|

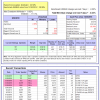

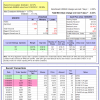

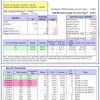

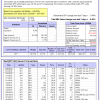

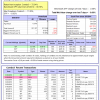

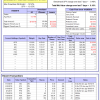

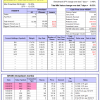

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 9.5%, and for the last 12 months is 1.7%. Over the same period the benchmark E60B40 performance was 15.8% and 7.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.23% at a time when SPY gained -0.20%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $122,585 which includes -$61 cash and excludes $1,278 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 9.3%, and for the last 12 months is 0.7%. Over the same period the benchmark E60B40 performance was 15.8% and 7.0% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.23% at a time when SPY gained -0.20%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $124,573 which includes -$185 cash and excludes $1,408 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 9.1%, and for the last 12 months is -0.2%. Over the same period the benchmark E60B40 performance was 15.8% and 7.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.24% at a time when SPY gained -0.20%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $126,536 which includes -$171 cash and excludes $1,531 spent on fees and slippage. |

|

|

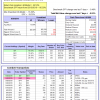

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 8.1%, and for the last 12 months is 4.6%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.49% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $649,950 which includes -$5,021 cash and excludes $22,629 spent on fees and slippage. |

|

|

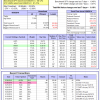

iM-Combo3.R1: The model’s out of sample performance YTD is 11.3%, and for the last 12 months is -1.5%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.09% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $172,590 which includes $2,098 cash and excludes $5,514 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 13.7%, and for the last 12 months is -0.5%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of iM-Combo5 gained -0.53% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $144,792 which includes $1,354 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 20.6%, and for the last 12 months is 12.3%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Since inception, on 7/1/2014, the model gained 121.16% while the benchmark SPY gained 68.12% and VDIGX gained 76.51% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.75% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $221,161 which includes $313 cash and excludes $2,656 spent on fees and slippage. |

|

|

iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 13.8%, and for the last 12 months is 6.4%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of iM-Best7(HiD-LoV) gained 0.27% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $124,425 which includes $87,270 cash and excludes $3,407 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is -4.4%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.18% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $156,893 which includes $1,811 cash and excludes $1,037 spent on fees and slippage. |

|

|

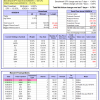

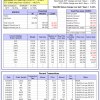

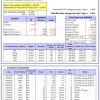

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 21.4%, and for the last 12 months is 2.2%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Since inception, on 6/30/2014, the model gained 108.15% while the benchmark SPY gained 68.12% and the ETF USMV gained 91.41% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.19% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $208,153 which includes $902 cash and excludes $5,761 spent on fees and slippage. |

|

|

iM Min Volatility (USMV) Investor: The model’s out of sample performance YTD is 25.9%, and for the last 12 months is 13.1%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Since inception, on 1/3/2013, the model gained 261.91% while the benchmark SPY gained 132.08% and the ETF USMV gained 148.51% over the same period. Over the previous week the market value of iM Min Volatility (USMV) Investor gained 0.34% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $361,909 which includes -$2,194 cash and excludes $2,156 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -5.2%, and for the last 12 months is -0.2%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of iM-Best(Short) gained 1.49% at a time when SPY gained -0.48%. Over the period 1/2/2009 to 9/30/2019 the starting capital of $100,000 would have grown to $84,408 which includes $118,696 cash and excludes $26,345 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 14.9%, and for the last 12 months is 5.4%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.74% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $121,883 which includes $698 cash and excludes $673 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 17.9%, and for the last 12 months is 13.7%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.66% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $127,439 which includes $1,911 cash and excludes $00 spent on fees and slippage. |

|

|

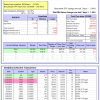

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 19.1%, and for the last 12 months is 3.0%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained -0.35% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,116 which includes $6,395 cash and excludes $513 spent on fees and slippage. |

|

|

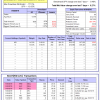

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 6.2%, and for the last 12 months is 2.1%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.48% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $150,058 which includes $1,970 cash and excludes $3,393 spent on fees and slippage. |

|

|

iM-VIX Timer with ZIV: The model’s out of sample performance YTD is -8.5%, and for the last 12 months is -32.1%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained -0.38% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $165,362 which includes $327 cash and excludes $7,434 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 14.6%, and for the last 12 months is 7.0%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.34% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $125,687 which includes -$195 cash and excludes $3,516 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 12.7%, and for the last 12 months is 3.6%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.02% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $108,545 which includes $80 cash and excludes $1,320 spent on fees and slippage. |

|

|

iM-Min Drawdown Combo: The model’s out of sample performance YTD is 14.6%, and for the last 12 months is 5.9%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained -0.03% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $116,849 which includes $28,914 cash and excludes $1,375 spent on fees and slippage. |

|

|

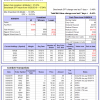

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 5.5%, and for the last 12 months is -24.3%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -1.09% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $146,049 which includes $737 cash and excludes $3,569 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 8.5%, and for the last 12 months is -6.8%. Over the same period the benchmark SPY performance was 20.4% and 4.1% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -0.44% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $127,218 which includes $760 cash and excludes $3,330 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.