- In order to maximize returns one has to know when to enter and exit the TIAA Real Estate Account.

- Our analysis shows that a firm sell signal arises when its 1-year rolling return moves below 0%.

- A subsequent buy signal would be given when its 1-year rolling return moves from below to above 0%.

This $20-billion account provides direct ownership interests in commercial real estate, offering diversification beyond traditional equity and fixed-income investments with guaranteed daily liquidity. The daily value is determined by a formula resulting in very low volatility of the account’s unit value, as evidenced by the smooth performance graph of the TIAA Real Estate Account (QREARX), hereinafter further referred to as TIAAreal.

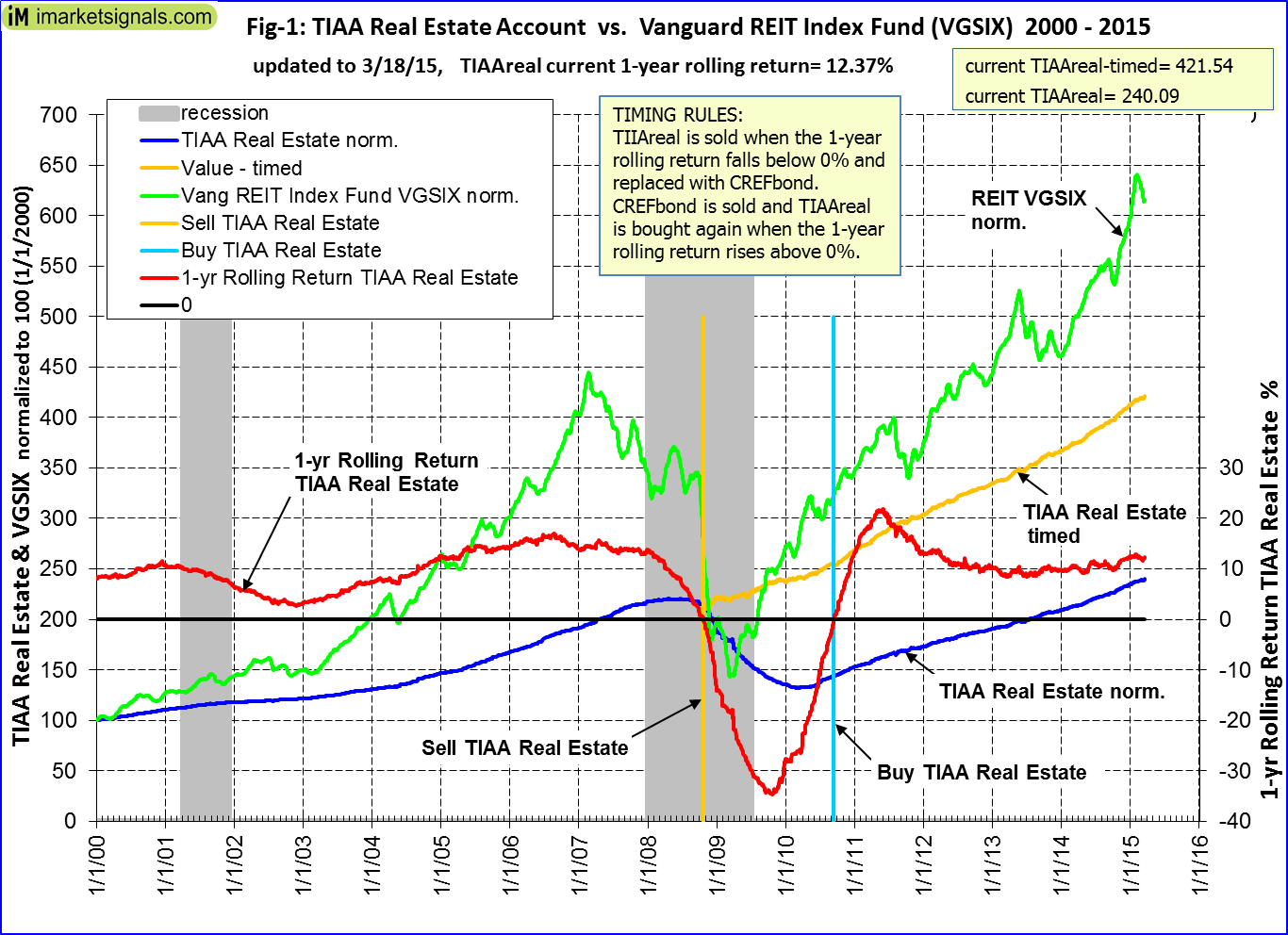

In this article we analyzed the performance of TIAAreal which recorded a minimum 1-year Rolling Return of -35% as shown by the red graph in the chart below. This chart is similar to our monthly update posting at iMarketSignals.com and is marked as Fig-1.

The blue graph depicts the performance of TIAAreal normalized to 100 at the beginning of the year 2000. The yellow graph shows the performance with timing and assumes that funds were invested in the CREF Bond Market Account (QCBMRX) during the time when not invested in TIAAreal. This would have resulted for an initial $100 investment to grow to $421, whereas a static investment in TIAAreal would only be worth $240 at the end.

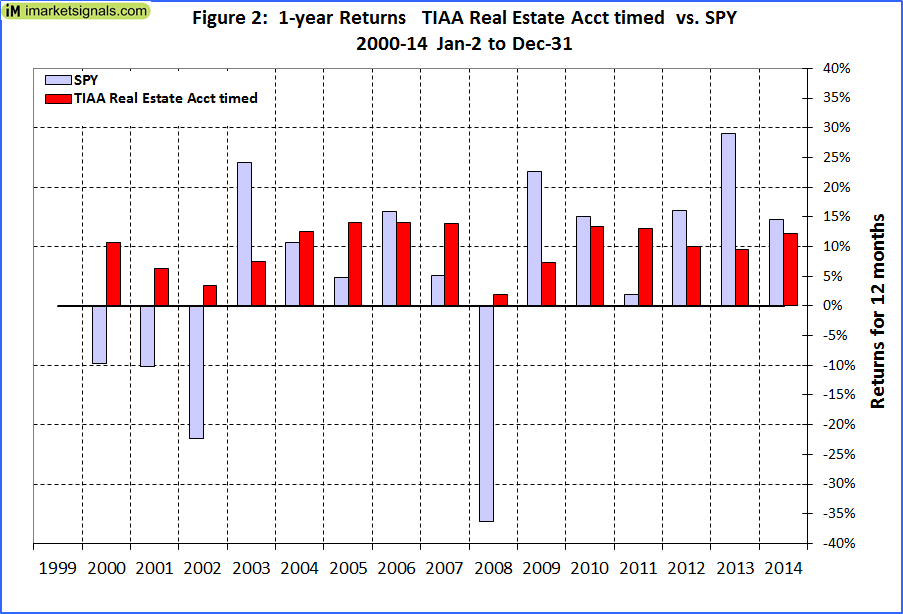

Annual returns

Figure-2 shows the calendar year returns. TIAAreal-timed always would have had positive returns, even in 2008 when there were huge losses for the broader market.

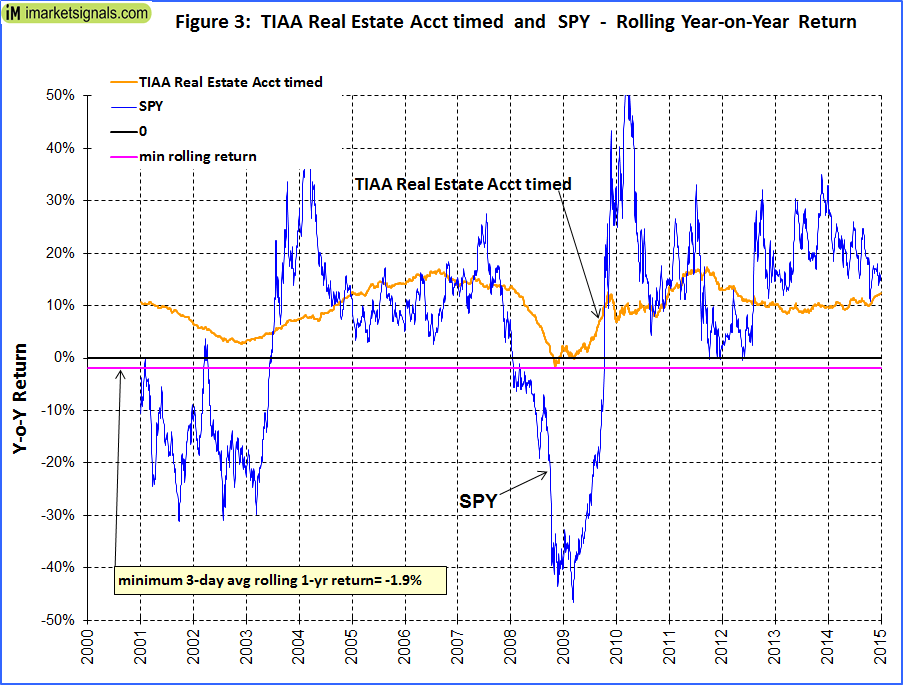

Rolling 1-year returns

Figure-3 shows the rolling year-on-year return. Only for a very short period at the end of 2008 would the return have been slightly negative. At the end of 2014 the rolling return was over 12% comparing favorably with that of SPY.

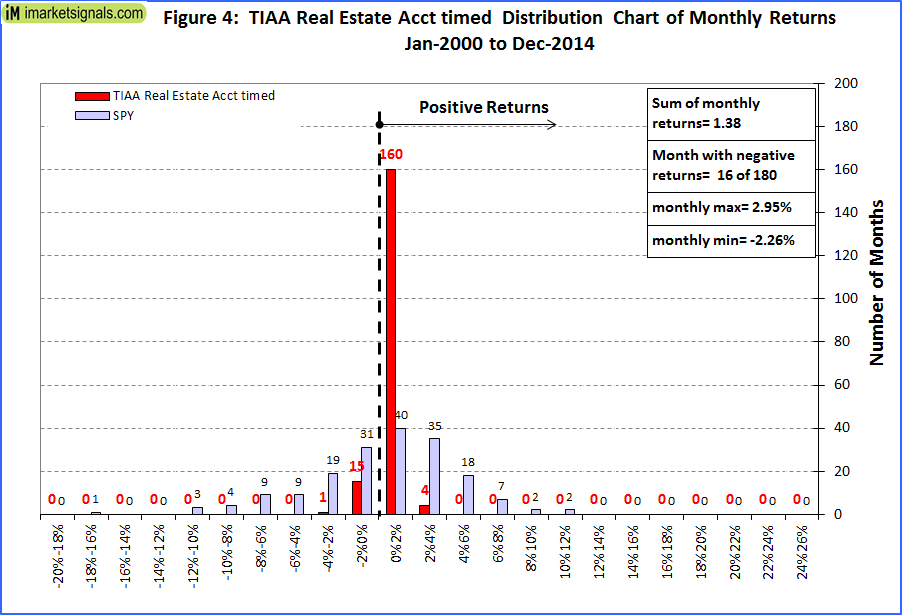

Distribution of monthly returns

Figure-4 shows the monthly returns. There were only 16 months during the 15 year period when the monthly return was negative.

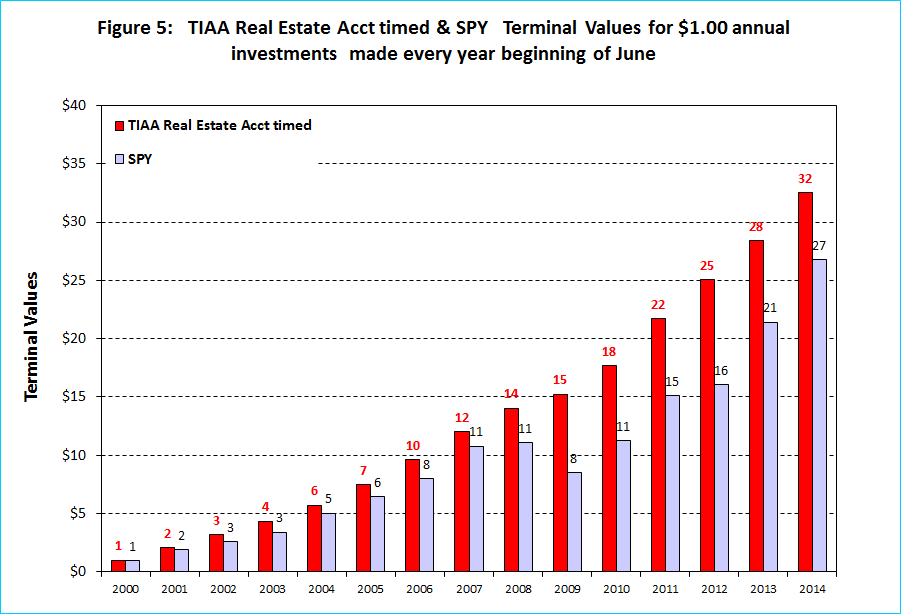

Terminal Values

To simulate savings over time, terminal values were calculated for annual hypothetical investments of $1. Starting with a dollar during each of the 15 years from 2000 to 2014, one would have invested a total of $15 cumulatively by the end. Summing the terminal values, this strategy would have netted this dollar-per-year investor $32 at the end. Following the same strategy but investing in SPY, one would have only $27.

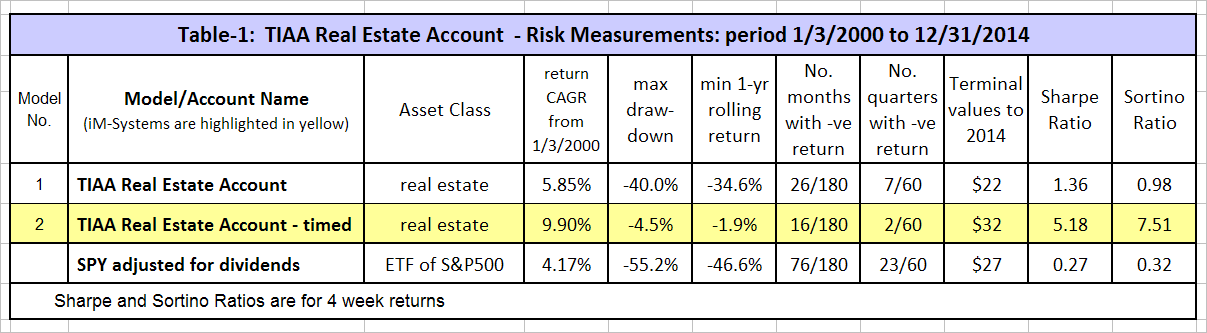

Risk

The high Sharpe and Sortino ratios for TIAAreal-timed indicate that this should be a low-risk investment.

Following TIAAreal-timed

Monthly updates of performance are posted on our website.

Disclosure: The author currently holds TIAA Real Estate.

Is there any track record before 1999? My concern is that there’s only 1 round trip signal here.

Inception date was 10/2/95. There was never a 1-year negative rolling return except as shown in Figure-1.

would you recommend a buy on the VGSIX since it appears to be producing a better result than then TIAA timed?

Historic performance has been better for VGSIX but much more volatile than that of the TIAA Real Estate Account. TIAAreal-timed appears to be less risky than VGSIX.

George,

This model shows good promise but some of us do not have access to TIAA.

Would FRIFX be a good candidate as a substitute to time in a similar way of use TIAA signals?

The timing method appears to only work for the TIAA Real Estate Account.

where in the wold can I buy QREARX? I have IB and Robin Hood and neither offer it.

You need an account at TIAA-CREF if you want to invest in the TIAA Real Estate Account (QREARX). It is not available from any broker.

Agreed. You need to have a TIAA-CREF retirement account (typically 403(b)). Not sure if it’s available via a standard TIAA account, brokerage or otherwise.

Upon indication of a QREARX sell, is it a 100% sell? As discussed above, is the recommendation to place proceeds into QCBMRX and hold until QREARX returns to buy?

According to the model the signal is a 100% sell/buy. There is currently no indication that a sell signal is imminent because the 1-year rolling return to the end of Apr-2018 is 4.42%.

If/when your model suggests moving out of QREARX into CREFBond, which CREFBond fund are you referring to? TBILX (T-C Bond Index Fund); TIORX (T-C Core Bond Fund); QCBMIX (CREF Bond Market R3) or other? Thanks.

The model used the QCBMRX bond fund, but this is not a recommendation to invest in this fund.

When there is a sell signal for the TIAA Real Estate Account the idea is to preserve capital and re-invest when the TIAA Real Estate forms a trough.

Will you please tell me how/when you notify your customers about TIAA real estate sells or buy points. It seems very close to a sell at this point I haven’t seen an updated chart for the month of July. Thanks

The 1-year rolling return to the end of Jul-2020 is still about 1%.

The chart will be updated coming Friday, 8/7/20.

TIAA manages the price to reduce volatility. This fund cannot escape the effects of the covid-19 pandemic, my guess is that the price will continue to drift lower.

I can’t seem to find the latest chart. I Am invested in QREARX and am watching closely for your sell signal. How will you advise if a sell is indicated? Thanks.

https://imarketsignals.com/wp-content/uploads/2020/09/Fig-11.-9-4-2020.png

as of 9/3/2020 1 year rolling return 0.07%

Would you be willing to add the buy/sell info and timing on QREARX to your Sunday grid sent out by email?

The TIAA Real Estate account is managed for minimum volatility. Therefore when a trading signal appears one does not have to act immediately on it. So there is no need for weekly updates. Since the sell signal the account’s unit value has not changed much.

I’m just looking for a convenient way to keep track of your signals. Thanks.