- The Cyclically Adjusted Price to Earnings Ratio (CAPE ratio) is at 30.2, a very high level which signals overvaluation of stocks and low forward returns, according to Shiller.

- This level was only exceeded twice in the last 136 years, from Aug-1929 to Sep-1929 and from Jun-1997 to Jan-2002, with market declines of 77% and 45% then recorded.

- The Moving Average CAPE Ratio Methodology used here references stock market valuation to a 35-year moving average of the Shiller CAPE ratio instead of the 1881-2017 long-term average.

- Based on the 35-year moving average methodology, historic market performance points towards continuing up-market conditions, possibly for a number of years.

- To avoid the bear market, exit stocks when the spread between the 5-month and 25-month moving averages of S&P-real becomes negative and simultaneously the CAPE-Cycle-ID score is 0 or -2.

Shiller warns in his recent commentary The Coming Bear Market? :

The US stock market today looks a lot like it did at the peak before all 13 previous price collapses. That doesn’t mean that a bear market is imminent, but it does amount to a stark warning against complacency.

He gives no guidance when the bear market will commence, which could be years away. The methodology used here provides information on how to avoid the coming bear market which the current high CAPE ratio may be signaling.

The CAPE Ratio

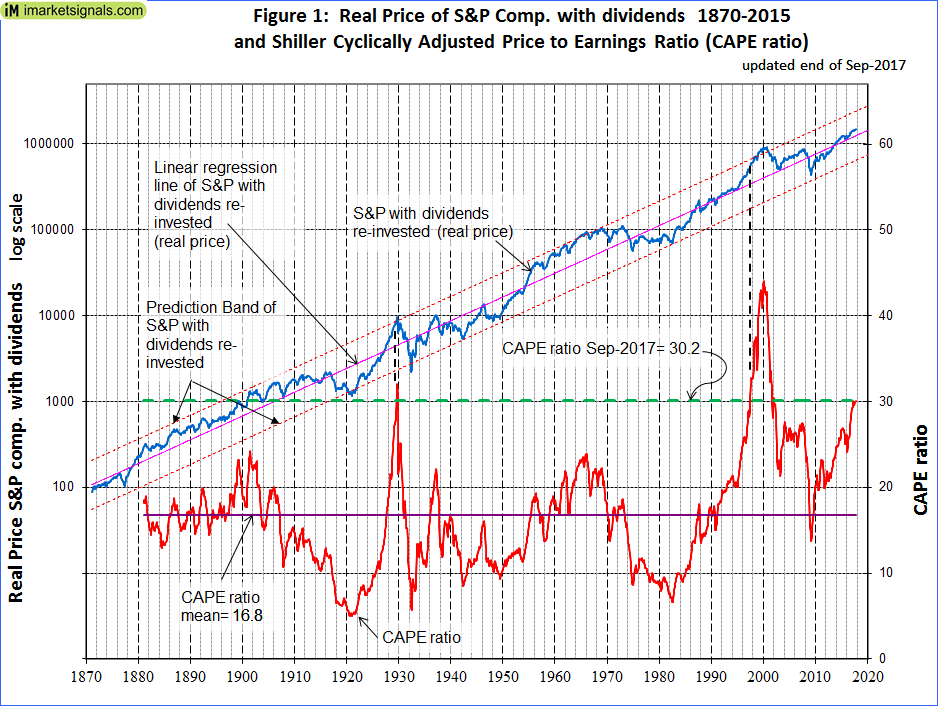

Shown at the top of Figure-1 is the real price of the S&P-Composite with dividends re-invested (S&P-real) from 1871 onward together with the best-fit line plotted to a semi-log scale. Below S&P-real is the CAPE ratio, which is the real price of the S&P 500 Index, divided by the arithmetic average of the last 10 years of real reported 12 months earnings per share of the Index, also referred to as P/E10.

The CAPE ratio is currently at a level of 30.2, which is 13.4 higher than its 1881-2016 long-term average of 16.8, which according to Shiller signals an expensive stock market. This high level was only exceeded twice in the past, from Aug-1929 to Sep-1929 and from Jun-1997 to Jan-2002, with respective market declines of 77% and 45% then recorded from peak to trough.

It would have been premature to exit the market in Jun-1997 when the CAPE reached a level of 30.2 because the market gained another 64% to its peak three years later. However, this level would have been a good exit signal in Aug-1929 because the market peaked one month later before losing 77%.

It is apparent from those two previous records that a CAPE ratio becoming greater than 30 does not necessarily signal an imminent market collapse, and as such it is not a very useful indicator of expected market performance now; it only indicates that stocks are expensive.

The Moving Average CAPE Ratio Methodology

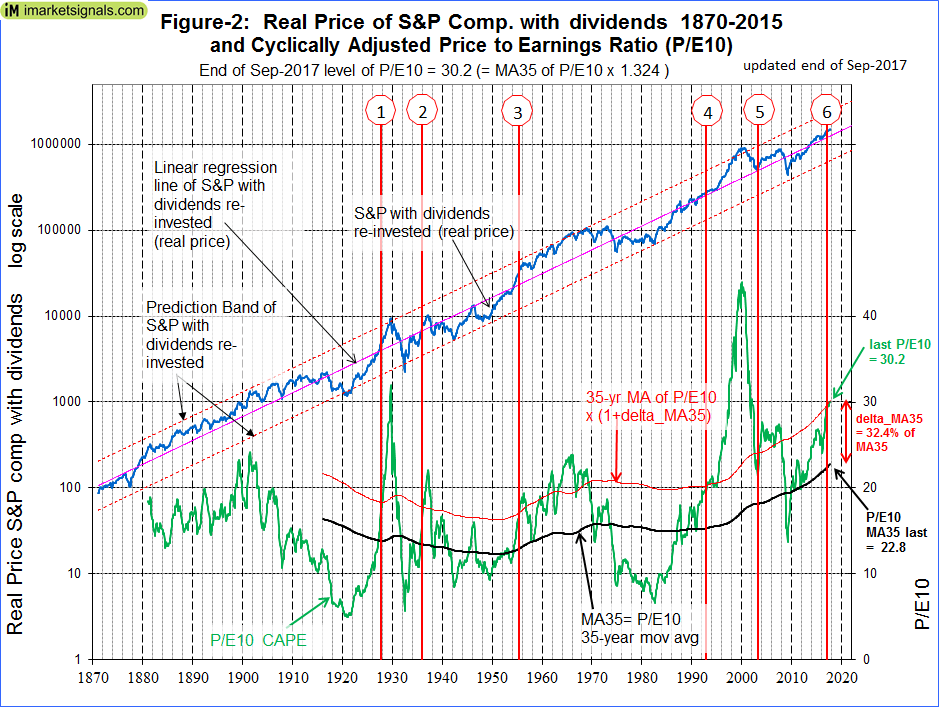

An alternative to Shiller’s approach is to assess stock market valuation using a 35-year moving average of the CAPE ratio (35MA), rather than referencing the valuation to the 1881-2017 long-term average. (Article link)

This method should to some degree smooth or eliminate effects from changes to accounting practices, dividend policies, and other reporting parameters over time. A moving average over 35 years was chosen so that it would cover at least three business cycles based on the longest recent expansion and contraction period of 128 months (from Mar-1991 to Nov-2001).

Currently, the 35MA is at 22.8. The difference between the CAPE ratio and the 35MA is equal to 30.2 – 22.8= 7.4, which is equal to 32.4% of the 35MA, and is termed “delta_MA35”.

The current condition with a delta_MA35 of 32.4% is indicated by the red graph. One can see that the CAPE moved from below to above this graph many times during the last 100 years. An inspection of Figure-2 shows that the periods when the CAPE was above the red graph coincided approximately with periods when the S&P-real was also over its long-term linear regression line, indicating elevated market levels.

Five occasions, other than the most recent one, were identified when the CAPE moved from below to above a level of 35MA x 1.324, i.e. when similar conditions as the current one existed. (After Signal-3, five additional signals occurred before 1970. They were ignored since they all preceded the market low of Sep-1974 prior to Signal-4.)

After each delta_MA35 signal the market continued to gain for periods ranging from 0.9 to 13.4 years as shown in Table-1 below. Shiller is correct that the present Cape ratio “…doesn’t mean that a bear market is imminent”. One would have exited the market prematurely at the time of the delta_MA35 signals, missing out on substantial gains to the subsequent market highs as listed in column-7 of the table.

A better exit signal occurs when after a delta_MA35 signal the spread between the 5-month and the 25-month moving averages of S&P-real changes from positive to negative and simultaneously the score of the CAPE-Cycle-ID is at 0 or -2.

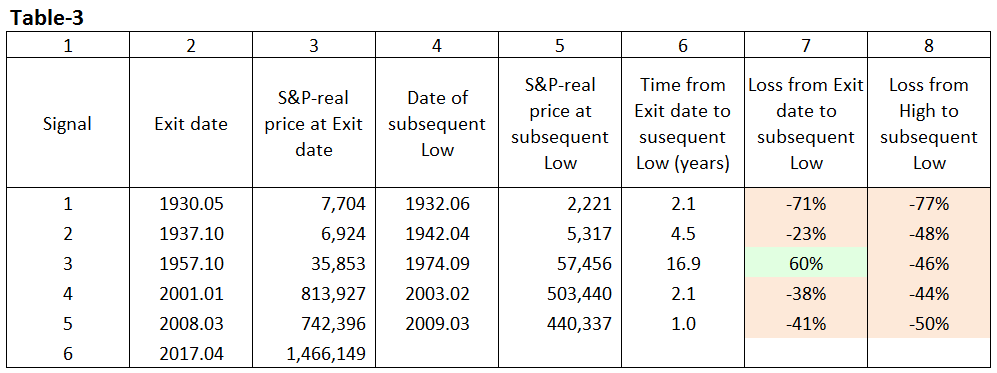

Tables-2 and -3 provides the information relevant to the improved exit signals.

No market timing system is perfect, but except for Signal-3, one would have avoided major losses by exiting the market according to the improved exit signals. Table-3, column-7 lists the losses avoided when exiting the market at the improved exit date, which can be compared to the peak to trough losses in column-8 of the table.

Conclusion

The current level of the CAPE ratio relative to its 35-year moving average does suggest that stock prices are high. However, a bear market is not imminent and could be years away.

An exit signal after the CAPE moves from below to above a level of 35MA x 1.324 (the current condition) arises when subsequently the spread between the 5-month and 25-month moving averages of S&P-real changes from positive to negative and simultaneously the score of the CAPE-Cycle-ID is at 0 or -2.

Currently the 5-month moving average of S&P-real is higher than the 25-month moving average; the spread between them is positive, standing at +133,232, and the CAPE-Cycle-ID score is +2. Therefore, the Moving Average CAPE Ratio Methodology is not signaling to exit the stock market now.

The monthly updates of the CAPE-Cycle-ID and the spread between the 5-month and 25-month moving averages of S&P-real can be followed at iMarketSignals.

|

Date |

5-mo Moving Avg of S&P-real |

25-mo Moving Avg of S&P-real |

Spread |

CAPE Cycle-ID score |

|

2017.06 |

1,448,031 |

1,300,037 |

147,994 |

2 |

|

2017.07 |

1,456,115 |

1,309,430 |

146,685 |

2 |

|

2017.08 |

1,459,081 |

1,318,809 |

140,271 |

2 |

|

2017.09 |

1,463,209 |

1,329,977 |

133,232 |

2 |

I have readout your article this article very helps full for understanding to how to chose the best stock for investment according to the market variation as per your information you have give the useful information about the stock in which month nifty go to high and low as per your article Nifty Impulse Trend 29th SEPTEMBER 2017 Performance so it is such very helpful for the investor as well as traders .

so please continuously provide these type of information about the each stock

Your bog is very good this blog is full of information. if you are think that you will investing stock market this blog will help you and gives you a good advice

Hi George

I’d be be very interested to see the correlation between CAPE and iM-BCIg is that available ?

Love the site btw , excellent source of unbiased information and data.

Thanks

Mike

Mike, we don’t have a correlation for the two models.

The BCI is weekly, and CAPE is monthly updated.

BCI exit signal dates are on Figure-1 here:

https://imarketsignals.com/2013/exit-signals-for-the-stock-market-from-ims-business-cycle-index/

Here is a comparison of signals prior to recessions:

CAPE…………………….BCI

12/31/1969 … 10/02/1969

12/31/1973 … 09/13/1973

02/28/1978 … 11/08/1979

02/26/1982 … 07/02/1981

xx/xx/xxxx … 04/26/1990

05/31/2002 … 01/11/2001

07/31/2008 … 11/01/2007