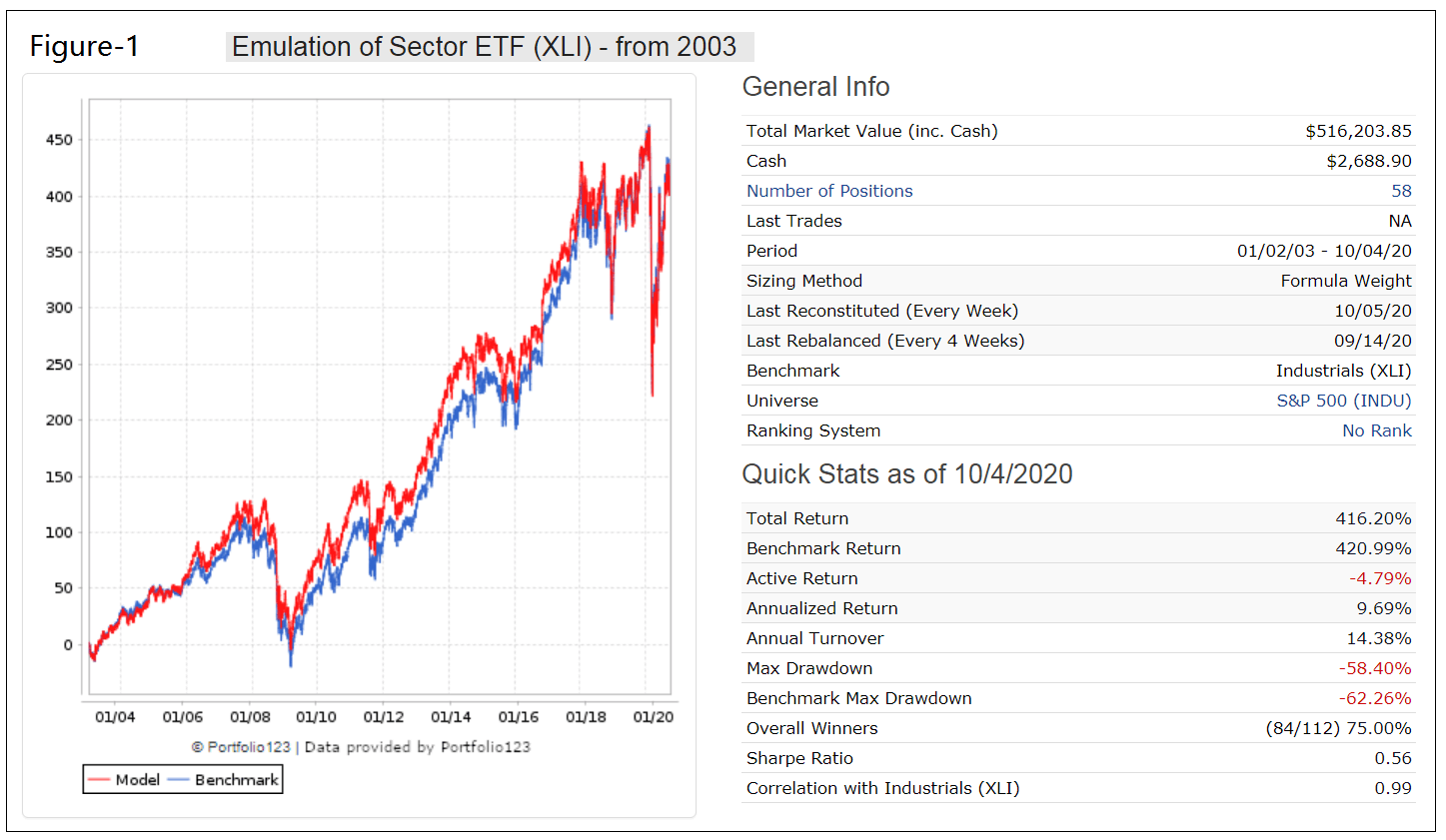

A backtest from 1/2/2003 to 10/4/2020 with all the cap-weighted stocks in the custom universe shows a 99% correlation with the performance of benchmark XLI and almost identical total returns of 420% over this period. In the Figure-1 below, the red graph depicts the performance of the custom universe and the blue graph the performance of XLI.

The performance plots are not perfectly identical because of the difference in the holdings of the universe and XLI, but one can nevertheless expect that stocks selected by the model will not differ much from what would have been selected from a universe of XLI’s actual historic holdings.

Trading 5 stocks from the custom universe S&P 500 (INDU)

The iM-Top5(XLI)Select trading strategy invests periodically in only five equal weighted stocks from the custom universe S&P 500 (INDU), as selected by the Portfolio 123 “Greenblatt” ranking system.

The buy rules require stocks to have a dividend yield greater than that of the S&P 500 index. Additionally, an Altman Z-Score greater than 1.80 to predict possible corporate bankruptcy, and a Beneish M-Score less than -1.70 to eliminate companies that are associated with increased probability of manipulations.

A position is sold only after a minimum holding period of 4 weeks if its rank gets less than 75%, or the percentage from highest close since a position was started becomes less than -15%.

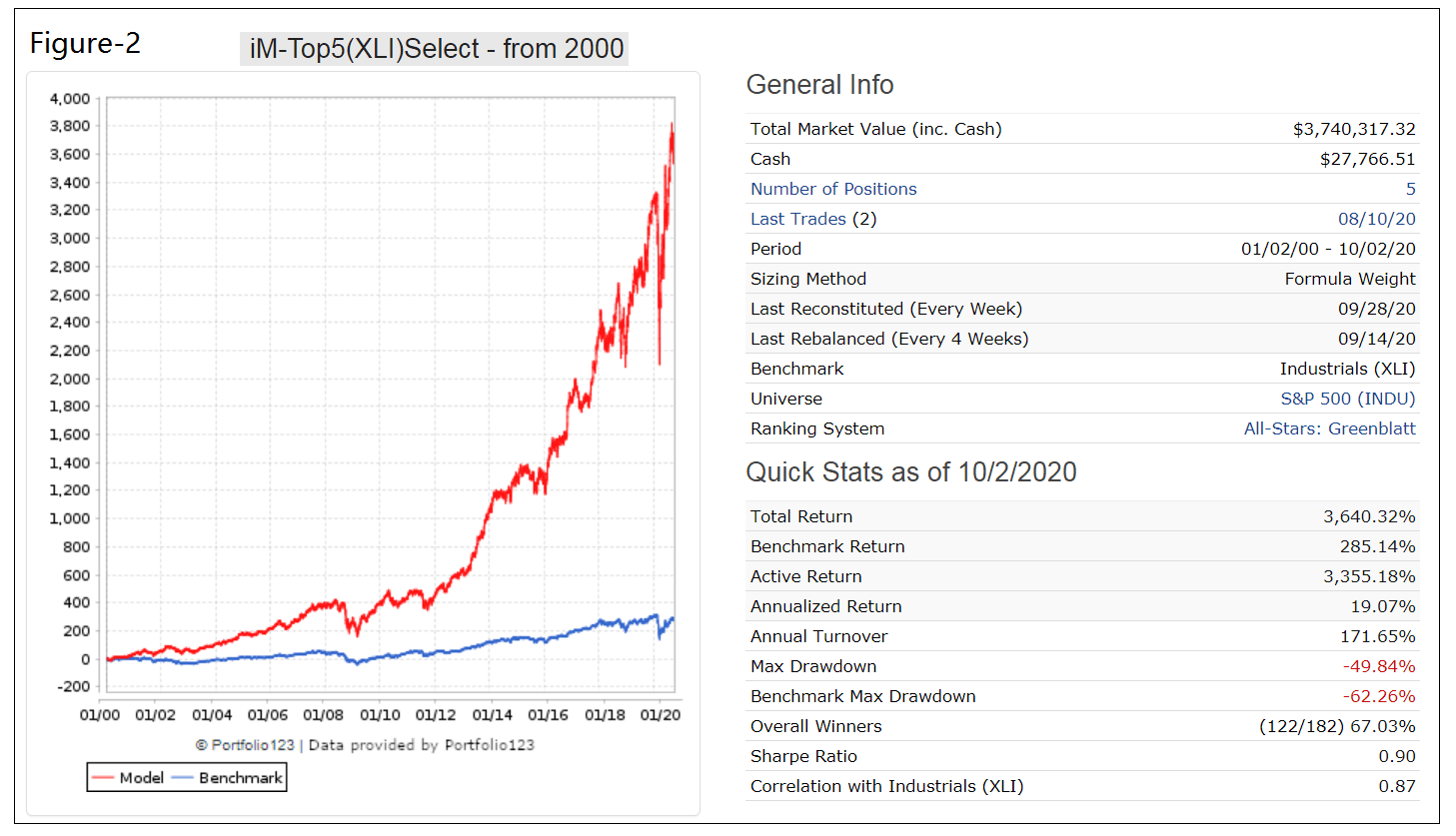

Figure-2 shows the simulated performance of this strategy from 1/2/2000 to 10/2/2020 and also that of the benchmark XLI. The model shows an annualized return of 19.1% (XLI produced 6.7%) and maximum drawdown of -50% (-62% for XLI). Annual turnover is low, about 170%. Trading costs of 0.12% of each trade amount were assumed in the simulation.

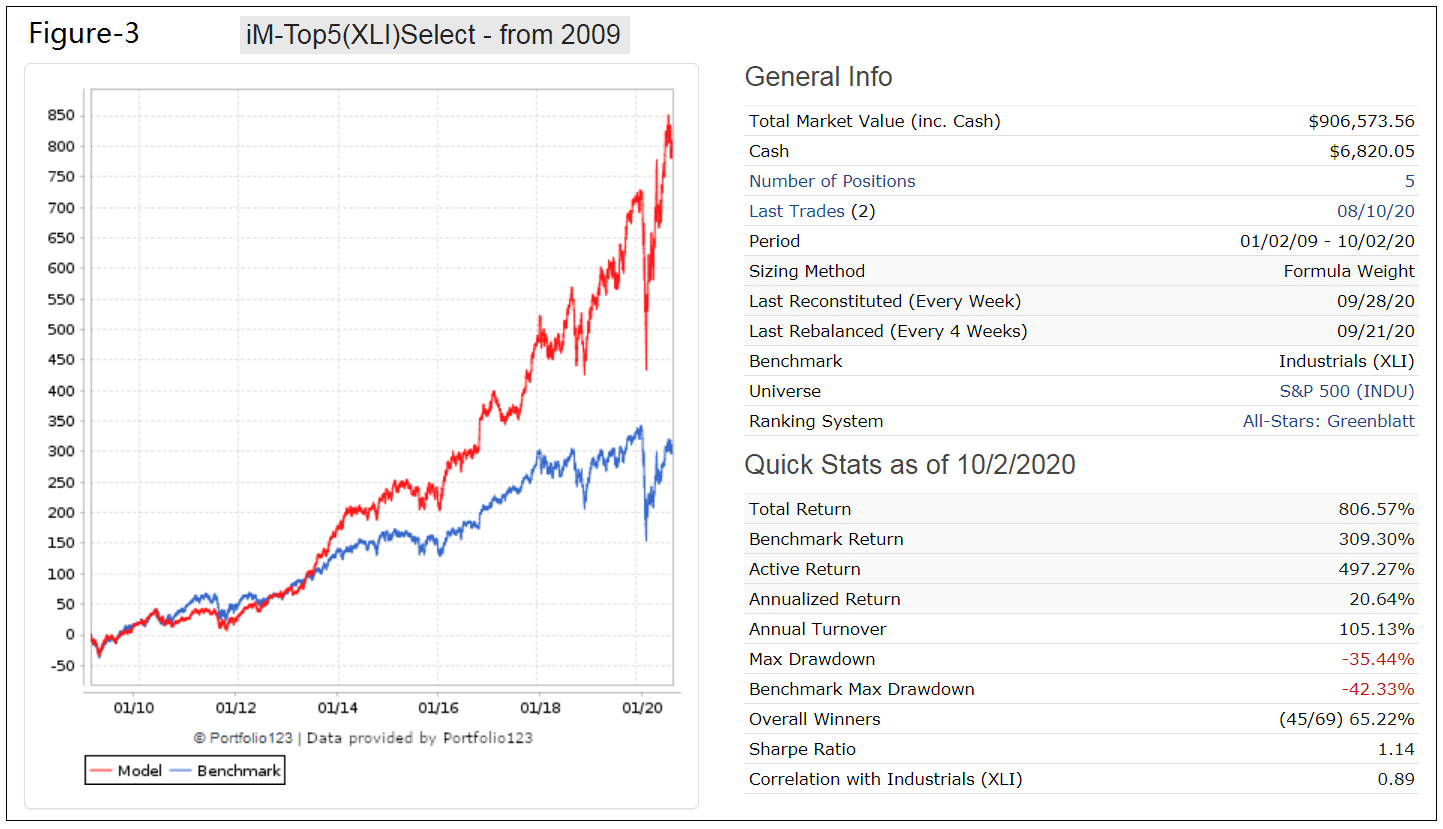

Industrial stocks have performed reasonably well since 2009, with XLI showing a 12.7% annualized return for the period 1/2/2009 to 10/2/2020. The simulated performance of the trading strategy for the same period is shown in Figure-3. The model outperformed XLI; the backtest shows an annualized return of 20.6% and a maximum drawdown of -35% (-42% for XLI). Annual turnover is very low, about 100%.

Investment Risk

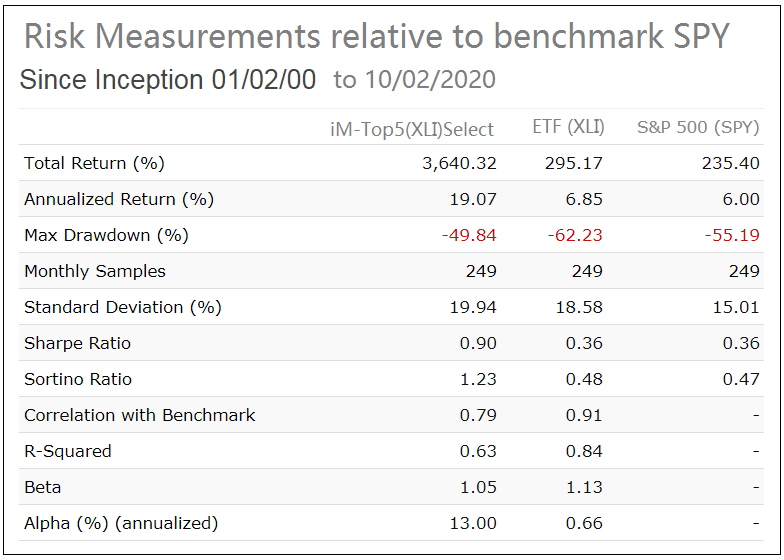

In the table below are the risk statistics from 2000 to 2020 for the model and XLI relative to the benchmark S&P 500 (SPY). It is evident from the risk measures that the trading strategy carries less risk than investing in XLI over the longer term.

Performance comparison with 4% withdrawal rate

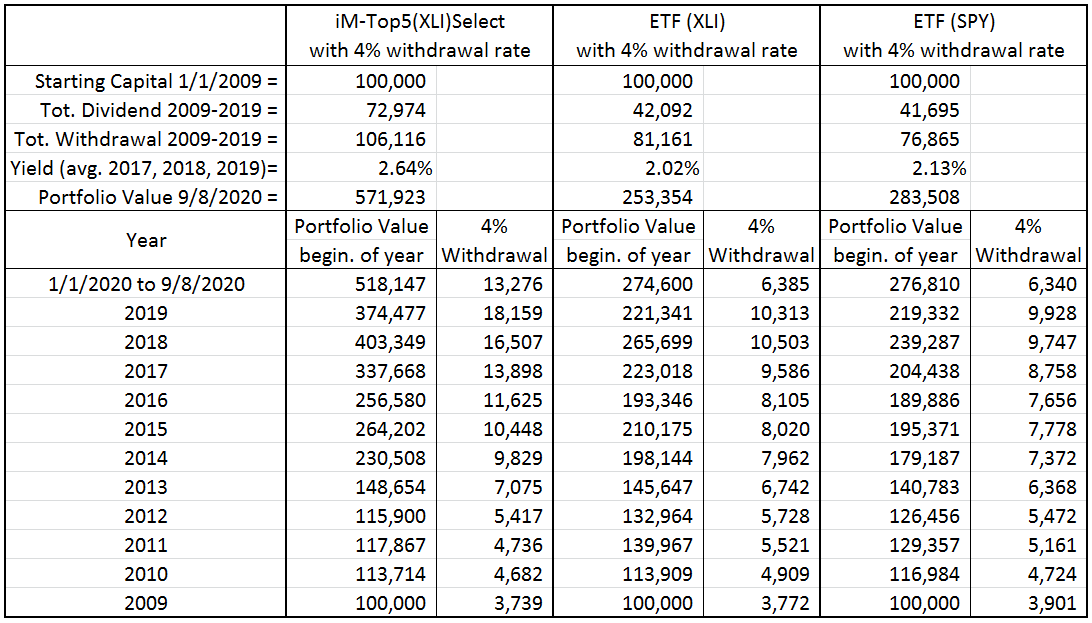

The table below compares the annual withdrawal amounts and portfolio values for the trading strategy, XLI, and SPY assuming an initial investment of $100,000 at the beginning of 2009 and annual withdrawals of 4.0% of portfolio value.

Total withdrawals and end portfolio value for the trading strategy are 30% and 120% higher, respectively, than what would have been provided by a buy-and-hold investment in XLI. Also for the model the average dividend yield over the preceding three calendar years is significantly higher than that of XLI.

Conclusion

The analysis shows that the iM-Top5(XLI)Select investment strategy would have produced good returns, preferable to a buy-and-hold investment in stock index funds such as XLI or SPY. Reasonably high withdrawal rates should be possible without depleting the investment.

Moderate trading is required. The model shows a an average annual turnover of about 170% with a position held on average for 30 weeks and not shorter than 4 weeks. The current holdings are listed in the appendix.

Also, at iMarketSignals one can follow this strategy where the performance will be updated weekly.

Appendix

Current Holdings (as of 10/01/2020)

Ticker |

Name |

MktCap |

Days Held |

Yield % |

Sector |

| EMR | Emerson Electric Co. | 40 B | 200 | 3.05 | INDUSTRIAL |

| ETN | Eaton Corp Plc | 41 B | 151 | 2.84 | INDUSTRIAL |

| HON | Honeywell International Inc | 116 B | 53 | 2.25 | INDUSTRIAL |

| LMT | Lockheed Martin Corp | 106 B | 95 | 2.73 | INDUSTRIAL |

| SNA | Snap-On Inc | 8 B | 165 | 2.92 | INDUSTRIAL |

Disclaimer:

All results shown are hypothetical and the result of backtesting over the period 2000 to 2020. No claim is made about future performance.

Leave a Reply

You must be logged in to post a comment.