The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicators COMP and iM-BCIg are both a bit lower from last week’s level. MAC-AU is also invested.

Blog Archives

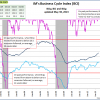

BCI 6-20-13

With BCI at 155.8 and BCIg at 20.9 no sign of a recessionary trend is indicated

iM Update 6-14-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicators COMP and iM-BCIg are both a bit higher from last week’s level. MAC-AU is also invested.

BCI 6-13-13

The BCI marginally increased to 155.5 and the BCIg increased slightly to 21.2; both signalling a economy far from a recession.

iM Update 6-7-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher from last week’s level, and iM BCIg is also higher. MAC-AU is also invested.

BCI Update 6-6-13

Positive are the further decreases in the seasonally adjusted insured unemployment, for the week ending May 25 the number was 2,952,000, a decrease of 52,000 from the preceding week’s upward revised level of 3,004,000. Negative is the slight -1.1% downward trend of this week’s 5 day average of the S&P 500.

Positive are the further decreases in the seasonally adjusted insured unemployment, for the week ending May 25 the number was 2,952,000, a decrease of 52,000 from the preceding week’s upward revised level of 3,004,000. Negative is the slight -1.1% downward trend of this week’s 5 day average of the S&P 500.

Read more >

iM Update 5-31-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening again, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher from last week’s level, and iM BCIg is also higher. MAC-AU is also invested.

BCI Update 5-30-13

This week negative influence on the BCI, namely that the S&P 500 is slightly down and the continued claims of the insured unemployed has risen, could not outweigh the strong gains of the previous weeks, and the moving averages of these elevate the BCI to 155.3 a gain of 0.23% on last week. The BCIg is also up at 20.8 (BCIg is the 6-month smoothed annualized growth of BCI and six added to it) For more information please visit the BCI page

This week negative influence on the BCI, namely that the S&P 500 is slightly down and the continued claims of the insured unemployed has risen, could not outweigh the strong gains of the previous weeks, and the moving averages of these elevate the BCI to 155.3 a gain of 0.23% on last week. The BCIg is also up at 20.8 (BCIg is the 6-month smoothed annualized growth of BCI and six added to it) For more information please visit the BCI page

Read more >

iM Update 5-24-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve may be steepening again, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher from last week’s level, and iM BCIg is also higher. MAC-AU is also invested.

BCI Update 5-23-13

The BCI keeps on climbing, not only driven by the gains of the S&P 500; the continues unemployment dropped by a massive 112 thousand from last week’s upwards revised figure of 3.024 million to 2.912 million. A further positive economic trend is the quantity of new houses sold, 454 thousand estimated for April, which is up from the upward revised figure of 444, from 411 thousand of March.

The BCI keeps on climbing, not only driven by the gains of the S&P 500; the continues unemployment dropped by a massive 112 thousand from last week’s upwards revised figure of 3.024 million to 2.912 million. A further positive economic trend is the quantity of new houses sold, 454 thousand estimated for April, which is up from the upward revised figure of 444, from 411 thousand of March.

Read more >