We report on a refined technique to analyze financial series based on the previous highest peak of the series in a business cycle, which we term the “off-peak-mode” of an index. We demonstrate this method by using our iMarketSignals Business Cycle Index (BCI) in off-peak-mode to achieve average leads to recessions of 20 weeks. Exiting the stock market at these early signals significantly improves investment performance. Furthermore, the current level of the BCI in off-peak-mode near 100 provides confirmation that a recession is not likely to occur within the next year.

The “Off-Peak-Mode” Method.

The inspiration for this method came from Doug Short’s web-pages. He uses the off-peak technique of presenting data as a percentage from the previous peak (example). Our refinement was simply to reset or break the curve at the beginning of a business cycle, which we defined as the end of a NBER recession (FRED series USREC).

The procedure to determine BCIp is as follows: the first reading of the BCI after a recession end would register as a peak at 100%, because there is no previous reading. Subsequent values, if they are lower, would register lower percentages, but a new weekly high would again register at 100%, however older values are never revised.

This “off-peak” curve is scaled by a simple formula to define the new indicator BCIp = 100 * (p – x) / (100 -x), where p is the “off-peak” value expressed as a percentage of the previous peak and x is the level such that BCIp is zero at x%. The calibration of x is done so that BCIp=0 gives an average lead to recession of 13 weeks.

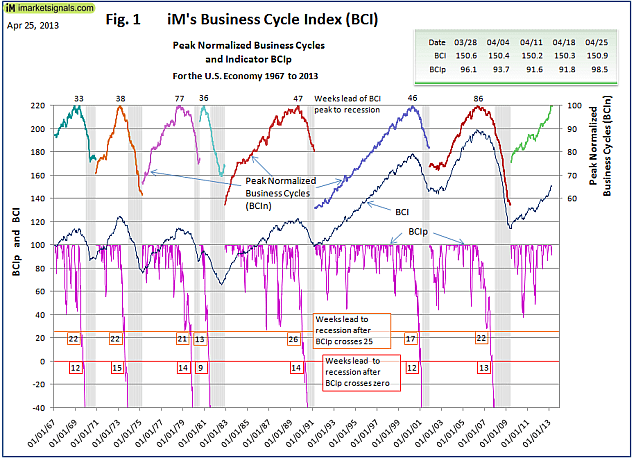

Figure-1 below helps in the understanding of the off-peak-mode method. The BCI is shown as a thin dark blue continuous graph. The series of multi-colored graphs on the top of the chart is the BCI sectioned into business cycles (from recession end to next recession end) and scaled such that the highest peak, of the respective cycle, registers 100, giving the Peak Normalized BCIn. The lower purple graph is the off-peak-mode indicator BCIp with the recession warning levels of 25 and zero indicated by the horizontal red lines. The number of weeks to recession at the two warning levels are shown in the red boxes for the seven recessions since 1967.

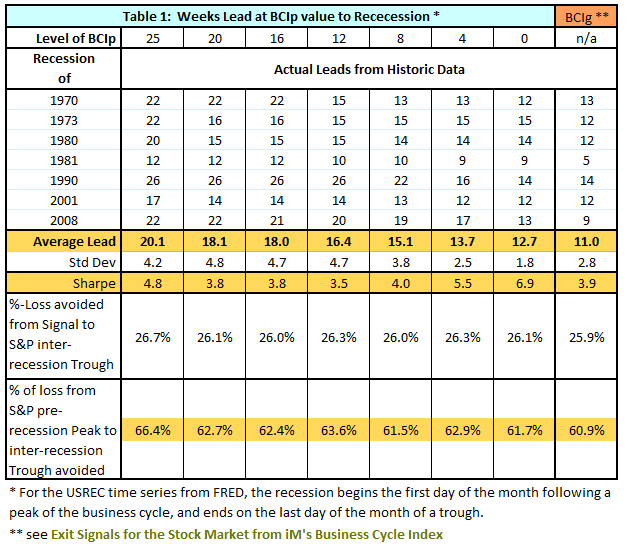

Table 1 below list the weeks to recession when BCIp reaches various levels and the losses avoided when exiting the stock-market at the time of the respective signals.

The maximum average lead of 20 weeks is nearly double the previous reported average of 11 weeks lead (last column in Table 1) derived from the growth method. In our article we showed that on average 60.9% of the loss from S&P pre-recession peaks to inter-recession troughs is avoided when exiting the stock-market at signals produced 11 weeks in advance. This percentage is now increased to 66.4% if one exits the market earlier using the BCI off-peak-mode signals at the BCIp level 25.

The Peak Normalized Business Cycle Index (BCIn)

Earlier, we introduced the BCIn as the BCI sectioned into business cycles (from recession end to next recession end) and scaled such that the highest peak, of the respective cycle, registers 100. (Series of multi-colored graphs on the top of Figure 1.)

These graphs are of interest as they allow an optical comparison of the current business cycle to the past cycles; however, we never know if we reached the peak. For example, the green last section graph depicts the current business cycle which had a level of 100 a few weeks ago. If the BCI were to decline from now onwards, this level would register as a peak. However, if the BCI were to gain in the future, then this level would not be a peak, and the entire green graph would be “pushed” lower.

Nevertheless, we can make an important observation from the previous peaks of BCIn which occurred 33 to 86 weeks before recessions, 52 weeks on average. Based on this we can state that when BCIn = 100, which implies per definition that BCIp=100, that the following one year period should be recession free, which is the current situation.

Conclusion

Our new off-peak-mode indicator BCIp provides an investor with a new analytical tool to judge the probability of an oncoming recession based on past performance; true positive signals to recessions were generated averaging 20 weeks prior to the past seven recessions.

The off-peak-mode method could equally be adapted to an off-floor-mode, i.e. we look at growth from the deepest troughs. These techniques are not only applicable to our Business Cycle Index, many others indices can be transformed into iM’s off-peak-mode to improve their forecasting or signaling prowess.

Leave a Reply

You must be logged in to post a comment.