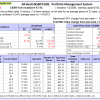

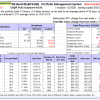

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 23 days, and showing combined -0.24% average return to 11/4/2013

Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 23 days, and showing combined -0.24% average return to 11/4/2013

Read more >

Blog Archives

Best10 11-4-13

iM-Combo2: A Small-Cap Model in Combination with iM-Best(SPY-SH)

Using a third party small-cap model from the web-based trading simulation platform in combination with our iM-Best(SPY-SH), we demonstrate the benefits of combining this model with iM-Best(SPY-SH), these include a reduced volatility, constant positive rolling returns, and high annualized returns with low drawdowns. The model was chosen because its algorithm does not include market-timing, and also because it holds 50 stocks, has a low annual turnover, and should be able to support a relatively high total portfolio size of $3.5-million on its own.

Read more >

Best(SPY-SH) 11-4-13

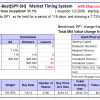

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 119 days, and showing 7.73% return to 11/4/2013

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 119 days, and showing 7.73% return to 11/4/2013

Read more >

iM Update 11-1-13

The IBH stock market model is out of the market. The MAC stock market model is invested, the bond market model avoids high beta (long) bonds, the yield curve is steepening, the gold model is not invested, but the silver model is invested. The recession indicator COMP is higher from last week’s level and iM-BCIg is also higher. MAC-AU is invested.

Read more >

Best10 10-28-13

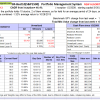

Currently the portfolio holds 10 stocks, 2 of them winners, so far held for an average period of 24 days, and showing combined -1.32% average return to 10/28/2013

Currently the portfolio holds 10 stocks, 2 of them winners, so far held for an average period of 24 days, and showing combined -1.32% average return to 10/28/2013

Read more >

iM-Combo5: Large-Cap Models in Combination with iM-Best(SPY-SH) and iM-Best1(Sector SPDR)

Using 3 large-cap models from the web-based trading simulation platform in combination with Best(SPY-SH) and Best1(Sector SPDR), we demonstrate that the combination would have produced very high positive rolling returns and also high annualized returns with low drawdowns and low volatility.

Best(SPY-SH) 10-28-13

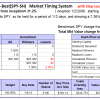

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 112 days, and showing 7.36% return to 10/28/2013

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 112 days, and showing 7.36% return to 10/28/2013

Read more >

A Buy Signal from the Modified Coppock Indicator for the S&P 500

The latest interim buy signal from the modified Coppock indicator was generated on October 25, 2013, and this model will stay invested until September 2014, possibly longer if another buy signal appears before then.

Best10 10-21-13

Currently the portfolio holds 10 stocks, 5 of them winners, so far held for an average period of 26 days, and showing combined 0.21% average return to 10/21/2013

Currently the portfolio holds 10 stocks, 5 of them winners, so far held for an average period of 26 days, and showing combined 0.21% average return to 10/21/2013

Read more >